Contents

Guide

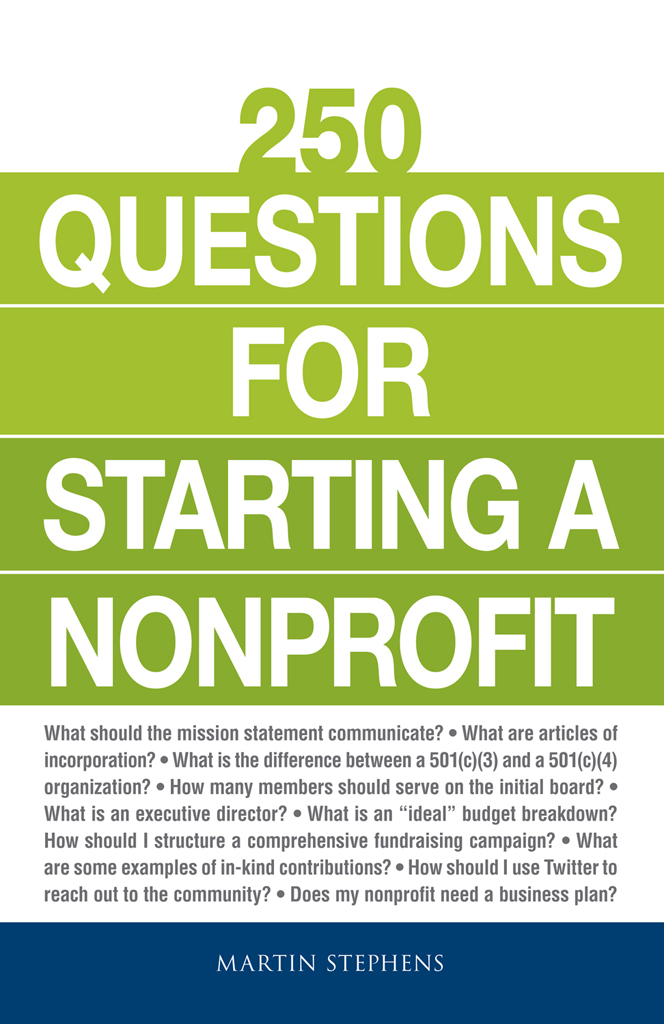

250

QUESTIONS

FOR

STARTING A

NONPROFIT

MARTIN STEPHENS

Avon, Massachusetts

CONTENTS

INTRODUCTION

Many people are undergoing economic hardship. The Great Recession had long-lasting effects on the finances of almost everyone in the country. Theres a huge income gap between the haves and the have-nots in the United States. The college graduating class of 2014 had the highest student loan debt ever. And a recent study revealed that one in three Americans is not only in debt, but is also behind on their payments.

People need help, and they need it right now.

Fortunately, for as long as there has been hardship, there have been people who want to help. Thats where nonprofits come in. Nonprofits take on roles that were once handled by government agencies, or step in when government intervention is not enough. They can do everything from feeding the homeless, to building houses after natural disasters, to funding arts and music programs. Starting a nonprofit is a noble goal, but there are many complicated steps to navigate along the waysteps with which this book will help you.

Sometimes its hard to know the right questions you need to ask to get started. This book asksand answers!them for you. It will guide you through the basic steps of setting up a nonprofit organization: crafting a mission statement, finding staff members, and selecting the members of your board. It will also give you some ideas on how to go about one of the most important tasks of a nonprofit: fundraising. Finally, youll be taken through the complicated steps of becoming an official nonprofit: filing your articles of incorporation, crafting a business plan, and filling out the application for federal nonprofit status.

Obtaining nonprofit status for your organization is a major accomplishment that helps assure that your organization will be able to continue your charitable good works for years to come, even after youre no longer involved. However, the tax-exempt status that comes with being a federally recognized nonprofit is a valuable commodity, one the IRS fiercely protects. At each step of forming your nonprofit, you must be careful in how you write your bylaws, how you conduct yourself, and how you handle your money, in order to avoid jeopardizing your nonprofit status.

In addition to answering all your questions about forming a nonprofit, in the back of the book youll find sample Articles of Incorporation, bylaws, and job descriptions, to help you get started when crafting these crucial documents. Its important to check what your individual state requires when dealing with any official documents. Some states have their own forms, and some states have no forms at all.

This book is not meant to be the only resource you consult; rather its a jumping-off point for you to gain a basic understanding about starting a nonprofit organization and obtaining nonprofit status. Later on, as youre filing your paperwork, use it as a valuable reference guide to make sure youre meeting every requirement.

Starting a nonprofit is a great adventure that is sure to be challenging but also rewarding. Good luck, enjoy the journey, and start asking questions!

PART I

Getting Started

Chapter 1

THE BASICS

#1. Why nonprofits?

When problems and issues arise in communities, the people in those communities come together to fix them. Often such movements are led by organizers, whose job it is to bring together like-minded people. For any group of people to make lasting change, there must be some form of organization, a structure that will enable them to raise money, set an agenda, and carry out tasks in service of that agenda.

This is what a nonprofit does.

If youre involved in a nonprofit, you arent doing this organizing to make a profit as you might if you were working in a corporation. Whats important to you is the goal of the nonprofit. Your passion may be for the local community or it may be about a national or global entity. Whatever the case, your nonprofit brings together people with shared interests who want to accomplish something. To that end, theyve formed a legal entity in which all profits are returned to the organization and the community it serves.

No one questions the need for many of the services that nonprofits or charities assume as necessary for healthy, vibrant communities, so the government grants a lot of leeway in recognition of the sacrifices that individuals involved in nonprofits are willing to make. The government understands that nonprofits exist because of their members passion for a cause.

However, regulations governing every aspect of forming and operating a nonprofit organization have become complex. Books such as this one can help you understand and cope with this mountain of rules; as well, you can draw on the expertise of business professionals.

#2. What is a nonprofit?

To understand fully what a nonprofit corporation is, it helps first to understand what a for-profit corporation is. A corporation is a unique legal entity recognized by state and federal governments as completely separate from the people who own it. Corporations are viewed as though they were people, with many of the same rights and privileges, although technically many of the companies only exist on paper.

For-profit corporations have five essential components:

- They may have limited liability, meaning investors in the corporation can only lose (or are only liable for) the amount of money they have invested, rather than potentially losing everything they own.

- They maintain a continuity of existence, which means that the corporation can literally exist forever, well beyond the lifetimes of the founders or current owners.

- They offer an ease of ownership transfer through the sale of shares, rather than selling the actual business.

- They have the ability to raise money or capital through expanded ownership. In other words, if more shares are sold or more partners are brought in, there is no limit to the amount of money that can be raisedand of course, lost.

- They offer shareholders the ability to profit from the growth of the business through the increased value of their shares, when shares are sold on the open market, or through the payment of dividends based on the profit the corporation has generated.

Nonprofit corporations share many of these characteristics. However, unlike for-profit corporations, in which individual owners, partners, or shareholders may personally benefit from the organization, in a nonprofit corporation no individual may directly benefit from any profit generated by the organization. Rather, the money generally considered profit must be turned back into the organization to continue its work.

Nonprofit organizations can and do make money, although, as stated previously, this money must be returned to the corporation. Nonprofits may also hire staff, engage private consultants, and operate as does any other corporation; the important distinction is that salaries or fees of employees must be established as set amounts rather thanas in a for-profit companybased on the corporations financial performance. A sliding-scale compensation structure that depends on the success of the organization would place employees, especially officers, in the position of directly benefiting from the organization. This would be contrary to the tax code and in all probability cause the nonprofit to lose its tax-exempt status.