2014 Marshall Cavendish International (Asia) Private Limited

Published by Marshall Cavendish Editions

An imprint of Marshall Cavendish International

1 New Industrial Road, Singapore 536196

All rights reserved

No part of this publication may be reproduced, stored in a retrieval system or transmitted, in any form or by any means, electronic, mechanical, photocopying, recording or otherwise, without the prior permission of the copyright owner. Requests for permission should be addressed to the Publisher, Marshall Cavendish International (Asia) Private Limited, 1 New Industrial Road, Singapore 536196. Tel: (65) 6213 9300, fax: (65) 6285 4871. E-mail:

The publisher makes no representation or warranties with respect to the contents of this book, and specifically disclaims any implied warranties or merchantability or fitness for any particular purpose, and shall in no event be liable for any loss of profit or any other commercial damage, including but not limited to special, incidental, consequential, or other damages.

Other Marshall Cavendish Offices:

Marshall Cavendish Corporation. 99 White Plains Road, Tarrytown NY 10591-9001, USA Marshall Cavendish International (Thailand) Co Ltd. 253 Asoke, 12th Flr, Sukhumvit 21 Road, Klongtoey Nua, Wattana, Bangkok 10110, Thailand Marshall Cavendish (Malaysia) Sdn Bhd, Times Subang, Lot 46, Subang Hi-Tech Industrial Park, Batu Tiga, 40000 Shah Alam, Selangor Darul Ehsan, Malaysia.

Marshall Cavendish is a trademark of Times Publishing Limited

National Library Board, Singapore Cataloguing-in-Publication Data

Lim, Edwin, 1962, author.

Personal investing : how to invest your money for consistent returns / Edwin Lim, Dr. Kaiwen Leong and Edward H. Choi. Singapore : Marshall Cavendish Business, 2014.

pages cm

ISBN : 978-981-4561-01-3 (paperback)

eISBN: 978 981 4634 71 7

1. Finance, Personal. 2. Investments. I. Title

HG179

332.024 dc23

Printed in Singapore by Markono Print Media Pte Ltd

CONTENTS

CHAPTER 1

STOP WASTING YOUR TIME MAKING MONEY

Lets be honest. Most of us are trying to make money and get rich. And there is nothing wrong with that. After all, money is money. But behind the greed in your eyes are deeper aspirations. You want to make all that money to support not just yourself, but your loved onesyour family, your children. You want to leave something behind for your children so that they can get a head start in life.

But even though you have all this money in the bank and live a comfortable life, bear in mind that a few uninformed money-managing decisions can deplete all your savings. This is why it is important to learn to manage your money and not allow money to manage you. That is the heart of investingto turn what you already have into more.

The bottom line is, stop wasting your time making money. Start making investments.

CASH IS NOT KING

When I lived in China in early 2000, credit cards and cheques were not widely accepted and I had to carry a bundle of cash with me when shopping. Of course, pulling out a wallet filled with cash made me feel rich. But at the same time, it meant that I had to hold more cash than necessary under my mattress. My money was just sitting there, stagnant.

Many people argue that cash is king and this might be true to some extent. We might want enough cash to ensure that we are not squeezed into a corner during tough times or to be able to take advantage of an investment opportunity. If you are saving for a vacation or university education or, more generally, have firm plans requiring the use of cash within the next three to five years, it makes sense to keep cash or maintain deposit accounts in high-rate, low-risk products such as fixed deposits or certificates of deposit.

The cash Im referring to, however, is money you plan to keep for the long term, such as for retirement or that you have no need of for the next seven years or more.

Many wealthy individuals do not hold all of their assets in cash. Specialised banks and a division of private bankers actively seek out these wealthy individuals to invest their cash into a diversified portfolio of investments. Even Warren Buffett, the American business magnate, once said that the worst investment you can have is cash cash is going to become less over time. So why is cash not a popular choice in the overall investment portfolios of wealthy people?

INFLATION

One of the biggest enemies of your hard-earned savings is inflation, which erodes the value of cash. In the five years after the 2008 financial crisis, banks were offering a meagre 0.25% in savings rates, while inflation rates in both American and Asian economies were averaging between 1% to over 4%. This means that the longer your cash sits in your account or under the mattress, the less you can buy with it each year.

Cash is fantastic to have on a rainy day or for short-term needs, but it is not an asset that will appreciate in value on its own over the long term. You can place cash in fixed deposits or certificates of deposit that earn more than the normal savings rates but even that may not be sufficient to offset the inflation rate over time.

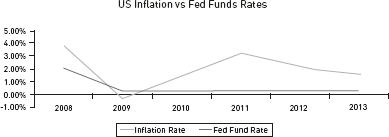

The chart below illustrates the average federal fund rates that commercial banks would benchmark their savings rates against the inflationary rate from the 2008 financial crisis to 2013. America was seriously affected by the crisis and you can clearly see how inflation would have eroded the value of your savings if you had kept your assets in cash.

Even Asian economies such as Singapore, which were not so badly affected by the financial crisis, had average inflation rates of 5.2% in 2011 and 4.6% in 2012, while banks were offering meagre average savings rates between 0.05% to 0.1%. As an example, $100,000 placed into a savings account for one year with a savings rate of 0.05% would get you a mere $50 in return. You could probably get higher returns by simply spending the money on discounted items.

CURRENCY VALUATION

With any investment strategy, you always want to establish some control over the value of your assets. However, the value of a countrys currency is primarily influenced by its economic, financial and macro policies. This means that you have no control over its value and your assets are highly dependent on your governments policies. For example, following the devastating financial crisis in America and Europe, the values of the USD and Euro have taken a beating over the past decade against more resilient Asian economies such as Singapore. The chart below shows the steadily declining value of the US Dollar against the Singapore Dollaran approximately 26% fall from an exchange rate of 1.70 down to 1.25.

Of course, the argument for holding on to cash in Singapore Dollars would be applicable as you have gained 26% in value, but the key point here is that you cannot control a countrys economic situation. If Singapore were to experience an Asian financial crisis similar to that in the late 1990s, the tables would be turned.

Next page