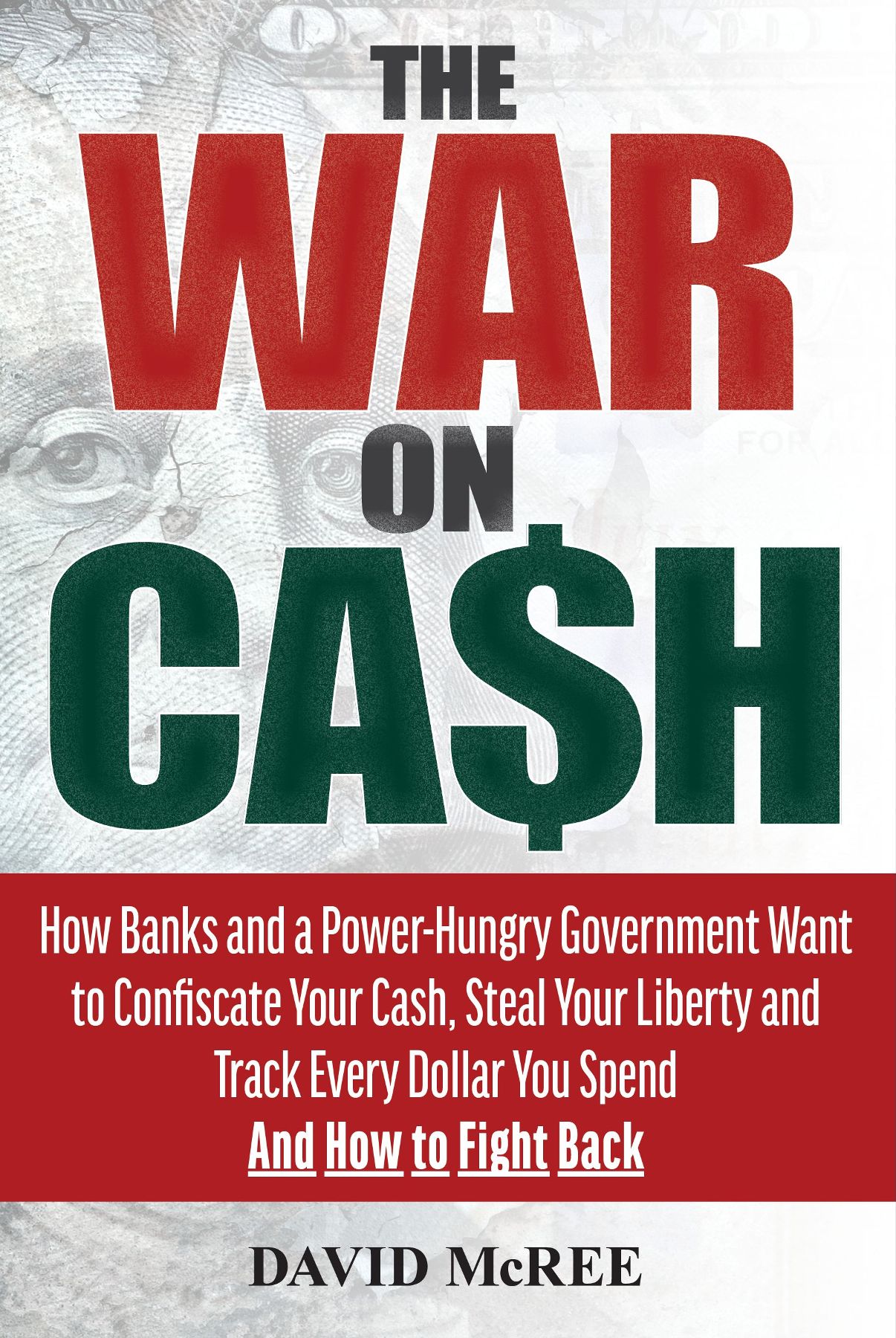

THE WAR ON CA$H

How Banks and a Power-Hungry Government Want to Confiscate Your Cash, Steal Your Liberty and Track Every Dollar You Spend And How to Fight Back

DAVID McREE

www.humanixbooks.com

Humanix Books

The War on Cash

Copyright 2020 by David McRee

All rights reserved

Humanix Books, P.O. Box 20989, West Palm Beach, FL 33416, USA

No part of this book may be reproduced or transmitted in any form or by any means, electronic or mechanical, including photocopying, recording, or by any other information storage and retrieval system, without written permission from the publisher.

Humanix Books is a division of Humanix Publishing, LLC. Its trademark, consisting of the words Humanix Books is registered in the Patent and Trademark Office and in other countries.

Disclaimer: The information presented in this book is meant to be used for general resource purposes only; it is not intended as specific financial advice for any individual and should not substitute financial advice from a finance professional.

ISBN: 9781630061531 (Trade Paper)

ISBN: 9781630061548 (E-book)

CONTENTS

P OWERFUL FORCES ARE AT work, and they are not working for your personal benefit. All over the world, including in the United States of America, governments, certain academics, banks and civil service organizations (including large non-governmental organizations [NGOs]) are cooperating to stop you from using cash.

They want you to have no option but to pay for everything you buy using electronic payment systems. They want you to be unable to go to a bank and withdraw your money in cash. They want you to be afraid to have more than a few dollars cash on your person, in your home, or in your car.

Laws have already been passed in Europe and the United States to restrict the use of cash for certain things. Banks are adopting policies against keeping cash in a safe deposit box, or paying bills with cash.

Legitimate businesses and their employees are being cut off from the banking system because their customers usually pay in cash, or because the businesses sell a legal product or service that the government does not approve of.

The IRS has seized bank accounts of people and businesses that have done nothing wrong except make regular deposits of less than $10,000 to their bank account.

Law enforcement officers are seizing cash from anyone they think is carrying too much cash. If you have more than a couple of hundred bucks on you, youre suspected of being a drug dealer or a terrorist. No drugs or bombs need be in your possession. The cash is the evidence.

In this book I have five goals:

- 1. To show you that the outrageous attacks on your natural rights as mentioned above are actually happening.

- 2. To convince you that the use and possession of cash is essential to a free and prosperous society.

- 3. To show you that these attacks on your cash and your privacy are not isolated events, but are representative of a worldwide trend that is affecting everyone and involves mega-millions of dollars.

- 4. To show you that unless something is done, there is a high likelihood that you will lose the ability to meaningfully use cash in your lifetime or you will be persecuted for your use of cash.

- 5. And finally, to suggest how you can fight back.

When I first conceived of the idea and title for this book, I had actually not heard the phrase war on cash used in the media. But within a few weeks of beginning my outline, libertarian and conservative websites began using the phrase. Cashless economy and cashless society are other terms often used instead of war on cash and are often found in articles that stress the convenience aspect of electronic transactions and the inconvenience of cash. But there is much more to a cashless society than the aspect of convenience. It finds its dark heart in a governments fundamental distrust of its citizens.

Although the coordinated actions that create the modern war on cash are fairly recent, the idea of a cashless society isnt. As far back as the 1960s... it was widely predicted that electronic fund transfer [EFT]... would replace checks and even cash as the primary method for exchanging value in the United States. Of course, this did not come to pass quickly, because consumers were not particularly interested in electronic transactions. Nevertheless, banks pushed forward with EFT systems to reduce the expense of handling huge volumes of checks and to reduce the number of people needed to process them, including bank tellers. The genesis of the movement toward a cashless society began as a cost-saving measure for financial institutions. It has evolved into a coordinated effort by governments, financial institutions, private foundations, NGOs and elite academics to declare war on cash as a means of exchange among people.

What exactly do I mean by the war on cash?

The war on cash is the effort by governments around the world to stop people from using cash to pay for things they buy. They do this by making the use of cash suspicious, by passing laws and regulations restricting the use of cash, and by requiring financial institutions to report certain types of cash transactions. The government cannot wage an effective war on cash by itself. It must recruit banks to be its eyes and ears and to put policies in place to make it hard or risky to do business in cash.

The war on cash is not being driven solely by governments. The huge payment processing companies understand that getting a piece of every financial transaction in the world is worth trillions of dollars, and the early bird gets the worm. The data collection industry is also salivating over the profit potential of massive data collection, analysis and sales.

This book is intended to be a wake-up call to anyone not familiar with the tactics being used by governments and their allies to restrict the publics use of cash, and to abuse the laws for their own purposes. It is not intended to be a scholarly or comprehensive work.

People dont need a PhD in meteorology to know when its raining. All they have to do is open their eyes. Likewise, people dont need a PhD in economics or finance to know when they are being taken advantage of by governments and financial institutions: they just need to open their eyes. This book is intended to be an eye-opener. It covers many angles and provides both an overview for readers new to the topic and a starting point for those doing independent research.

I have provided citations for many of the statements I make in this book to allow readers to verify my sources and to learn more about topics that interest them. I have tried to use sources that are trusted and respected, and Ive tried scrupulously to avoid propagandistic articles and websites. In all cases, even though I may only list one citation, I have checked that source against several others. I generally cite the source that I believe to be the most relevant, trustworthy, and complete. In many cases, an article appears on one website and is then echoed all over the web. It can sometimes be difficult to track down the original source. If I could not find a reputable source for a story, I didnt include the information in this book. In some cases, the original internet source is access-limited by a pay wall. In such cases, I have cited another source that summarized or quoted the original, if I found such a source.

Next page