First published in 2013 by John Wiley & Sons Australia, Ltd 42 McDougall St, Milton Qld 4064

Office also in Melbourne

Typeset in 11/13 pt ITC Berkeley Oldstyle Std

Colin Nicholson 2013

The moral rights of the author have been asserted

National Library of Australia Cataloguing-in-Publication data:

Author: Nicholson, Colin John, 1943- (author).

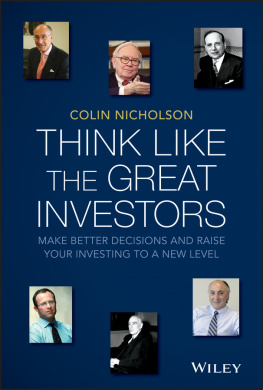

Title:Think like the great investors : make better decisions and raise your investing to a new level / Colin Nicholson.

ISBN:9781118587140

Notes:Includes index.

Subjects:Stocks Australia.

Investments Australia Decision making.

Finance, Personal.

Dewey Number:332.6322

All rights reserved. Except as permitted under the Australian Copyright Act 1968 (for example, a fair dealing for the purposes of study, research, criticism or review), no part of this book may be reproduced, stored in a retrieval system, communicated or transmitted in any form or by any means without prior written permission. All inquiries should be made to the publisher at the address above.

Cover design by Susan Olinsky

Cover photos (top row left to right) Fairfax Photo Library / AFR Picture by Patrick Cummin, ASSOCIATED PRESS ID# 110502062091, ASSOCIATED PRESS ID# 510529037, (bottom row left to right) Fairfax Photo Library / AFR Picture by Jim Rice, ASSOCIATED PRESS ID# 4508241116, Fairfax Photo Library / Photo by Michele Mossop

Charts produced using Insight Trader Charting software. See www.insighttrading.com.au.

Printed in Singapore by C.O.S Pte Ltd

10 9 8 7 6 5 4 3 2 1

Disclaimer

The material in this publication is of the nature of general comment only, and does not represent professional advice. It is not intended to provide specific guidance for particular circumstances and it should not be relied on as the basis for any decision to take action or not take action on any matter which it covers. Readers should obtain professional advice where appropriate, before making any such decision. To the maximum extent permitted by law, the author and publisher disclaim all responsibility and liability to any person, arising directly or indirectly from any person taking or not taking action based on the information in this publication.

The best investors succeed because they seem to think counterintuitively. They make better decisions by avoiding the common cognitive biases, which are natural to us all, but that hold us back in our investing. Learn how the great investors think and raise your investing to a new level so you can join the winners circle.

For Tony Featherstone

who commissioned my articles for Shares magazine

About the author

Investor, author and investment educator Colin Nicholson has a bachelors degree in economics from the University of Sydney and a Graduate Diploma in Applied Finance and Investment from the Financial Services Institute of Australasia (Finsia). He taught both fundamental and technical analysis for Finsia for many years and was judged Outstanding Presenter for 1997 by student feedback. In 1995 Finsia made him a Senior Fellow. Colin is a past national president of the Australian Technical Analysts Association, which made him an honorary life member in 2001.

Colin has invested in stocks on the Australian market since the late 1960s while employed in sales and marketing in the food, brewing and paint industries. Since April 1987 he has been self-employed, earning his income from investing, supplemented by writing and teaching. He is a popular speaker at conferences and member meetings of the Australian Investors Association, the Australian Shareholders Association and the Australian Technical Analysts Association.

Colin does not sell anything except his books and his writing on his website www.bwts.com.au. This book builds on the idea that winning investors think differently, as discussed in his book Building Wealth in the Stock Market (originally published as The Aggressive Investor ), which sets out his investment methods.

Important note

This book has been written for the sole purpose of teaching investment techniques. It neither purports nor intends to offer advice to any reader to invest in any specific financial product or to use any specific investment method. Readers should not act on the basis of any matter in this book without considering their own particular circumstances, taking professional advice where appropriate. Past performance should not be regarded as evidence that any particular method will be profitable in the future. The decision to invest is for the reader alone. The author expressly disclaims all and any liability to any person, in respect of anything, and of the consequences of anything, done, or omitted to be done, in reliance, whether whole or partial, upon any part of this book.

Colin Nicholson is not a licensed investment adviser. He does not give either specific or general advice as defined in legislation.

Colins methods have been developed to meet his financial objectives and to be consistent with his level of knowledge, experience and risk tolerance. Readers should regard his work as a model in developing their own investment plan.

The core articles that make up the chapters of this book were originally published in Shares magazine. Other chapters are expanded versions of articles written for AFR Smart Investor magazine and published in Colin Nicholsons newsletter and on his website www.bwts.com.au.

All chapters have been extensively revised and arranged to provide a basic introduction to common decision-making errors that adversely affect our investment returns.

The chapters in part I now have a section suggesting strategies to manage the cognitive biases described. The addition of strategies provides a practical guide to better investment decision making.

Part I

Stretching our mind

Mans mind stretched to a new idea never goes back to its original dimensions.

Oliver Wendell Holmes

Most of us have learned to make decisions in a haphazard manner based on doing what comes naturally. However, research in the new field of behavioural finance has shown that our natural instincts often do not serve us well. Once we are introduced to the common cognitive biases in the way we make decisions, we will never look at the investing process the same way again.

Chapter 1

Shaping our destiny

It is in your moments of decision that your destiny is shaped.

Anthony Robbins

I am a very keen reader of books and articles about investing. In particular, I love reading about the great investors, those who consistently achieve outstanding returns that make them and their clients very wealthy. After all, if we want to be better investors, our best models are those with a proven outstanding track record.

The more I study the great investors, the more I am struck by the way the quality of their thinking seems to be superior to that of the ordinary investor. I find that the great investors have several key attributes that, in combination, lead to outstanding results and to their classification as outstanding investors:

Education. This is a must. A very few have been entirely self-taught, but most will have a tertiary qualification, usually at postgraduate level. Moreover, they maintain their level of education over their career in all sorts of ways, both formal and informal.