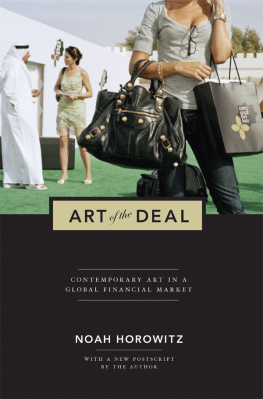

Art of the Deal

Art of the Deal

Contemporary Art in a Global Financial Market

Noah Horowitz

With a new postscript by the author

PRINCETON UNIVERSITY PRESS PRINCETON AND OXFORD

COPYRIGHT 2011 BY PRINCETON UNIVERSITY PRESS

Published by Princeton University Press,

41 William Street, Princeton, New Jersey 08540

In the United Kingdom:

Princeton University Press,

6 Oxford Street, Woodstock, Oxfordshire OX20 1TW

press.princeton.edu

All Rights Reserved

Eighth printing, and first paperback printing, with a new postscript by the author, 2014

Paperback ISBN 978-0-691-15788-7

The Library of Congress has cataloged the cloth edition of this book as follows

Horowitz, Noah, 1979

Art of the deal : contemporary art in a global financial market / Noah Horowitz.

p. cm.

Includes bibliographical references and index.

ISBN 978-0-691-14832-8 (hardcover : alk. paper) 1. ArtMarketingHistory20th century. 2. ArtMarketingHistory21st century. 3. ArtEconomic aspectsHistory20th century. 4. ArtEconomic aspectsHistory21st century. 5. Art as an investment. I. Title. II. Title: Contemporary art in a global financial market.

N8600.H67 2011

382.457dc22 2010021904

British Library Cataloging-in-Publication Data is available

This book has been composed in Sabon with Trade Gothic Display

Printed on acid-free paper.

Printed in the United States of America

10 9 8

For Louise

Why should anyone want to buy a Czanne for $800,000?

Whats a little Czanne house in the middle of a landscape?

Why should it have value? Because its a myth. We make myths about politics, we make myths about everything. I have to deal with myths from 10 AM to 6 PM every day. And it becomes harder and harder. We live in an age of such rapid obsolescence. My responsibility is the myth-making of myth materialwhich handled properly and imaginatively, is the job of a dealerand I have to go at it completely. One just cant prudently build up a myth.

Leo Castelli, art dealer, 1966

List of Tables

Tables

Preface

How are prices established? What drives fashion and taste? What exactly does money buy?

The first decade of the new millennium witnessed one of the greatest booms in the history of the art market. At its core was the dizzying rise of contemporary art, and as it quickly and confidently asserted itself as the most lucrative sales category, rife speculation about the relationship between art and value took hold.

The year that began by setting further records but would also mark the bursting of the bubble2008presented two excellent examples of this landscape. The most notable was Damien Hirsts auction at Sothebys London, in September, which proved to be the final major triumph of the markets latest ascent; the second, an auction of Chinese contemporary art at Sothebys Hong Kong, five months earlier.

A gargantuan media spectacle preceded Hirsts two-day sale, intriguingly named Beautiful Inside My Head Forever, and its sheer size and value were astonishing: over two hundred works, all purposely made for the auction, at a presale estimate of $122 to $176 million. Although famous artists occasionally consign their work direct to auctionincluding Hirsts own Pharmacy Sale at Sothebys in 2004, which grossed $20 millionnone has ever had a stand-alone auction on this scale. By cutting his dealers, Jay Jopling and Larry Gagosian, out of the equation, Hirst mounted a bold attack on the conventions of the art business, declaring that he did not need the support of these powerful brokers. He could go it alone.

This achievement, however impressive, paled in comparison to events that broke out on the very day of the sale itselfMonday, September 15. The global financial markets had been weakening for over a year, and this was when they fell into the abyss. American investment bank Lehman Brothers declared its bankruptcy; Merrill Lynch announced that it would be sold to rival Bank of America; and American International Group, the worlds largest insurance provider, announced that it was on the brink of failing (culminating the following day in an $85 billion bailout by the U.S. Federal Reserve). This was a moment of extreme financial turmoil, drawing comparison with the onset of the Great Depression in 1929.

And yet, seemingly against all odds, the gala evening sale of Hirsts spot paintings, butterfly motifs and animal vitrines realized a staggering $127 million. After the final lot was hammered down on Tuesdays lesservalued day sale, the two-day total stood at $201 million, with almost a quarter of the lots selling above $1 million and three quarters above their high estimates. The auction house reported that one in three buyers was new to Sothebys, the majority of these coming from developing markets such as Russia and the Middle East. This strengthened the belief that the globalization of the contemporary art market, already much commented upon, would continue to support price levels despite the financial crisis. The contrast between the tumultuous state of the global economy and the extravagances of the art world could not have been any sharper. This sale, above all other sales, seemed to belie almost any rationale.

Logic nevertheless has a curious way of determining art market events. In Hirsts case, this means prying beyond the incongruity of how his work could sell so strongly amidst the economic turmoil and appreciating Beautiful for what it actually was: the culmination of a painstakingly orchestrated marketing campaign by Hirst and Sothebys, and a demonstration of the artists singular adeptness at combining media and financial clout. Most notably, there was no hiding the fact that Hirsts dealers, though circumvented

Though extreme, this treatment was hardly unique and followed on the back of Hirsts exhibition of For the Love of God, a platinum-coated human skull adorned with 8,601 diamonds, in a high-security recessed antechamber of Joplings London gallery, White Cube, in 2007. The circumstances of this sale seamlessly exposed the economic gamesmanship that had become so prevalent in the market: though the skull was originally announced to have sold to a private buyer for 50 million (approximately $100 million at the time), making it one of the single most expensive artworks ever sold and the priciest by a living artist, news soon leaked that it had in fact been purchased by an investment consortium consisting of none other than Hirst, Jopling, and a third, unnamed party who were busy concocting its global exhibition tour. Art though it may be, For the Love of God was also an overt financial investment that Hirst & Co. would seek to add value to in years to come before selling it off for good.

Our second introductory example concerns another Sothebys auction, of April 2008: Chinese Contemporary Art IIIThe Estella Collection. Although this sale netted only a fraction (at $18 million) of Beautifuls record taking, it was a similarly important and highly controversial illustration of some of the strategic ways that economic value was generated in a newly global and diverse art market.

The Estella Collection was assembled by Michael Goedhuis, a New York dealer, beginning in 2004. Its moniker was a marketing concoction drawn from Charles Dickenss Great Expectations: I felt it was a name the Chinese could pronounce, Goedhuis has said. Although Estella wasnt a pretty character, its a pretty name.subsequently purchased were sourced from galleries and artists studios in mainland China, and over the course of three years, some two hundred pieces were brought together under the auspices that they would be part of a major private collection, that the collection would be chronicled in a book of the highest scholarship, and that some, if not all, of the works would eventually be donated to a museum. The items spanned sculpture, drawing, and painting, the highlight of which was Zhang Xiaogangs oil on canvas,

Next page