Rod Caldwell - Learn bookkeeping in 7 days: dont fear the tax man

Here you can read online Rod Caldwell - Learn bookkeeping in 7 days: dont fear the tax man full text of the book (entire story) in english for free. Download pdf and epub, get meaning, cover and reviews about this ebook. City: Milton;Qld, year: 2012;2010, publisher: Wiley, genre: Romance novel. Description of the work, (preface) as well as reviews are available. Best literature library LitArk.com created for fans of good reading and offers a wide selection of genres:

Romance novel

Science fiction

Adventure

Detective

Science

History

Home and family

Prose

Art

Politics

Computer

Non-fiction

Religion

Business

Children

Humor

Choose a favorite category and find really read worthwhile books. Enjoy immersion in the world of imagination, feel the emotions of the characters or learn something new for yourself, make an fascinating discovery.

- Book:Learn bookkeeping in 7 days: dont fear the tax man

- Author:

- Publisher:Wiley

- Genre:

- Year:2012;2010

- City:Milton;Qld

- Rating:4 / 5

- Favourites:Add to favourites

- Your mark:

Learn bookkeeping in 7 days: dont fear the tax man: summary, description and annotation

We offer to read an annotation, description, summary or preface (depends on what the author of the book "Learn bookkeeping in 7 days: dont fear the tax man" wrote himself). If you haven't found the necessary information about the book — write in the comments, we will try to find it.

Do you struggle with keeping your books?

Do you dread facing your finances?

Do you constantly fear that the tax man will come knocking?

Learn Bookkeeping in 7 Days is your step-by-step guide to taking the stress out of keeping your books!

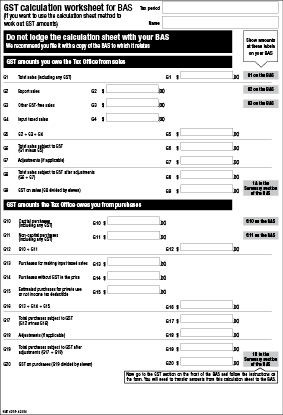

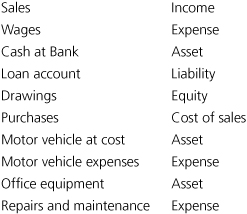

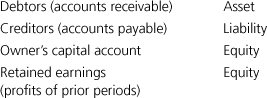

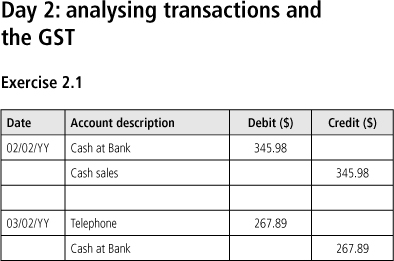

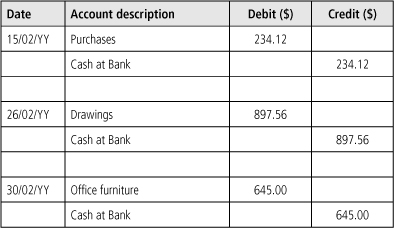

This small business guide covers all of the basics, from setting up a general ledger through to confidently conquering your BAS, and all thats in between. In 7 quick and easy steps this book arms you with the knowledge you need to move to more advanced systems and will free up your time to focus on your business.

Packed full of taxation tips, tricks and traps, this is essential reading for all small business owners and anyone wanting to easily and quickly learn bookkeeping.

*Bonus resources can be downloaded from the authors website at www.tpabusiness.com.au.

Rod Caldwell: author's other books

Who wrote Learn bookkeeping in 7 days: dont fear the tax man? Find out the surname, the name of the author of the book and a list of all author's works by series.

![Jane E. Kelly - Bookkeeping and Accounting All-in-One For Dummies [UK edition]](/uploads/posts/book/80164/thumbs/jane-e-kelly-bookkeeping-and-accounting.jpg)