Bruce W. Chase - Not-for-Profit Financial Reporting

Here you can read online Bruce W. Chase - Not-for-Profit Financial Reporting full text of the book (entire story) in english for free. Download pdf and epub, get meaning, cover and reviews about this ebook. year: 2020, publisher: Wiley, genre: Romance novel. Description of the work, (preface) as well as reviews are available. Best literature library LitArk.com created for fans of good reading and offers a wide selection of genres:

Romance novel

Science fiction

Adventure

Detective

Science

History

Home and family

Prose

Art

Politics

Computer

Non-fiction

Religion

Business

Children

Humor

Choose a favorite category and find really read worthwhile books. Enjoy immersion in the world of imagination, feel the emotions of the characters or learn something new for yourself, make an fascinating discovery.

- Book:Not-for-Profit Financial Reporting

- Author:

- Publisher:Wiley

- Genre:

- Year:2020

- Rating:3 / 5

- Favourites:Add to favourites

- Your mark:

- 60

- 1

- 2

- 3

- 4

- 5

Not-for-Profit Financial Reporting: summary, description and annotation

We offer to read an annotation, description, summary or preface (depends on what the author of the book "Not-for-Profit Financial Reporting" wrote himself). If you haven't found the necessary information about the book — write in the comments, we will try to find it.

Not-for-Profit Financial Reporting — read online for free the complete book (whole text) full work

Below is the text of the book, divided by pages. System saving the place of the last page read, allows you to conveniently read the book "Not-for-Profit Financial Reporting" online for free, without having to search again every time where you left off. Put a bookmark, and you can go to the page where you finished reading at any time.

Font size:

Interval:

Bookmark:

Notice to readers

Not-for-Profit Financial Reporting: Mastering the Unique Requirements is intended solely for use in continuing professional education and not as a reference. It does not represent an official position of the American Institute of Certified Public Accountants, and it is distributed with the understanding that the author and publisher are not rendering legal, accounting, or other professional services in the publication. This course is intended to be an overview of the topics discussed within, and the author has made every attempt to verify the completeness and accuracy of the information herein. However, neither the author nor publisher can guarantee the applicability of the information found herein. If legal advice or other expert assistance is required, the services of a competent professional should be sought.

You can qualify to earn free CPE through our pilot testing program.

If interested, please visit https://aicpacompliance.polldaddy.com/s/pilot-testing-survey.

2019 Association of International Certified Professional Accountants, Inc. All rights reserved.

For information about the procedure for requesting permission to make copies of any part of this work, please email with your request. Otherwise, requests should be written and mailed to Permissions Department, 220 Leigh Farm Road, Durham, NC 27707-8110 USA.

ISBN 978-1-119-74409-2 (Paper)

ISBN 978-1-119-74412-2 (ePDF)

ISBN 978-1-119-74410-8 (ePub)

ISBN 978-1-119-74413-9 (obk)

Course Code: 746492

CYCT GS-0419-0A

Revised: February 2019

Financial Reporting

- Identify the two classes of net assets.

- Identify the basic financial statements prepared by not-for-profits (NFPs).

- Identify various reporting formats used by NFPs.

- Identify reporting issues related to investments and endowments.

This chapter will discuss what basic information NFP entities must report in their financial statements. We will also discuss some of the reporting formats used by NFP entities.

FASB Accounting Standards Update (ASU) No. 2016-14, Presentation of Financial Statements of Not-for-Profit Entities, was released on August 18, 2016. This ASU changes the way all NFPs classify net assets and prepare financial statements. The standard is effective for annual financial statements issued for fiscal years beginning after December 15, 2017, and for interim periods within fiscal years beginning after December 15, 2018. Early application is permitted.

This chapter will cover the major accounting and financial reporting requirements under ASU No. 2016-14.

Is there a difference between a class of net assets and a fund? Yes! A fund has a self-balancing set of accounts with assets, liabilities, and fund balance accounts, whereas net assets simply represent the difference between assets and liabilities.

How an entity maintains its internal records is not an issue addressed by FASB. Instead, FASB Accounting Standards Codification (ASC) 958, Not-for-Profit Entities, requires that information about each class of net assets be reported in the financial statements.

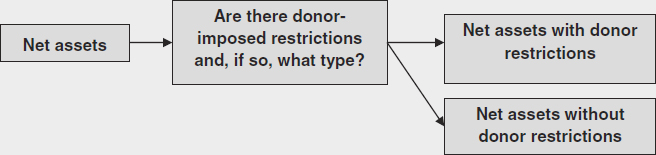

NFP organizations are unique in that they often receive substantial amounts of contributions. These donations can contain donor-imposed restrictions as to their use. Information about restrictions on net resources is important to financial statement users.

A donor-imposed restriction is defined as a stipulation (donors include other types of contributors, including makers of certain grants) that is more specific than the broad limits resulting from the nature of the organization, the environment in which it operates, and the purpose specified in its articles of incorporation or bylaws.

Net assets can be broken down into two classes.

: Two classes of net assets

: Two classes of net assets

The two classes of net assets are described as follows:

- Net assets with donor restrictions. The part of the net assets of an NFP that is subject to donor-imposed restrictions. These types of restrictions can be either temporary or perpetual in nature.

- Net assets without donor restrictions. The part of the net assets of an NFP that is not subject to donor-imposed restrictions.

Footnote disclosures are required to include the timing and nature of the donor-imposed restrictions, as well as the composition of net assets with donor restrictions at the end of the period. The disclosures will continue to show an analysis by time, purpose, and perpetual restrictions.

At times, an NFPs governing board may make designations or appropriations that result in self-imposed limits on the use of resources without donor restrictions, known as board-designated net assets. FASB added a new requirement to disclose board designations on net assets without donor restrictions. Board-designated net assets can be described in the notes to the financial statements if the nature of the designation (that is, amount and purpose) is not clear from the description on the face of the statement of financial position.

| All net assets are classified as net assets without donor restrictions, unless the net assets result from contributions whose use is limited by donor-imposed stipulations. |

- Which is accurate of net assets?

- Donor stipulations that are temporary or perpetual in nature will be footnote disclosed.

- Board-designated resources are reported as net assets with donor restrictions.

- In the absence of donor-imposed restrictions, net assets must be classified as net assets with donor restrictions.

- Endowment funds are classified as net assets with donor restrictions whose use is limited by donor-imposed stipulations that expire by passage of time.

FASB ASC 958 requires NFP entities to present financial statements showing aggregate information about the entity. It establishes minimum standards for financial reporting that are generally no more stringent than requirements for a business enterprise. In general, it allows significant flexibility in presenting certain information, allowing financial reporting to evolve to meet the needs of different NFP groups.

| The general purpose financial statements required by FASB ASC 958-205-05 for NFP entities are the statement of financial position, the statement of activities, the statement of cash flows, and accompanying notes to the financial statements. NFP entities must also present an analysis of expenses by function and nature in one location. This may be presented in the notes to the financial statements, in the statement of activities or as a separate statement. A fourth statement of functional expenses is no longer required only for certain NFP entities; this information must now be reported by all NFPs. |

Font size:

Interval:

Bookmark:

Similar books «Not-for-Profit Financial Reporting»

Look at similar books to Not-for-Profit Financial Reporting. We have selected literature similar in name and meaning in the hope of providing readers with more options to find new, interesting, not yet read works.

Discussion, reviews of the book Not-for-Profit Financial Reporting and just readers' own opinions. Leave your comments, write what you think about the work, its meaning or the main characters. Specify what exactly you liked and what you didn't like, and why you think so.