IFRS Explained

First edition 2010

ISBN 978-0-7517-8630-9 Master e-book ISBN

ISBN 9780 7517 8545 6

British Library Cataloguing-in-Publication Data

A catalogue record for this book is available from the British Library

Published by

BPP Learning Media Ltd

BPP House, Aldine Place

London W12 8AA

www.bpp.com/learningmedia

Printed in Malta

Printed on paper sourced from sustainable, managed forests.

All our rights reserved. No part of this publication may be reproduced, stored in a retrieval system or transmitted, in any form or by any means, electronic, mechanical, photocopying, recording or otherwise, without the prior written permission of BPP Learning Media Ltd.

BPP Learning Media Ltd

2010

Contents

Page |

Part A:The regulatory and conceptual framework |

Part B:Single entity financial statements |

Part C:Group financial statements |

Part D:Specialised standards |

Introduction

This book is intended for those with basic accounting knowledge who now wish to get familiar with IFRS. We have dealt with the standards under topic headings and the aim has been to show how the provisions of the standards are applied in practice. Rather than detailed cross-references to sections and sub-sections, we have concentrated on bringing out the key points and showing examples and workings where applicable.

We have explained in some detail the preparation of IFRS financial statements including consolidated financial statements. Many readers will already be familiar with consolidation procedures, but may find it useful to go through the basics before taking account of those issues peculiar to IFRS, such as non-controlling interest at fair value.

We have omitted two standards dealing with financial reporting by financial institutions:

IAS 26 Accounting and Reporting by Retirement Benefit Plans

IFRS 4 Insurance Contracts

These are complex standards and knowledge of them is not required by most preparers of financial statements.

The IASB and the regulatory framework

Impact of globalisation

The current reality is that the worlds capital markets operate more and more freely across borders. The impacts of rapid globalisation are epitomised by the words of Paul Volker, Chairman of the IASC Foundation Trustees in November 2002, in a speech to the World Congress of Accountants.

Developments over the past year and more have strongly reinforced the logic of achieving and implementing high-quality international accounting standards. In an age when capital flows freely across borders, it simply makes sense to account for economic transactions, whether they occur in the Americas, Asia, or Europe, in the same manner. Providing improved transparency and comparability will certainly help ensure that capital is allocated efficiently. Not so incidentally, generally accepted international standards will reduce the cost of compliance with multiple national standards.

As the modern business imperative moves towards the globalisation of operations and activities, there is an underlying commercial logic that also requires a truly global capital market. Harmonised financial reporting standards are intended to provide:

A platform for wider investment choice

A more efficient capital market

Lower cost of capital

Enhanced business development

Globally, users of financial statements need transparent and comparative information to help them make economic decisions.

From 2005 EU listed companies have been required to use IAS/IFRS in preparing their consolidated financial statements. This is an important step towards eventual harmonisation with the US.

International Accounting Standards Board (IASB)

The International Accounting Standards Board is an independent, privately-funded accounting standard setter based in London. Contributors include major accounting firms, private financial institutions, industrial companies throughout the world, central and development banks, and other international and professional organisations.

In March 2001 the IASC Foundation was formed as a not-for-profit corporation incorporated in the USA. The IASC Foundation is the parent entity of the IASB.

From April 2001 the IASB assumed accounting standard setting responsibilities from its predecessor body, the International Accounting Standards Committee (IASC). This restructuring was based upon the recommendations made in the Recommendations on Shaping IASC for the Future. In essence, the restructuring was driven by the need to increase the level of resourcing owing to an increasing workload.

The 15 members of the IASB come from nine countries and have a variety of backgrounds with a mix of auditors, preparers of financial statements, users of financial statements and an academic.

The formal objectives of the IASB are to:

(a) Develop, in the public interest, a single set of high quality, understandable and enforceable global accounting standards that require high quality, transparent and comparable information in financial statements and other financial reporting to help participants in the various capital markets of the world and other users of the information to make economic decisions

(b) Promote the use and rigorous application of those standards

(c) Work actively with national standard-setters to bring about convergence of national accounting standards and IFRSs to high quality solutions

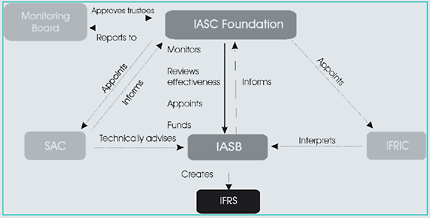

Structure of the IASB

The structure of the IASB can be illustrated by the following diagram:

IASC Foundation

The IASC Foundation is made up of 22 Trustees, who essentially monitor and fund the IASB, the SAC and the IFRIC. The Trustees are appointed from a variety of geographic and functional backgrounds according to the following procedure:

(a) The International Federation of Accountants (IFAC) suggested candidates to fill five of the Trustee seats and international organisations of preparers, users and academics each suggested one candidate.

(b) The remaining Trustees are at-large in that they were not selected through the constituency nomination process.

Standards Advisory Council (SAC)

The SAC is essentially a forum used by the IASB to consult with the outside world. It consults with national standard setters, academics, user groups and a host of other interested parties to advise the IASB on a range of issues, from the IASBs work programme for developing new IFRSs, to giving practical advice on the implementation of particular standards.

International Financial Reporting Interpretations Committee (IFRIC)

IFRIC provides guidance on specific practical issues in the interpretation of IFRSs. The IFRIC is discussed in more detail below.

Scope and authority of IFRSs

The IASB achieves its objectives primarily by developing and publishing IFRSs and promoting the use of those standards in general purpose financial statements and other financial reporting.