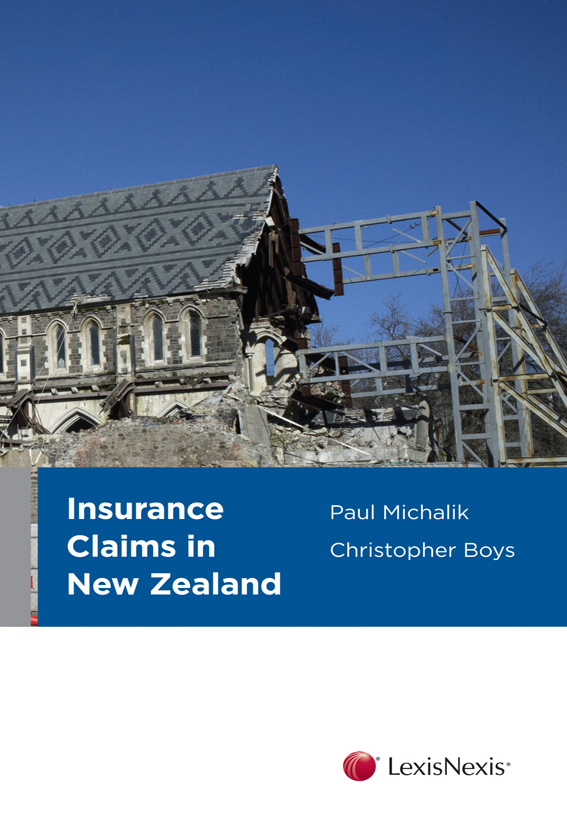

Paul Wojciech Michalik - Insurance Claims in New Zealand

Here you can read online Paul Wojciech Michalik - Insurance Claims in New Zealand full text of the book (entire story) in english for free. Download pdf and epub, get meaning, cover and reviews about this ebook. year: 2015, publisher: Lexis Nexis NZ, genre: Romance novel. Description of the work, (preface) as well as reviews are available. Best literature library LitArk.com created for fans of good reading and offers a wide selection of genres:

Romance novel

Science fiction

Adventure

Detective

Science

History

Home and family

Prose

Art

Politics

Computer

Non-fiction

Religion

Business

Children

Humor

Choose a favorite category and find really read worthwhile books. Enjoy immersion in the world of imagination, feel the emotions of the characters or learn something new for yourself, make an fascinating discovery.

- Book:Insurance Claims in New Zealand

- Author:

- Publisher:Lexis Nexis NZ

- Genre:

- Year:2015

- Rating:5 / 5

- Favourites:Add to favourites

- Your mark:

- 100

- 1

- 2

- 3

- 4

- 5

Insurance Claims in New Zealand: summary, description and annotation

We offer to read an annotation, description, summary or preface (depends on what the author of the book "Insurance Claims in New Zealand" wrote himself). If you haven't found the necessary information about the book — write in the comments, we will try to find it.

Insurance Claims in New Zealand — read online for free the complete book (whole text) full work

Below is the text of the book, divided by pages. System saving the place of the last page read, allows you to conveniently read the book "Insurance Claims in New Zealand" online for free, without having to search again every time where you left off. Put a bookmark, and you can go to the page where you finished reading at any time.

Font size:

Interval:

Bookmark:

Insurance Claims in New Zealand

Paul Michalik

LLB (Hons) (VUW), BA (VUW), BCL (Oxon)

Christopher Boys

LLB (VUW) , BA (VUW), Dip Ed (CCEd)

LexisNexis NZ Limited

Wellington

2015

| LexisNexis | |

| NEW ZEALAND | LexisNexis, PO Box 472, WELLINGTON |

| AUSTRALIA | LexisNexis Butterworths, SYDNEY |

| ARGENTINA | LexisNexis Argentina, BUENOS AIRES |

| AUSTRIA | LexisNexis Verlag ARD Orac GmbH & Co KG, VIENNA |

| BRAZIL | LexisNexis Latin America, SAO PAULO |

| CANADA | LexisNexis Canada, Markham, ONTARIO |

| CHILE | LexisNexis Chile, SANTIAGO |

| CHINA | LexisNexis China, BEIJING, SHANGHAI |

| CZECH REPUBLIC | Nakladatelstv Orac sro, PRAGUE |

| FRANCE | LexisNexis SA, PARIS |

| GERMANY | LexisNexis Germany, FRANKFURT |

| HONG KONG | LexisNexis Hong Kong, HONG KONG |

| HUNGARY | HVG-Orac, BUDAPEST |

| INDIA | LexisNexis, NEW DELHI |

| ITALY | Dott A Giuffr Editore SpA, MILAN |

| JAPAN | LexisNexis Japan KK, TOKYO |

| KOREA | LexisNexis, SEOUL |

| MALAYSIA | LexisNexis Malaysia Sdn Bhd, PETALING JAYA, SELANGOR |

| POLAND | Wydawnictwo Prawnicze LexisNexis, WARSAW |

| SINGAPORE | LexisNexis, SINGAPORE |

| SOUTH AFRICA | LexisNexis Butterworths, DURBAN |

| SWITZERLAND | Staempfli Verlag AG, BERNE |

| TAIWAN | LexisNexis, TAIWAN |

| UNITED KINGDOM | LexisNexis UK, LONDON, EDINBURGH |

| USA | LexisNexis Group, New York, NEW YORK |

| LexisNexis, Miamisburg, OHIO |

National Library of New Zealand Cataloguing-in-Publication data

Michalik, Paul.

Insurance claims in New Zealand.

ISBN 978-1-927248-26-3 (pbk).

978-1-927313-02-2 (ebk).

1. Insurance lawNew Zealand. 2. ContractsNew Zealand.

I. Boys, Christopher. II. Title.

346.93086dc 23

Copyright 2015 LexisNexis NZ Limited.

All rights reserved.

This book is entitled to the full protection given by the Copyright Act 1994 to the holders of the copyright, and reproduction of any substantial passage from the book except for the educational purposes specified in that Act is a breach of the copyright of the author and/or publisher. This copyright extends to all forms of photocopying and any storing of material in any kind of information retrieval system. All applications for reproduction in any form should be made to the publishers.

Disclaimer

Insurance Claims in New Zealand has been written, edited and published and is sold on the basis that all parties involved in the publication exclude any liability, including negligence or defamation, for all or any damages or liability in respect of or arising out of use, reliance or otherwise of this book. The book should not be resorted to as a substitute for professional research or advice for any purpose.

Enquiries should be addressed to the publishers.

Visit LexisNexis NZ at www.lexisnexis.co.nz

There has been a seismic shift in insurance law in the years since I first taught it at the University of Canterbury in the early 2000s.

By necessity, lawyers who have not previously had a great deal to do with insurance have had to come to grips with an area of law which is, frankly, tricky. While it may be true that insurance law is simply a specie of contract law, it is a very odd one, underpinned by doctrines which predate contract law as we know it (most obviously, the doctrine of good faith). Insurance law has its own library of concepts and a vocabulary with definitions that can be counterintuitive. The traditional and formidable two-thousand-page texts in the area are not always the best way to start.

This work is therefore a boon for lawyers and insurance practitioners who need direct and immediate access to the fundamentals of insurance law. It is not weighed down with layers of authorities and the genealogy of jurisprudence it gets straight to the point, providing a clear legal analysis with a helpful practical commentary.

The authors assume that the reader is intelligent, with an understanding of the law generally but not in the specifics of insurance. The accessibility of the text (including definitions of commonly used terms) is a real bonus, and it will reduce the number of times that junior lawyers need to shamefacedly admit that they dont understand technical terms.

While this work is informed by what has become called earthquake jurisprudence, it is by no means defined by it. Questions of indemnity, reinstatement, damage and other issues have been clarified by the courts since 2001, and these developments are analysed. In particular, Chapter 8 provides a very useful insight into the assessment of claims, which is clearly based on considerable practical insurance experience, and the text captures the tension in the insurance assessment process.

As 2016 approaches, lawyers may have particular cause to turn to the section on limitation. The authors traverse the risk that limitation runs from the date of the loss. Clearly, as we approach September 2016 and February 2017, any lawyer advising on an earthquake-related claim will need to turn their mind to this matter. Insurers who have not resolved claims by those dates can expect to be showered in proceedings.

The work also addresses the more traditional (and infrequently litigated) issues such as average, subrogation, double insurance and joint/composite insurance. When those issues are occasionally struck, however, they tend to be complex and significant, so these chapters will be of real use.

This book will be a first port of call for lawyers, insurance practitioners and students who need an accessible, accurate and up-to-date guide on insurance law and the way it interfaces with insurance practice. A contribution of this kind to the scholarship in the area benefits not only the readers, but also those people that the readers come to assist. It is therefore most welcome.

Dr Duncan Webb

June 2015

Our aim in writing this book has been to make something helpful. Rather than attempting to create a comprehensive, rigorous and academic textbook of insurance law to compete with the great English names in the field, we have endeavoured to produce something that will be of practical use to all those who might want or need to learn a little bit more about insurance law in New Zealand.

Our focus has been on claims, as these are the sharp end of insurance law. It is in dealing with claims that legal doctrines can produce results that would surprise someone who only had access to the text of the insurance contract to read. It is also in dealing with claims that the insurance relationship comes under the most pressure and when the people affected will feel most need of help, advice and guidance. We hope that this book will be able to provide something of all three.

There are many fine English texts available, which remain informative and helpful. However, since at least the 1970s, New Zealand insurance law has deviated from that in England. The law in areas such as avoidance for misdisclosure, insurable interests and breach of a condition or warranty are significantly affected by the different New Zealand legal environment. For these reasons, we have focused on New Zealand authorities, be they statutes or cases.

Font size:

Interval:

Bookmark:

Similar books «Insurance Claims in New Zealand»

Look at similar books to Insurance Claims in New Zealand. We have selected literature similar in name and meaning in the hope of providing readers with more options to find new, interesting, not yet read works.

Discussion, reviews of the book Insurance Claims in New Zealand and just readers' own opinions. Leave your comments, write what you think about the work, its meaning or the main characters. Specify what exactly you liked and what you didn't like, and why you think so.