Derivatives in a Day

Everything you need to master the mathematics that drive derivatives

Stewart Cowley

Contents

About the Author

Stewart Cowley has been working in the financial markets since 1987. He is one of a handful of people ever to have held a triple-A rating by Standard & Poors and was awarded the prestigious Gold Medal for long-term investment performance by FE Trustnet. He has also been one of the UKs most visible fund managers, having written for the New Statesman , the Sunday Telegraph and Citywire . He has made frequent appearances on the BBC and Sky News. His previous books Man Vs Money and Man Vs Big Data have both been bestsellers.

And what there i s to conquer

By strength and submission, has already been discovered,

Once or twice, or several times, by [those] one cannot hope

To emulate but there is no c ompetition

For us, there is only the trying

From East Coker, Four Quartets , T. S. Eliot

1. Introduction

I n his 2003 annual letter to Berkshire Hathaway shareholders, the money-managing goliath Warren Buffett called derivatives financial weapons of mass destruction. Many people, even those who didnt know what derivatives were, nodded in agreement and those who nodded most vigorously knew the least about derivatives. Thats because derivatives financial instruments deriving their value, not from owning something, but from the price movements of something they are related to (like stocks, bonds, currencies and commodities) are both fiendishly simple and fiendishly difficult to understand.

Or so a lot of people would like y ou to think.

These prejudices have some basis in truth: derivatives nearly single-handedly brought about the near-collapse of the entire Western financial system in 2008. But, besides this trifling incident, it is arguable derivatives have been given something of a bad rap. This is understandable if you perceive them to be complex and anarchic, but also if the sheer size of derivatives markets turns your knees into quiver ing jellies.

To give you a sense of perspective, if you were to project all the money and financial assets in the world onto the side of the 102-floor Empire State Building, the first 81 floors would be the derivatives markets. The next 13 floors would be occupied by global debt markets; five floors would be reserved for global stock markets; the remaining floors by actual cash in circulation, gold and real estate. The small blinking red light on the top of the communications tower would b e Bitcoin.

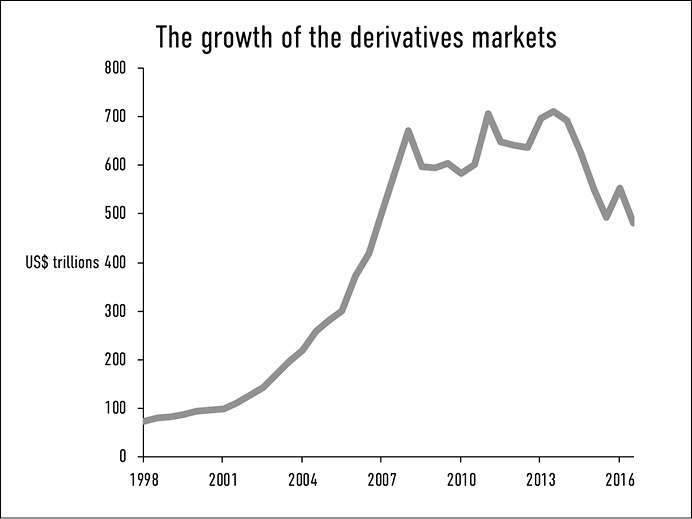

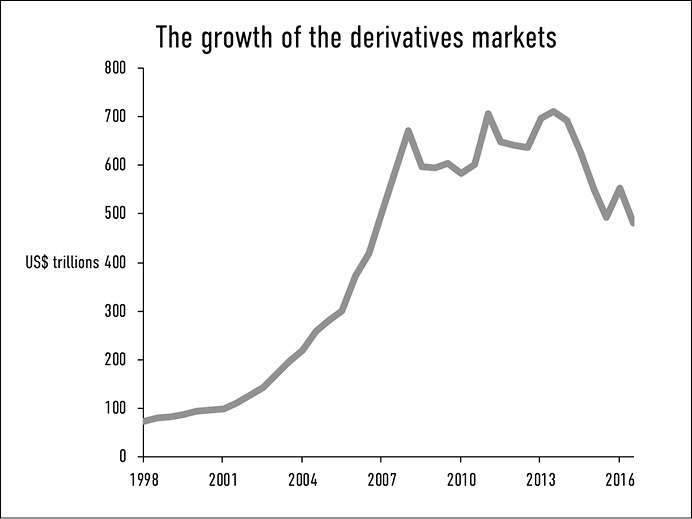

As of December 2016, the Bank of International Settlements the financial organisation owned by 60 member states which act as the central banks central bank calculated that there were derivatives with a notional value of $500 trillion swilling around the world, with profits of $15trn sitting inside the instruments falling under its governance. Fifteen trillion dollars is close to the value of the total annual national income of the United States, a truly staggering number. From the late 1990s, until its near-term peak in 2013, the derivatives market achieved an astonishing 15% compound annual growth rate, making it one of the true growth industries of the modern era.

Figure 1: The astonishing rise of derivatives

Suspicion surrounding the derivatives market isnt helped by a lack of transparency. Although derivatives can be traded on regulated exchanges, making oversight easy, there also exists an over-the-counter (OTC) market where derivatives are traded between private institutions. Here, timely visibility of the market structure and its risks are all but impossible.

For many, this opacity, and the nervousness that comes with it, masks the fundamental usefulness of derivatives, especially if you are an administrator or risk manager. But the competitiveness of fund management means fund managers no longer have the luxury of being able to allow investment strategies to work themselves out over months or years; they need to be able to react and trade quickly, and the place to do that is the derivatives market. League tables of fund performance, published on a daily basis, expose fund managers to the kind of minute scrutiny more normally reserved for football or baseball managers. Its a poisonous cocktail of rational behaviour and irrational e xpectations.

Fortunately, modern portfolio management has moved on in the past few years, in all kinds of ways. We now have a myriad of new mechanisms to defend our clients money from the ravages of market volatility and the unexpected. This is only right as we face a whole new set of threats and opportunities in the interconnected world of glob al finance.

This is where derivativ es can help.

For those of you not blessed with the mathematical abilities of most people who work in the derivatives markets the sort of talent enabling you to calculate large prime numbers in your head, for instance I promise to keep this book as simple and straightforward as possible. This is for pedagogic reasons, but also because I have noticed that, as I get older, my ability to handle higher mathematics has diminished somewhat. I also believe the mathematics of derivatives obscures their basic usefulness. Derivatives really are intensely practical things and, if you can pick out the principles behind them, there are things so mind-bogglingly useful inside of them you start to wonder why you hadnt done this kind of t hing before.

There are lots of basic ideas and some important practical day-to-day questions I want to answer in this book, which can be boi led down to:

- What are derivatives?

- How do I alter the characteristics of a portfolio using derivatives?

- How do I protect a portfolio using derivatives?

- How do I increase the returns to a portfolio using derivatives?

- Why do shoe repairers sell sports trophies?

The following chapters address these questions, although I suspect question five will evade the reasoning of even the most enquiring mind. But every one of these problems can be managed using a derivative of some sort. To aid the process, I will use simple spreadsheet examples with all the workings revealed so that you can create and play with these ideas at your leisure. Also, where I can, I will include relevant Bloomberg screens and internet resources to show you how systems can help you, although I accept that private investors and college students may not have the $2,000 per month it costs to have Bloomberg terminal installed on their computer. Still, for those working in fund management companies, it might help you find your way around the backwaters of a system some have taken an entire career to understand.

This book is also written with as much humour and anecdotal illustration as can be mustered from a musty subject. You will discover possibly the most disastrous national collaboration the world has ever seen. You will also come to understand how Thales of Miletus, in 350BC Greece, only missed having red braces, a large cigar and a New York accent by 2,400 years. But you shouldnt mistake a light touch for a lack of serious intent. As someone who worked in the financial markets for 30 years (please feel free to jump in at this point and exclaim No! Really, Stewart! You dont look old enough!), this is also a heartfelt and practical manifesto on the more obvious opportunities, and even mistakes, made for and by derivat ives users.