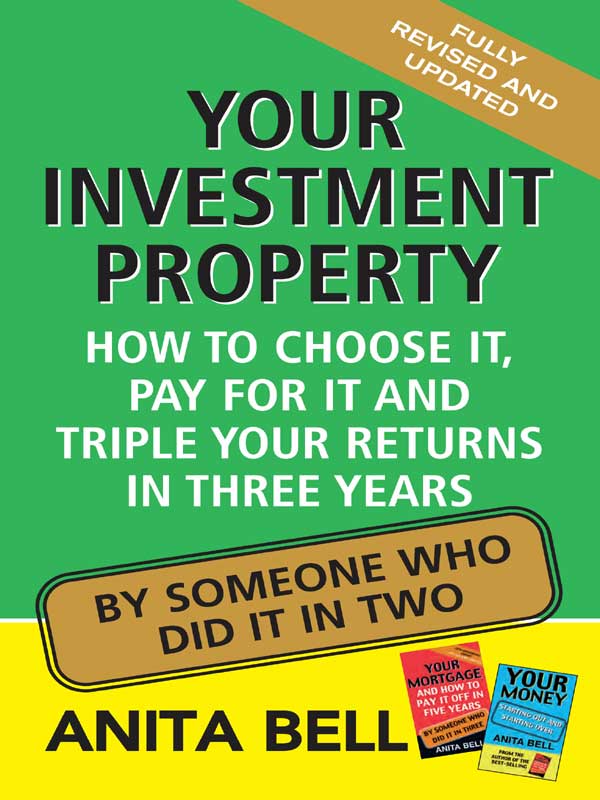

Anita Bell - Your Investment Property How to Choose It, Pay for It and Triple Your Returns in 3 Years

Here you can read online Anita Bell - Your Investment Property How to Choose It, Pay for It and Triple Your Returns in 3 Years full text of the book (entire story) in english for free. Download pdf and epub, get meaning, cover and reviews about this ebook. year: 2008, publisher: Penguin Random House Australia, genre: Romance novel. Description of the work, (preface) as well as reviews are available. Best literature library LitArk.com created for fans of good reading and offers a wide selection of genres:

Romance novel

Science fiction

Adventure

Detective

Science

History

Home and family

Prose

Art

Politics

Computer

Non-fiction

Religion

Business

Children

Humor

Choose a favorite category and find really read worthwhile books. Enjoy immersion in the world of imagination, feel the emotions of the characters or learn something new for yourself, make an fascinating discovery.

- Book:Your Investment Property How to Choose It, Pay for It and Triple Your Returns in 3 Years

- Author:

- Publisher:Penguin Random House Australia

- Genre:

- Year:2008

- Rating:5 / 5

- Favourites:Add to favourites

- Your mark:

- 100

- 1

- 2

- 3

- 4

- 5

Your Investment Property How to Choose It, Pay for It and Triple Your Returns in 3 Years: summary, description and annotation

We offer to read an annotation, description, summary or preface (depends on what the author of the book "Your Investment Property How to Choose It, Pay for It and Triple Your Returns in 3 Years" wrote himself). If you haven't found the necessary information about the book — write in the comments, we will try to find it.

Anita Bell: author's other books

Who wrote Your Investment Property How to Choose It, Pay for It and Triple Your Returns in 3 Years? Find out the surname, the name of the author of the book and a list of all author's works by series.

Your Investment Property How to Choose It, Pay for It and Triple Your Returns in 3 Years — read online for free the complete book (whole text) full work

Below is the text of the book, divided by pages. System saving the place of the last page read, allows you to conveniently read the book "Your Investment Property How to Choose It, Pay for It and Triple Your Returns in 3 Years" online for free, without having to search again every time where you left off. Put a bookmark, and you can go to the page where you finished reading at any time.

Font size:

Interval:

Bookmark:

Anita Bell is the bestselling author of seven other finance books. Having purchased her first property at the age of 16, she achieved debt freedom by the age of 26 and financial independence (with her husband, Jim) by 29. Anita has devoted much of her spare time over the last six years to sharing their favourite tips and shortcuts with other families.

Despite having no formal qualifications in the finance, real estate or share trading industries, Anita has become well known as one of Australias most popular finance authors and guest speakers. Her quick-and-easy strategies for contracts, income and repayments have changed the way Australians think about their loans and budgeting, and her tips and shortcuts have evolved to become even more valuable in todays property and investment markets than they were when she first began.

Addicted to staying busy, Anita enjoys horse-riding, archery, puzzles, a long list of home-crafts, quality time with her family and writing crime and adventure thrillers, which feature characters who enjoy and rely on problem solving as much as she does. She also sponsors a number of charities and youth encouragement awards.

All rights reserved. No part of this book may be reproduced or transmitted by any person or entity, including internet search engines or retailers, in any form or by any means, electronic or mechanical, including printing, photocopying (except under the statutory exceptions provisions of the Australian Copyright Act 1968 ), recording, scanning or by any information storage and retrieval system without the prior written permission of Random House Australia. Any unauthorised distribution or use of this text may be a direct infringement of the authors and publishers rights and those responsible may be liable in law accordingly.

Your Investment Property

FULLY REVISED & UPDATED

ePub ISBN 9781742744995

A Random House book

Published by Random House Australia Pty Ltd

Level 3, 100 Pacific Highway, North Sydney, NSW 2060

www.randomhouse.com.au

First published by Random House in 2002.

This revised and updated edition published in 2008.

Copyright Anita Bell 2008

The moral right of the author has been asserted.

All rights reserved. No part of this book may be reproduced or transmitted by any person or entity, including internet search engines or retailers, in any form or by any means, electronic or mechanical, including photocopying (except under the statutory exceptions provisions of the Australian Copyright Act 1968), recording, scanning or by any information storage and retrieval system without the prior written permission of Random House Australia.

Addresses for companies within the Random House Group can be found at

www.randomhouse.com.au/offices .

National Library of Australia

Cataloguing-in-Publication Entry

Bell, Anita, 1967.

Your investment property.

Rev. and updated ed.

ISBN 978 1 74166 733 2 (pbk.).

1. Real estate business Australia. 2. Real estate investment Australia. I. Title.

332.63240994

Cover design by Darian Causby/Highway 51 Designworks

This book is dedicated to those thousands of readers

who stopped me in the street to thank me for the first

book and ask for more, and to my wonderful family

who supported me in the process.

And also to Pam and Cheryll who taught me that

fair and decent real estate agents do exist.

Welcome to the wonderful world of investment loans and property. With this book I hope to answer all of your questions and more about buying and selling properties for profit. But you can also use or adapt many of the tips and shortcuts in here to buy or sell holiday homes, business premises, hobby farms or live-in fixer-uppers.

For those of you who dont know me from my first books, I must warn you that I have absolutely no formal qualifications whatsoever in the real estate or banking industries. Everything youre about to read is from personal experience gathered while I bought and paid off my own home PLUS three investment properties between the ages of sixteen and twenty-six. (And all of them in less than three years each while earning only low to middle incomes and without having to borrow against one to buy another.) There are also shortcuts and traps I discovered from helping to rescue othersfree of charge of course, because unlike many other finance authors, Im not involved in the finance industry.

Your Mortgage is for people starting out with a clean slate.

Your Money is to help you get and keep a clean slate.

Your Investment Property is for people with or without a clean slate.

My immediate goal is to keep your initial costs down, by focusing each book on self-contained specific financial goals, depending on your needs at any one stage in life. Thats why the chapter on selling your home quickly is in this book, not in Your Mortgage .

One last note before we begin

My goal of buying and paying out investments as fast as possible so I can move on to the next one debt-free is definitely NOT what youll hear from any other investment specialist that Im aware of. Even the reputable advisors seem to focus on debt maximisation and tax minimisation, aiming for capital gain in the long term, while I focus on minimising costs and maximising profits in the short term, using tax minimisation as an accelerator with capital gain as a bonus.

Why such different approaches? Well, I think of it as just two ends of the same solution, and the multitude of packages that get offered to you in the investment marketplace usually fall towards the far end from how I prefer to invest in property. My choice is based on the fact that I like to live debt-free and Ive learned how to get the best out of every cent that passes through my pocket in order to do that.

The debt maximisation argument is based on the assumption that you dont mind being in debt and that you are already doing the best you can with your personal finances. We can debate the pros and cons of both sides until were all blue in the face, because neither side is right or wrong. However, knowing that my alternative exists should arm you with the knowledge and confidence you need to find your own happy medium for your own circumstances. And yes, many of the tips and hints in this book should still apply to all reputable investment programs even if they involve big debt.

Sadly, no-one teaches us about money management early on, so a lot of sensible, hardworking people are falling behind despite their best intentions. Too often, theyre sinking way over their heads in debt and paying twice what they need to, while theyre chasing future projections of growth, instead of minimising debt and maximising profits to get ahead of the pack in leaps and bounds in the short term. But more on that later. Just remember that no matter what path you choose for investment, always do what FEELS right for YOU. Money is only part of the equation for financial success. Fun and contentment should play a big part too.

Dont commit to any investment program you dont like the sound of or cant completely understand. Because when it comes down to it, its personal preference, basic maths and common sense that still reign supreme.

Font size:

Interval:

Bookmark:

Similar books «Your Investment Property How to Choose It, Pay for It and Triple Your Returns in 3 Years»

Look at similar books to Your Investment Property How to Choose It, Pay for It and Triple Your Returns in 3 Years. We have selected literature similar in name and meaning in the hope of providing readers with more options to find new, interesting, not yet read works.

Discussion, reviews of the book Your Investment Property How to Choose It, Pay for It and Triple Your Returns in 3 Years and just readers' own opinions. Leave your comments, write what you think about the work, its meaning or the main characters. Specify what exactly you liked and what you didn't like, and why you think so.