Visit the URL below to access your free Digital Asset files that are included with the purchase of this book.

LLCs (Limited Liability Companies) are becoming increasingly popular. Aspiring entrepreneurs and small business owners catch wind of them, l earn that they can be used to limit their personal liabilities in the event of a major business disaster and think, Hmmm, this almost sounds like a free form of business loss insurance ... and, to some extent, theyre right.

While an LLC offers tremendous advantages as a structure for businesses, understanding the appropriate steps to take in starting one and whats really transpiring, in a legal sense, can require a lot of explaining. The intent of this book is to provide a sound understanding of how an LLC is formed, how it operates, and how it can be leveraged for the greatest benefit for your small business.

You may be wondering if a book and a little Internet research will adequately prepare you for setting up your LLC. Heres the deal: LLCs are a relatively new type of business structure. In fact, the first LLC was started less than 40 years ago in Wyoming. It was introduced as a mechanism to remedy what were perceived as shortcomings in other business structure formats, and the void it fillsin the business senseis often a benefit to those who elect to take advantage of the LLC format.

The idea of the LLC caught on, and by the 1990s LLCs could be formed in every state. Thats the other thing about LLCs: theyre formed within the state. You cant just go into business at-will, as you would with a sole proprietorship or a partnership. You have to file Articles of Organization in the state of your choice. Well talk more about how to choose the right state for your LLC in Chapter 6. The basics of the LLC are similar from state to state, but not identical. Were going to cover the the more universal elements of LLCs, while being sure to direct you towards resources with more state-specific information.

Do I Need A Lawyer?

Since the LLC is a newer form of business entity, theres still a lot to be decided by the courts when it comes to how LLCs operate under the law. So, the safest answer to this question is yes, but, as you can probably infer, thats also the most expensive option. With each passing year, and as more and more case law is generated that helps us understand the role of LLCs in the business environment, its become easier and easier to do things on your own. Were living in an age in which its easy to find great books (like this one!) and sophisticated online tools (such as legalzoom.com [no affiliation]). These inexpensive and at times free resources may provide sufficient information for certain individuals in certain states. Other individuals may find that the best option is to hire an attorney to help walk them through the process of forming an LLC.

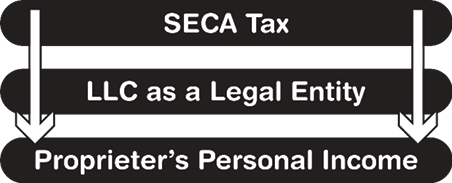

Pass-Through Taxation

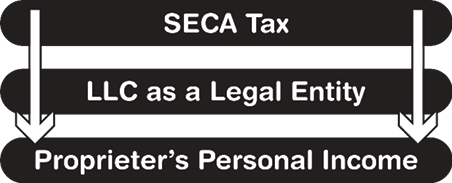

If you dont already understand the concept of pass-through taxation, then it is a good idea to get your head around it before you delve too deeply into this analysis of LLCs. Pass-through taxation refers to the taxing of business income through the taxing of personal income. Its one of the fundamental factors that distinguishes LLCs and sole proprietorships from corporations; LLCs and sole proprietorships are subject to pass-through taxation. The business entity itself isnt taxed, but the business earnings are taxed as part of the owners individual personal income.

Note : When business income is taxed via pass-through taxation, the business entity itself is classified by the IRS as a disregarded entity , meaning, an entity that exists but is not directly taxed.

Pass-through taxation isnt necessarily a bad thing, but it can definitely be more expensive than corporate taxation. In fact, whenever you ask your lawyer to review the negatives of the LLC model, this usually tops the list. Heres why: when a corporations profits are taxed, Medicare and Social Security taxes arent imposed (1.45% and 6.2%, respectively). For corporations, these types of taxes are only imposed on the salaries the corporation pays to its employees. When a person is acting as a sole proprietor, or when a group of people is acting as an LLC, their business profit is subject to Medicare and Social Security, as well as standard federal, state and local taxes. Pass-through taxation operates just like self-employment tax , so the LLC owner or partner is paying the full portion of his Social Security and Medicare obligations in taxes, as opposed to splitting these tax burdens with his employer.

Note : Ordinarily, when an individual is working for an employer, the employer pays 50% of the federally-required Medicare and Social Security withholdings. When an individual is classified as self-employed, he or she is responsible for paying 100% of the federal withholding. This Social Security funding tax is known as SECA, instead of FICASelf Employed Contributions Act and Federal Insurance Contributions Act, respectively. The good news for small business owners is that your employer portion of the SECA tax (50%) can be written off.

Its important to point out here that LLCs can opt to be taxed as corporations. Well go into further detail on taxation in Chapter 5.

Other Potential Disadvantages to an LLC

One of the problems with the general publics current understanding of LLCs is that theyre not all that clear on the downsides. Why stick with a sole proprietorship or a partnership when you can be absolved from all debt and legal liability with an LLC? In some ways it really is true, even though it may seem too good to be true. LLCs are awesome!

When you form an LLC, you and your co-founders or co-owners will only put at risk the money and the financial assets that you contribute to the LLC. If the LLC gets into trouble and cant pay its debts, or if someone wages a lawsuit against your LLC and wins, then theyre not going to get your house, your car, or anything out of your personal bank account.

What this means for you is if you have very little money in the bank, what you dont put into your business is protected. On the other hand, if youve got a lot of assets, a high net worth, etc., and you want to open up a construction company, then you should seriously consider going with an LLC to keep your personal assets safe in the event of an on-the-job accident or some other unforeseen event that ends up exerting a serious financial burden on your business. Many view this as a win-win situation. Every business person understands that he shouldnt invest more that he is willing to lose, and an LLC essentially guarantees that what he elects not to invest stays safe.

If youre just looking to devote yourself to the humble but delicious pursuit of being a donut shop owner, you could go the LLC route, but getting started is going to be a lot more time consuming and expensive. This is the chief setback of the LLC structure; when starting a sole proprietorship, you can pretty much just get up and go into business. Youll have to make sure you have the proper licensure and permits, and youll need to keep track of your earnings for tax purposes, but thats really about it.