This edition is published by PICKLE PARTNERS PUBLISHINGwww.picklepartnerspublishing.com

To join our mailing list for new titles or for issues with our books picklepublishing@gmail.com

Or on Facebook

Text originally published in 1924 under the same title.

Pickle Partners Publishing 2015, all rights reserved. No part of this publication may be reproduced, stored in a retrieval system or transmitted by any means, electrical, mechanical or otherwise without the written permission of the copyright holder.

Publishers Note

Although in most cases we have retained the Authors original spelling and grammar to authentically reproduce the work of the Author and the original intent of such material, some additional notes and clarifications have been added for the modern readers benefit.

We have also made every effort to include all maps and illustrations of the original edition the limitations of formatting do not allow of including larger maps, we will upload as many of these maps as possible.

COMMON STOCKS AS LONG TERM INVESTMENTS

BY

EDGAR LAWRENCE SMITH

TABLE OF CONTENTS

Contents

INTRODUCTION

These studies are the record of a failurethe failure of facts to sustain a preconceived theory. This preconceived theory might be stated as follows:

While a diversity of common stocks has, without doubt, proved a more profitable investment than high-grade bonds in the period from 1897 to 1923, during which dollars were depreciating, yet with the upturn in the dollar, bonds may be relied upon to show better results than common stocks, as they did in the period from the close of the Civil War to 1896, during which the dollar was constantly increasing in purchasing power.

Based upon a general understanding of the results which logically follow changes in the purchasing power of the dollar, such a theory should have been demonstrable, and the tests of the comparative investment value of bonds and of common stocks covering the period from 1866 to the end of the century, which are outlined in the following pages, were undertaken in its support. But they failed, because, quite unexpectedly, they demonstrated that the premise upon which the preconceived theory rested, namely, that high-grade bonds had proved to be better investments during the period of appreciating dollars, could not be clearly sustained by any evidence available.

The preconceived theory was, therefore, abandoned.

The facts assembled, however, seemed worthy of further investigation. If they would not prove what we had hoped to have them prove, it seemed desirable to turn them loose and to follow them to whatever end they might lead.

Fortunately they seem to have led to the isolation of certain characteristics inherent in a diversification of representative common stocks which may be of value to those investors who have given small heed to the long-term investment attributes of this class of security, and to others, who, while drawn to common stocks, have felt that their leaning in that direction should be repressed as lacking in conservatism.

Bonds, as a class, have certain recognized attributes. A diversification of common stocks has its own attributes, which differ from those of bonds. Each class of investment has its useful purpose and its proper place in any investment plan. A clearer understanding of their differing attributes may help to determine the relative proportion of each of these two classes of securities which will best serve the investment requirements and purposes of each investor.

ACKNOWLEDGEMENTS

While the account of these studies is brief, their pursuit has been long, and the author wishes to acknowledge the sympathetic co-operation through discussion which he has received from many sources, notably from members of the firm of Wood, Low & Company in whose offices they were carried out, and from Theodore T. Scudder and F. Haven Clark, of the firm of Scudder, Stevens & Clark, of Boston.

Their co-operation has not stopped with the completion of this volume, but has continued in the formulation of a practical plan under which certain fundamental principles of investment management disclosed by these studies may be brought, under responsible auspices, to the service of investors.

The tables were compiled largely by Mr. W. C. Beecken.

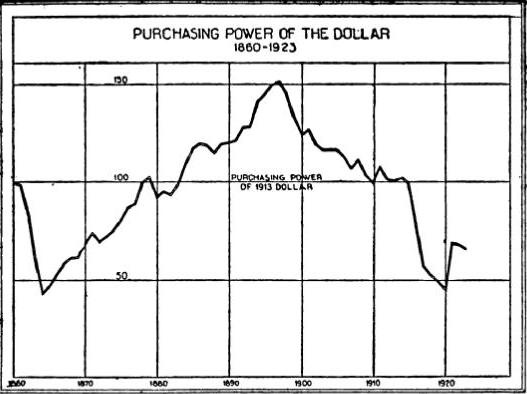

THE FLUCTUATING DOLLAR

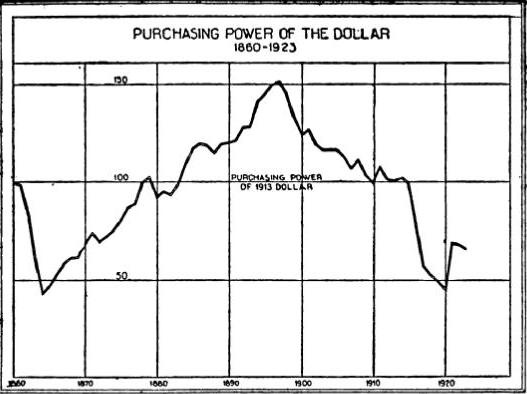

CHART No. 1.This chart is derived from U. S. Department of Labor index numbers of Wholesale Commodity Prices, using their old series, corrected, from 1860 to 1900 and the new series from 1900 on. The transfer from old to new series was made in 1900 because the transition in that year showed the smallest variation. See U. S. Dept. of Labor Bulletin No. 149, and Monthly Labor Review, Vol. XV, No. 1, July, 1922.

Variations in the dollar, as a measure of real value, have an important bearing upon the advantageous investment of individual resources. A series of studies is here presented, based on a comparison of high grade bonds and of common stocks over different periods extending from the close of the Civil War up to 1922. The cumulative evidence of these studies favors diversified common stocks, even in periods of appreciating currency, such as from 1866 to 1897. Since 1897, with currency depreciating, the diversified common stocks selected are shown to have been by far the superior form of long term investment.

CHAPTER IBONDS AND THE DOLLAR

WHEN the topic of conservative investment is under discussion, high grade bonds hold an unassailable position in the minds of most people, and the discussion usually resolves itself into weighing the relative merits of different issues of such bonds or how far it is safe to stray away from the most highly secured bonds in an effort to obtain a higher income return. Those who venture to suggest preferred stocks sometimes feel that they have gone as far as conservative opinion will support them. Common stocks are ordinarily left out of the discussion altogether.

Common Stocks are, in general, regarded as a medium for Speculationnot for Long Term Investment.

Bonds, on the other hand, are generally held to be the best medium for Long Term Investmentfree from the hazards of Speculation.

Is this view sound? What are the facts?

A venerable tradition of conservatism has attached to first mortgages whether upon real estate or upon corporate property as the basis for an issue of bonds. This tradition was supported by experience up to 1897, when the purchasing power of the dollar reached its highest point. But the experience of investors in real estate mortgages and in mortgage bonds, with respect to a depreciating currency since 1897 and with respect to a rising interest rate since 1902, raises grave doubt as to the justification of this tradition with particular reference to personal as opposed to institutional investments.

Because common stocks are regarded as speculative, they are frequently omitted entirely from the lists of a great many investors. Is this omission based on a thorough study of the relative merits of bonds and stocks or is it based in part on prejudice? It is true that stocks fluctuate in price in response to many factors, some related to the industry they represent, some to general business conditions, some to the temporary market position of avowed speculators.

Is it not possible that the association of speculation with common stocks has somewhat influenced a majority of investors against them, and has exaggerated in their minds the danger of possible loss to those who buy them for long term investment?

Next page