Acknowledgements

Most people dont write books while theyre learning about the subject along the way, but my publisher, Sophy Williams, thought I could do it. Thanks Sophy for taking a punt on me, and the world of ethical investment. I feel so fortunate to have had this opportunity and Im grateful to be able to pass my knowledge on. I really hope it makes a difference.

To the team at Black Inc., you guys rock. Thanks in particular to my editor, Kate Morgan. Your wonderful eye and easy nature have made this process a dream. Caraline Douglas and Pam Rupasinghe, you know how much I love Instagram, thanks for your digital marketing prowess. Sallie Butler, Im stoked to have been able to work with you to share this message, too. Alex Adsett, how lucky I am to have an agent who I can call a friend. Thank you as always for your enthusiasm and chats about our cats.

Writing a book is hard. Writing a book during a pandemic while selling a property, buying a new one, moving and starting a renovation is lunacy-level behaviour. I was only able to do this thanks to an extraordinary support network, in particular Kate Vines who helped me during my Ballarat purchase process, and Margot Bourchier who took me straight to Bunnings on arrival. Also, those who propped me up when I didnt think I could keep going: my parents Sharyn and Colin, brothers Paul and Joel, my (practically) sister-in-law Christine Stone, and friends Beck Thiso and Sally Wright.

Moving to a regional town alone took a massive leap of faith. To those who made Ballarat feel like home almost instantly: Katherine White and Brooke Lyons, Im indebted. Thanks Kat, for the constant reno chats and the local immersion, and Brooke for offering to read my early pages youre a magnificent editor.

A book like this doesnt come together without remarkable people giving their time and being incredibly vulnerable, sharing personal financial information. Thank you to every single interviewee who chatted to me. There are too many of you to thank here, but please know that its appreciated and I hope it helps other aspiring ethical investors move forward.

Finally, Peach and Olive, youll never read this because youre cats, but I want it on paper that having you snooze next to me while I write makes all the difference.

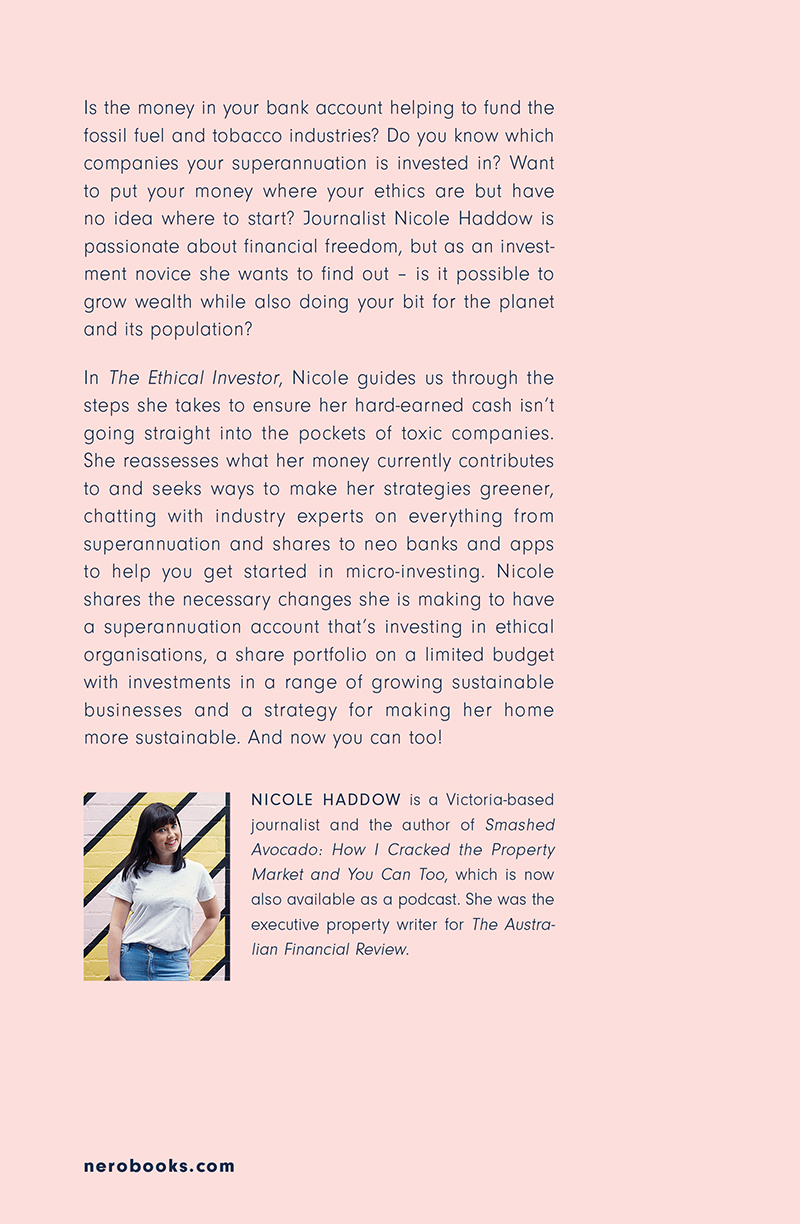

What Is Ethical Investment?

ETHICAL OR SOCIALLY RESPONSIBLE INVESTING involves consciously putting money into financial plans or businesses that dont damage the environment or have negative social outcomes. The aim, of course, is to simultaneously derive a return on that investment.

It turns out that ethical investment isnt a new concept. The Quakers were doing it back in the eighteenth century, insisting that their members couldnt engage slaves, arguing, rightly, that a trade that involved the buying and selling of people was immoral. Similarly, in the same era, Methodist preacher John Wesley wrote a sermon called The Use of Money. In it, he questions whether gold, silver and other valuables were to blame for corruption. The love of money, we know, is the root of all evil; but not the thing itself. The fault does not lie in the money, but in them that use it, he concluded.

Man, this guy had no idea how much worse things were going to get.

By the twentieth century, more people were advocating against investing in sin stocks. But, while a small number of people could see the benefit of investing in good over evil, the reality was that alcohol, tobacco, gambling and coal paid the big bucks.

Ethical investment funds started to pop up in Australia during the 1980s and 1990s. But it wasnt until the early 2000s that increasing consumer pressure and green activism pushed those running larger institutions to sit up and take notice.

This wasnt just about climate change, though. The word ethical is open for interpretation in the investment space. Being ethical in business means different things to different people. It also depends on what your business is. A beauty company might be considered ethical because its research and development doesnt involve testing on animals. An accounting firm might be considered ethical because it pays its staff above award wages and provides quality working conditions. A fashion designer might be considered ethical if they choose to manufacture their garments locally, create domestic jobs and advocate against child labour.

So, where are we at right now?

Today, according to the Responsible Investment Association Australasia (RIAA), approximately $1 trillion of the $2.24 trillion in managed funds is classified as responsible. Thats not just because Australians are increasingly more aware of the impact their investments can have, its because ethical investment is really starting to pay. Big time.

A 2019 report by the RIAA showed that responsible share portfolios are consistently outperforming the benchmark. While the ASX 300 index showed returns of 5.6 per cent over five years and 8.91 per cent over ten years, ethical investment was returning 6.43 per cent and 12.39 per cent, respectively.

Its hardly a surprise. Ethical investment and innovation go hand-in-hand. Sustainable, environmentally friendly and socially conscious businesses are often making essential contributions to our future, and frequently taking a tech-focused approach. They provide products and services that are in demand. And where theres demand, theres likely going to be an ongoing return on investment.

Imagine if youd invested in Google just as the internet was taking off. The same logic can be applied to your approach to ethical investment. Why wouldnt I invest in renewable energy over coal? It makes sense to put my money into healthcare rather than tobacco. Aged care is among the fastest-growing sectors in Australia, and the need for better services and facilities is going to impact all of us in the future.

But if you were an early adopter of Google shares, you were taking a massive risk. No one knew it was going to be the behemoth that it is today. There was no history of returns when Google first went public. So if youre investing in ethical ventures that are new, its important to do research, as much as is possible, with whatever information is available.

Of course, we are seeing plenty of ethical disruptors that are delivering returns to happy shareholders. Like all shares, though, ethical options can rise and fall over time. Nonetheless, investors are keeping a very close eye on the ethical market.

Why green is the new black

There are a few reasons why ethical investment is on the up. For starters, young professionals are becoming acutely aware that they can invest in products that are aligned with their values, and thats driving a significant amount of change. Say what you will about smashed-avocado-eating millennials, but theyre leading the charge. According to a 2017 survey by Lonergan Research on behalf of RIAA, millennials were the most likely cohort (75 per cent of respondents) to choose a super fund with environmental, social and governance screening, while also seeking to maximise their returns. Sixty-nine per cent said they would consider ethical investment in the future.

Secondly, the barrier to entering the ethical investment market is much lower than it once was. Take, for example, the advent of micro-investing apps and exchange traded funds (ETFs). ETFs are comprised of several shares and assets. Theyre bought and sold on the stock exchange, just like individual shares. The difference is you get to buy a bundle of shares in one trade. So rather than buying a single share of one company, youre buying a very small share of lots of companies or assets. A key benefit is the diversification of ETFs. While one company in your ETF might take a dip in value due to market activities, that doesnt mean they all will.

Next page