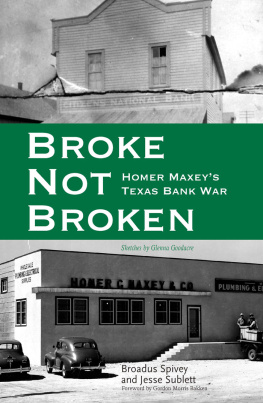

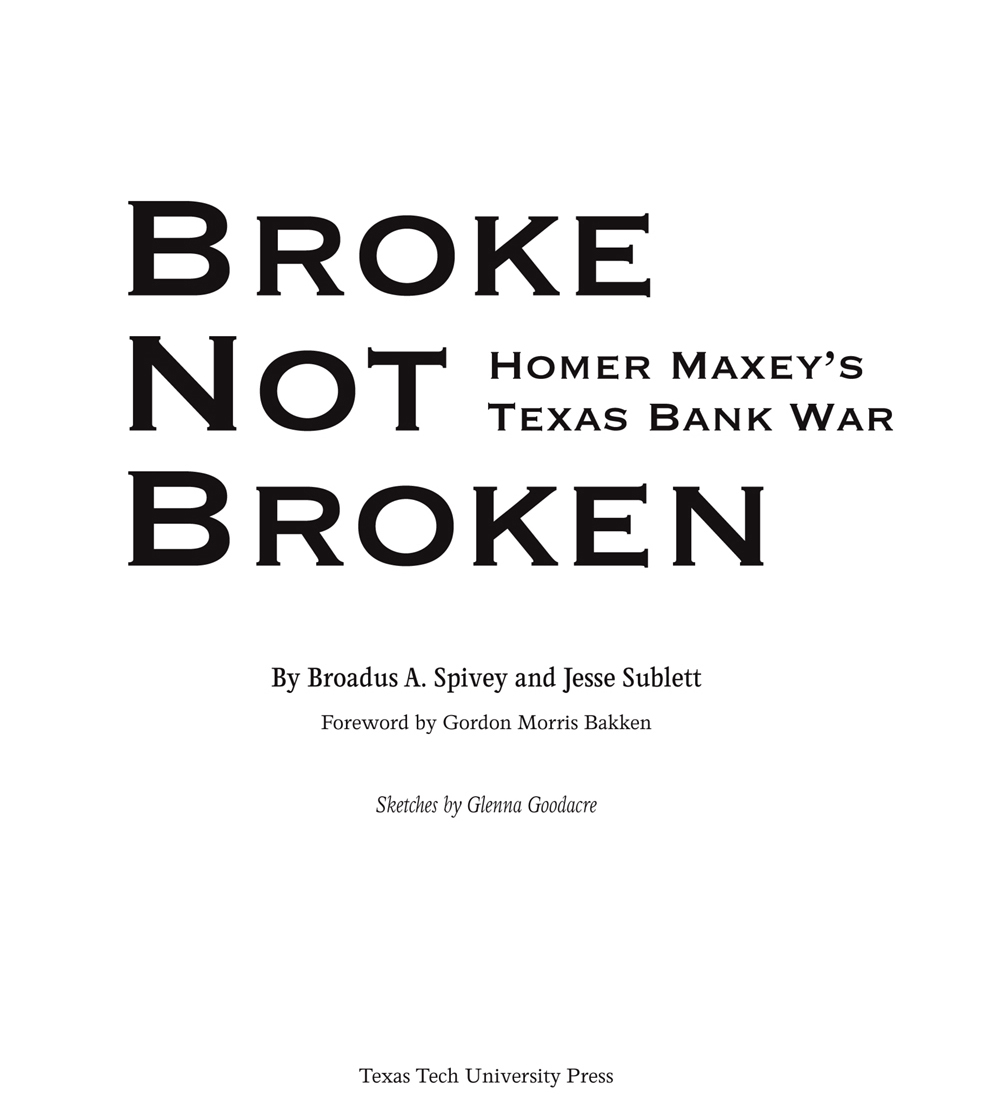

H omer Maxey was a war hero, multimillionaire, and pillar of the Lubbock, Texas, community. During the post-World War II boom, he filled the West Texas horizon with new apartment complexes, government buildings, hotels, banks, shopping centers, and subdivisions.

On the afternoon of February 16, 1966, executives of Citizens National Bank of Lubbock met to launch foreclosure proceedings against Maxey. In a secret sale, more than 35,000 acres of ranch land and other holdings were divided up and sold for pennies on the dollar. By closing time, Maxey was penniless.

Maxey sued the bank and every member of the board of directors, including long-time friends and business partners. Almost fifteen years, two jury trials, and nine separate appeals later, the case was settled on September 22, 1980.

Broke, Not Broken, the story of this record-breaking, precedent-setting legal case, illuminates a community and a self-styled go-getter who refused to back down, even when his opponents were old friends, well-heeled leaders of the community, a bank backed by powerful Odessa oil men, and the most formidable attorneys in West Texas.

Editorial Board

Michal Belknap

Richard Griswold del Castillo

Rebecca Mead

Matthew Whitaker

Also in the series

A Clamor for Equality: Emergence and Exile of an Early Californio Activist

Paul Bryan Gray

Hers, His, and Theirs: Community Property Law in Spain and Early Texas

Jean A. Stuntz

Lone Star Law: A Legal History of Texas

Michael Ariens

The Reckoning: Law Comes to Texass Edwards Plateau

Peter R. Rose

Sex, Murder, and the Unwritten Law: Courting Judicial Mayhem, Texas Style

Bill Neal

Treasure State Justice: Judge George M. Bourquin, Defender of the Rule of Law

Arnon Gutfeld

Copyright 2014 by Broadus Spivey and Jesse Sublett

Sketches Copyright 2014 by Glenna Goodacre

All rights reserved. No portion of this book may be reproduced in any form or by any means, including electronic storage and retrieval systems, except by explicit prior written permission of the publisher. Brief passages excerpted for review and critical purposes are excepted.

This book is typeset in Perrywood. The paper used in this book meets the minimum requirements of ANSI/NISO Z39.48-1992 (R1997).

Designed by Kasey McBeath

Cover designed by Kasey McBeath

Cover photographs courtesy of the Southwest Collections/Special Collections

Library at Texas Tech University.

Library of Congress Cataloging-in-Publication Data

Spivey, Broadus A., author.

Broke, not broken : Homer Maxeys Texas bank war / by Broadus A. Spivey and Jesse Sublett ; foreword by Gordon Morris Bakken ; sketches by Glenna Goodacre.

pages cm (American liberty and justice)

Includes bibliographical references and index.

ISBN 978-0-89672-855-4 (hardback) ISBN 978-0-89672-856-1 (e-book)

1. Maxey, Homer, 1911-1980Trials, litigation, etc. 2. Citizens National Bank of Lubbock--Trials, litigation, etc. 3. Judicial salesTexasLubbockHistory20th century. 4. CorruptionTexasLubbockHistory20th century. I. Sublett, Jesse, author. II. Goodacre, G. (Glenna), illustrator. III. Title.

KF228.M316S67 2014

346.76404'363dc23 2013050899

14 15 16 17 18 19 20 21 22 / 9 8 7 6 5 4 3 2 1

Texas Tech University Press

Box 41037 | Lubbock, Texas 79409-1037 USA

800.832.4042 |

The authors wish to extend special acknowledgment to Carla Maxey Elliott (9/13/354/06/13), whose contributions and support for this book about her father were essential to producing an important, accurate, and readable account of her fathers life.

The law doth punish man or woman

Who steals the goose from off the common,

But lets the greater felon loose

Who steals the common from the goose.

Anonymous eighteenth-century rhyme

CONTENTS

A s the book was in the final stages of production, Glenna Goodacre found a sketchbook that she used during the first week of the first jury trial in the Maxey case. In the limited time available to them, the authors were able to identify all of the principle figures she drew, with the exception of the jurors. Some of the figures were easy to identify, and the more difficult identifications were made after consultation with Glenna and some basic detective work. The easy ones were Homer Maxey (), were identified after comparison with other individual drawings in the sketchbook. Glenna, along with her sister, Carla Elliott, and her mother, sat in the same place every day of the trial, therefore, her visual perspective of the attorneys seated at their respective tables: plaintiffs were on the left, defense on the right. The sketchbook is dated November 3, 1969. During that time, Homer Maxey was in the witness box as he is depicted in the courtroom scene.

A s books and articles about banking and litigation go, this work is unique and a tribute to the tenacity of Homer Maxey and the Texas judicial system. Justice was served and the limits of law exposed in the appellate process. Yet this was unlike so many other episodes in American history.

Popular movements against debt collection via the judicial system were part of our early national experience. Daniel Shays was the catalyst for a rebellion in 1786 that shut down the Massachusetts court system to prevent the collection of debt both private and public. The rebellion was against debt collection for taxes and private encumbrances such as mortgages and promissory notes. Debtors had inadequate specie to pay taxes and debt. Money supply problems were endemic and government wanted payment in hard money, not worthless paper money. Shayss Rebellion was put down by force.

Debt in American society also was endemic, with every entrepreneur borrowing money to create wealth whether agricultural or mercantile. Bruce Manns Republic of Debtors: Bankruptcy in the Age of American Independence (2009) opens this window to people in debtors prison, from the wealthiest man in America to a justice of the United States Supreme Court. Without a bankruptcy statute, creditors put people in jail to encourage payment. A stable banking system contributed to a stable currency; Alexander Hamilton, with the US Constitutions authority and President George Washingtons blessing, helped create the Bank of the United States. The bank issued a new paper currency based on gold, silver, and government bonds on deposit that would vastly increase the countrys supply of money and therefore stimulate its economy. Hamilton was right.

The Second Bank of the United States under Nicholas Biddle strengthened the value of the dollar and applied strict and consistent standards before accepting local bank note issuance, thereby increasing greatly interior liquidity. The result was that The specie circularrequiring specie for public land salespushed the flow of gold and silver to Washington, and debtors were without the ability to pay local debt in hard money.

The Republican Party under President Abraham Lincoln returned the country to central banking. Congress passed a bankruptcy act in 1898, and mortgage debt became subject to judicial process or bankruptcy or both. The American West created a more efficient capital market, although exploitation was still evident in the commission charges of brokers. This relationship between debt and judicial foreclosure survived recessions and depressions until the 1930s.

Next page