Chapter 13

DOING THE BOOKS

The first thing to do in your brewery bookkeeping is to create a Change Bank. This is a box you keep in your safe with a specific amount of money in it. We use $400. It is divided into change from five-dollar bills down to pennies. It can be used for petty cash and to make change during a busy night when the first customer wants to pay with a $100 bill.

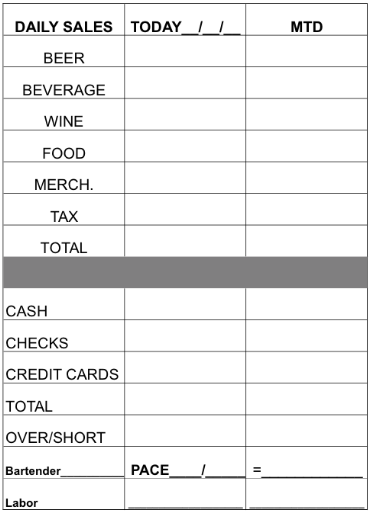

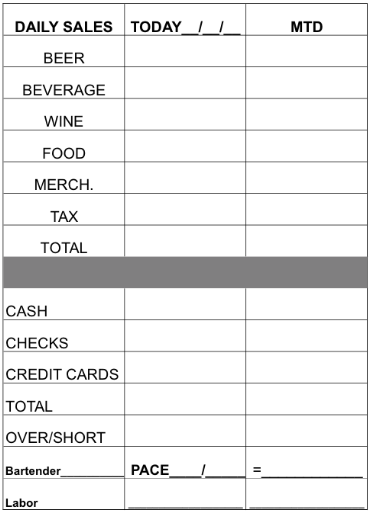

The next step involves doing the daily books. To do this we use what is called a Daily Sales Report.

The ownership of a brewery means selling beer, and that means taking in money. Just as important as the quality of your beer, is keeping track of how that money comes in and goes out. A good bookkeeping system is at the heart of a good business.

The simplest way to do the books would be to take all your sales for the day, make up a deposit slip and take it to the bank. However, if you did this, and many businesses do, in the long run you would be making your life more difficult. This is because you are selling much more than beer.

You are probably going to be selling food, perhaps liquor or wine, and maybe some merchandise, such as hats, tee shirts, and pint glasses. Dont forget that depending on where you live, you may be collecting a sales tax too. All these types of sales should be kept track of in their own categories.

To maintain a food cost of say 30%, you will need to know how much of your sales came exclusively from food. The same goes for beer, wine, or merchandise. Here is a simple system to do just this. This will also integrate into some pretty exciting things that will help you be successful. However lets first look at the Daily Sales Report or DSR . A template appears on the next page, which you can change to suit your needs. The template is followed by an explanation of how to create a DSR .

How to Create a Daily Sales Report ( DSR )

The DSR is simply your bookkeeping checklist. A piece of paper with lines on it to divide the categories of sales and the categories of money you bring in. Then a balance of the two resulting in an over, short, or even (balance) at the bottom of the ledger.

- You will start by ringing out your cash register.

- There will be a way for you to read your totals without resetting it back to zero, which can be done at any time, and a way to read the totals and reset the register for the next day.

- Depending on the type of cash register you have, the register will print up your totals according to what categories you have set up. Lets assume it prints totals for Beer, Beverage, Wine, Food and Merchandise. It will also give you a total for tax collected, if there is sales tax where you live.

- You will transfer those totals to the top portion of your DSR .

- Next, you will count the money in your cash register drawer.

- You do not start your day with an empty drawer because you would be unable to make change. So lets assume you start with $150 made up of change and bills, nothing larger than a five-dollar bill.

- Separate the cash from the checks and the credit card receipts. Start counting the cash with a calculator that prints, beginning with the largest denominations down to the pennies. Make an entry into the calculator for every level of denomination. For example, count all the twenties and enter the amount, followed by the tens, and so forth.

- When you have a total, subtract out the original $150, and then enter that into the DSR where it says Cash .

- Next, look at the tape from the calculator and add back the amounts starting this time with the pennies, on up to the fives. Take this amount and subtract it from $150 and the result will be what you need to add or subtract to your cash drawer to bring the drawer back to the original $150 it started with. The left over money will go into your deposit.

- Then total the checks and enter that amount.

- When you close out your credit card machine (your credit card company will show you how this works) it will print up a total of the credit cards for the day. Record that amount on your DSR and save the credit card receipts in a separate place for future reference. I like to just staple them to the back of the DSR . That way we have everything relating to that day in one place.

- Finally, you will add all the types of revenue you collected, Cash, Checks, and Credit Cards to come up with a total. That total should match your total sales for the day. If there is a difference, that is written down into your over/short space.

Correcting Errors

What if it doesnt match? Mistakes can happen in many places. The first place to look, however, will be within your money triangle. It is made up of three areas where you have money:

- Your change bank (lets assume it to be $400)

- Your cash drawer (we said it was $150)

- Your deposit (your sales for the day)

If you are short in your deposit, you must be over in one of the other two areas. For example, if you finish your deposit and then re-count your change bank and find that it is $20 short, most likely you are $20 over in your deposit or your cash drawer. The remedy would be to re-count those to locate the missing $20.

The exception to this would be a mistake at the cash register. This would include things like giving the wrong change, or forgetting to adjust for a mistaken item rung up. To find these mistakes is a lot tougher. However, if you look first to the money triangle, you will find the majority of your mistakes.

How to Make Fewer Errors

To assure that there are fewer mistakes when you do your books, always start the process by counting your change bank and end the process the same way. When I count a change bank, I make it a habit to run a calculator tape. Next to the total I put the date and my initials on it.

Its sort of like my guarantee that there is that amount of money in there. I place the tape in the change bank with the money. The next time the money is counted, whoever is doing the counting knows when it was counted last and that it had the correct amount of money in it.

Recording Your Pace

At the very bottom of your DSR , there is a place to record your pace. Your pace is an estimate of what you hope to do in sales in any given time for our example, one month based on the sales you have done so far in the month. It is based on a fraction, as in 5/31, in other words 5 days out of 31.

As an easy example, lets say that at the end of day 5 you have done $5,000. Using this formula, you would take the total sales month to date ($5,000), and divide it by the number of days of business so far in that month ($5,000 divided by 5). This gives you average daily sales of $1,000. Now take that average daily sales figure and multiply it by the total number of days in the month ($1,000 times 31) and this will give you a total of $31,000.

Assuming you continue to average $1,000 per day, you will have a pretty good idea of how much in sales you will do for the month. Stay with me here, this is powerful stuff. Instead of waiting until the end of the month to see how well you did, you will know on a daily basis. Armed with this information, you can now make adjustments in labor or start new promotions to boost sales. As we will get into later, this works into the budget process so that you can plan your profits instead of just hoping for the best.

When you are finished doing your books, take the print-out from the cash register that you used to record your sales information, and tape it to the back of your DSR . This will give you a way to verify that the sales you recorded on your DSR are the same as the sales recorded on your cash register. This will come in to play when you do your audits, which will be explained later in this manual.