Scott Nations - A History of the United States in Five Crashes: Stock Market Meltdowns That Defined a Nation

Here you can read online Scott Nations - A History of the United States in Five Crashes: Stock Market Meltdowns That Defined a Nation full text of the book (entire story) in english for free. Download pdf and epub, get meaning, cover and reviews about this ebook. year: 2017, publisher: William Morrow, genre: Romance novel. Description of the work, (preface) as well as reviews are available. Best literature library LitArk.com created for fans of good reading and offers a wide selection of genres:

Romance novel

Science fiction

Adventure

Detective

Science

History

Home and family

Prose

Art

Politics

Computer

Non-fiction

Religion

Business

Children

Humor

Choose a favorite category and find really read worthwhile books. Enjoy immersion in the world of imagination, feel the emotions of the characters or learn something new for yourself, make an fascinating discovery.

- Book:A History of the United States in Five Crashes: Stock Market Meltdowns That Defined a Nation

- Author:

- Publisher:William Morrow

- Genre:

- Year:2017

- Rating:4 / 5

- Favourites:Add to favourites

- Your mark:

A History of the United States in Five Crashes: Stock Market Meltdowns That Defined a Nation: summary, description and annotation

We offer to read an annotation, description, summary or preface (depends on what the author of the book "A History of the United States in Five Crashes: Stock Market Meltdowns That Defined a Nation" wrote himself). If you haven't found the necessary information about the book — write in the comments, we will try to find it.

In this absorbing, smart, and accessible blend of economic and cultural history, Scott Nations, a longtime trader, financial engineer, and CNBC contributor, takes us on a journey through the five significant stock market crashes in the past century to reveal how they defined the United States today

The Panic of 1907: When the Knickerbocker Trust Company failed, after a brazen attempt to manipulate the stock market led to a disastrous run on the banks, the Dow lost nearly half its value in weeks. Only billionaire J.P. Morgan was able to save the stock market.

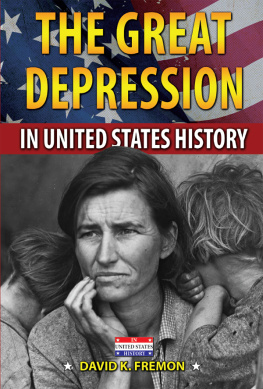

Black Tuesday (1929): As the newly created Federal Reserve System repeatedly adjusted interest rates in all the wrong ways, investment trusts, the darlings of that decade, became the catalyst that caused the bubble to burst, and the Dow fell dramatically, leading swiftly to the Great Depression.

Black Monday (1987): When portfolio insurance, a new tool meant to protect investments, instead led to increased losses, and corporate raiders drove stock prices above their real values, the Dow dropped an astonishing 22.6 percent in one day.

The Great Recession (2008): As homeowners began defaulting on mortgages, investment portfolios that contained them collapsed, bringing the nations largest banks, much of the economy, and the stock market down with them.

The Flash Crash (2010): When one investment manager, using a runaway computer algorithm that was dangerously unstable and poorly understood, reacted to the economic turmoil in Greece, the stock market took an unprecedentedly sudden plunge, with the Dow shedding 998.5 points (roughly a trillion dollars in valuation) in just minutes.

The stories behind the great crashes are filled with drama, human foibles, and heroic rescues. Taken together they tell the larger story of a nation reaching enormous heights of financial power while experiencing precipitous dips that alter and reset a market where millions of Americans invest their savings, and on which they depend for their futures. Scott Nations vividly shows how each of these major crashes played a role in Americas political and cultural fabric, each providing painful lessons that have strengthened us and helped us to build the nation we know today.

A History of the United States in Five Crashes clearly and compellingly illustrates the connections between these major financial collapses and examines the solid, clear-cut lessons they offer for preventing the next one.

Scott Nations: author's other books

Who wrote A History of the United States in Five Crashes: Stock Market Meltdowns That Defined a Nation? Find out the surname, the name of the author of the book and a list of all author's works by series.