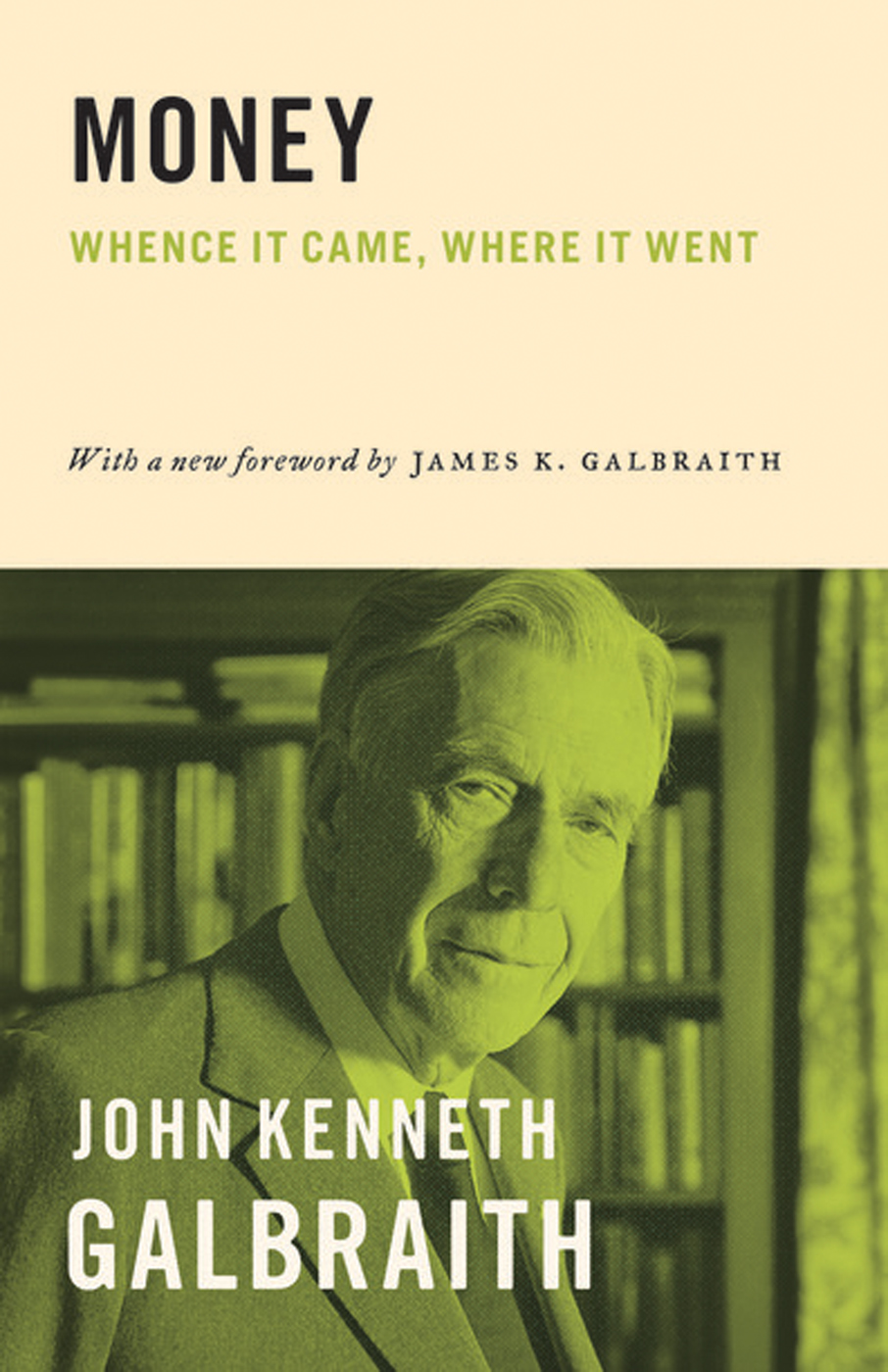

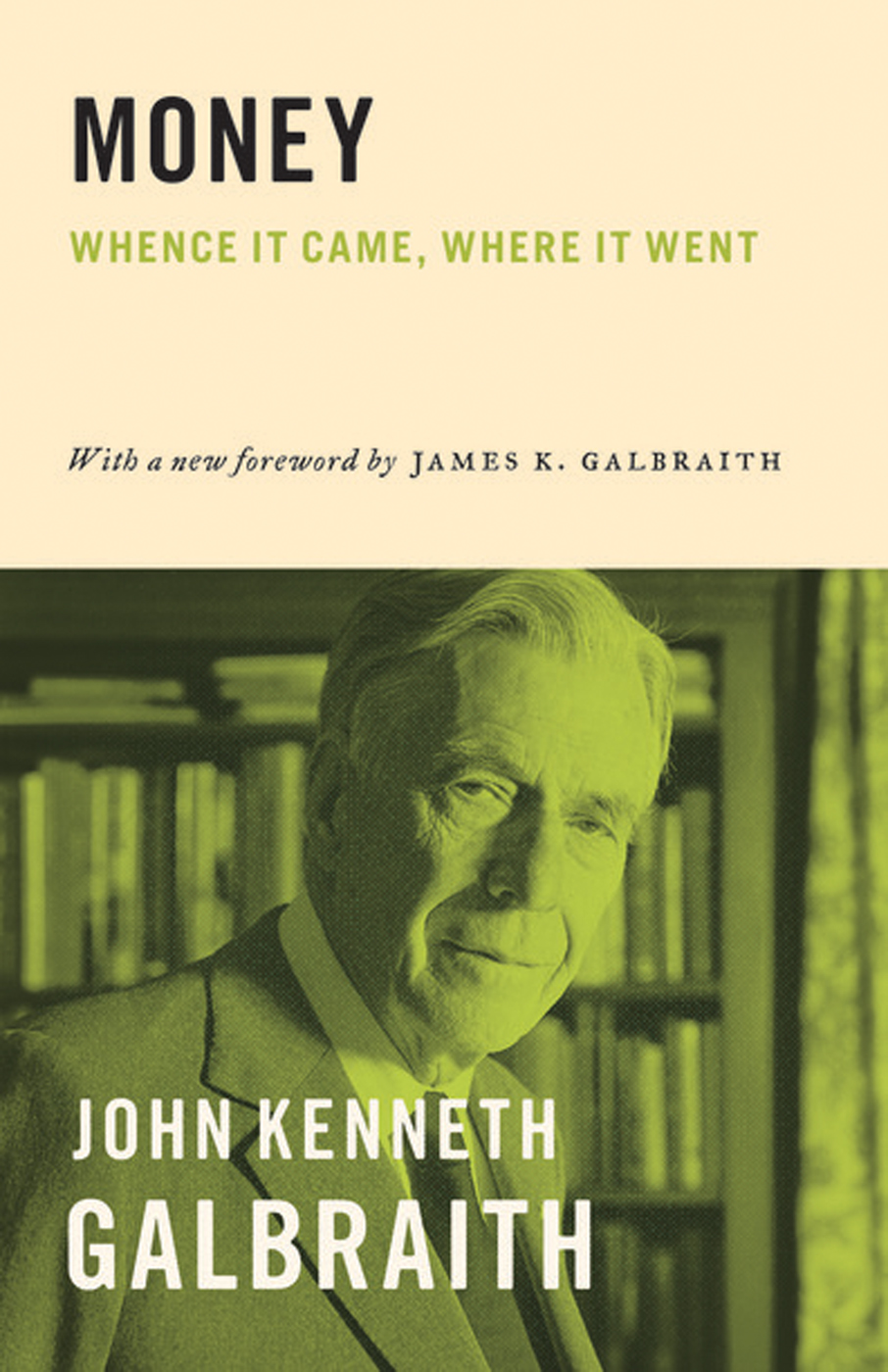

MONEY

MONEY

WHENCE IT CAME, WHERE IT WENT

JOHN KENNETH GALBRAITH

With a new foreword by JAMES K. GALBRAITH

PRINCETON UNIVERSITY PRESS

PRINCETON AND OXFORD

Copyright 2017 by the Estate of John Kenneth Galbraith

Foreword copyright 2017 by Princeton University Press

Requests for permission to reproduce material from this work should be sent to

Permissions, Princeton University Press

Published by Princeton University Press,

41 William Street, Princeton, New Jersey 08540

In the United Kingdom: Princeton University Press,

6 Oxford Street, Woodstock, Oxfordshire OX20 1TR

press.princeton.edu

Cover design by Andrea Guinn

Cover and frontispiece image courtesy of Harvard Public Affairs & Communications. Copyright President and Fellows of Harvard College

All Rights Reserved

Library of Congress Control Number 2017945483

ISBN 978-0-691-17166-1

British Library Cataloging-in-Publication Data is available

This book has been composed in Garamond Premier Pro and Trade Gothic LT Std

Printed on acid-free paper.

Printed in the United States of America

10 9 8 7 6 5 4 3 2 1

In memory of Jim Warburg

and with love

for Joan

CONTENTS

FOREWORD

James K. Galbraith

Money assembles the threads of high human folly, in the form of bankers, central bankers, speculators, and the political figures and the professors they own or, at least, give a persuasive appearance of owning. Nothing gave my father so much pleasure as to weave these threads.

This is a serious history, although not a work of original research. It is a narrative based on wide reading, a skeptical eye, and astute judgment, guided by his experience and by the sources he had available to him at the time. Mainly, though not exclusively, this is a history of money in the United States, from colonial times to the end of the Bretton Woods system in the early 1970s. Outside the United States, John Law and John Maynard Keynes play outsized roles here; the clay tokens of Sumer were unknown then, and the spectacular catastrophes of the 2000s had not happened.

The unique scale and distinctive politics of North America give this continent a special role in the annals of money, banking, fraud, and disaster. The isolation and primitive government of the early colonies set the pattern: originally wampum (seashells) was the circulating medium, and beaver pelts were the monetary reserve. In the South, tobacco served, giving rise to a calming but also malignant form of Greshams Law.

There followed paper money, the expedient of wartime and the fuel of revolutions, in the United States (Continentals and, later on, greenbacks) but also in France and later still in Russia. These, as my father wrote, are deeply disapproved of, in conventional histories, despite the fact that they were effective and indispensable. Banking is an ancient institution over which Americans waged political wars in the early nineteenth century and still today; wars that the bankers invariably win. Governments issue paper, and banks issue credit: these are the two ways to create money, for better or worse, each in their own way.

This book predates the fame of Hyman Minsky and he is not mentioned. It is, however, firmly in a reading of Keynes that does not separate the Treatise on Money from the General Theory, and therefore broadly in the tradition known today as modern monetary theory. Financial instability is the watch-phrase of the history it relates. Textbook fairy tales of wise central bankers issuing money at a careful pace designed solely to control inflation, while the real economy self-corrects to full employment, have no place in this portrait of the real world. Things did not get more stablein fact they got greatly less soas the nineteenth century gave way to the twentieth, even though government grew and economic understanding supposedly deepened. The disasters of our own time confirm that Galbraiths arch and skeptical outlook was sound. My father did not live to see the Great Financial Crisis of 2008, but it would not have surprised him. His book The Great Crash, 1929, first published in 1955, sold an additional 50,000 copies in 2009.

Galbraiths judgment that the return in 1925 of the United Kingdom to gold at the prewar parity was the most decisively damaging action involving money in modern times is now obsolete. The creation of the euro, and the integration into it of Greece, Spain, Portugal, and possibly Italy and Finland at impossible parities and without effective federal institutions has led to six years now of unending depression, under the policy sway of finance ministers far more dogmatic than Winston Churchill, Chancellor of the Exchequer in 1925.

In keeping with the traditional American primacy in monetary follies, one might point also to the repeal of Glass-Steagall and the legalization of credit default swaps under Bill Clinton, to the desupervision of the banks under George W. Bush, and to the concentration of power and market share in the top banks under Barack Obama. The first two together produced the greatest financial blowout of all time, and the third ensured that when recovery came, the spoils were routed through the same institutions that perpetrated the fiasco.

At the personal level, my fathers own instincts toward money were conservative. Early on, he imparted to me a basic philosophy: always have a little more than you need. He was a value investor and a skittish one; when I phoned on the night of the great stock market break of October 1987, his first words to me were, Not to worry. Ive been in cash for three weeks. Although he was the only Harvard professor in history to freeze his own salary, which he did for the universitys benefit in the 1970s, he finished solvent and left Mother plenty to live on. He never suffered any of the financial embarrassment here described.

And why did he write the book? For money, surely. But also, for fun. The pages that follow are proof.

Austin, Texas

August 26, 2016

ACKNOWLEDGMENTS

This book was, in an innocent way, its own progenitor. Initially it was to have been a long essay on the problems of economic management and monetary stabilization, and their origins. It was a timely undertaking. I could draw on a lifetime of reading, casual or otherwise, for these are matters of which an economist is expected to have knowledgeand I had always found the history of money, early and late, exceedingly engaging. So interesting was the task that the essay became a book, and the book became a long one. As may conceivably be evident, it was, as these things go, a joyful task.

No small part of the pleasure was from my partners in the enterprise. One of these was David Thomas, a highly faithful, intelligent and charming assistant, now, alas, lost to me in the practice of law. He had a remarkable ability to find both the things I needed and those on which I needed correction. Any malefactor so fortunate as to fall in his hands will be saved by Davids discovery of some hitherto unknown statute or decision exculpating him. As with almost everything I have written, Arthur Schlesinger read, challenged and corrected. No one else does so out of such a rich store of information and judgment. The errors that remain are all mine. My friend and assistant, Emeline Davis, typed, retyped and corrected the manuscript and generally managed its progress toward the printer. Nanny Bers helped her and me. And as in the case of everything Ive done for years, all questions of adequacy of explanation, editing, style and elementary good taste were subject to the unfailing eye and implacable authority of Andrea Williams. To all, all thanks.

Next page