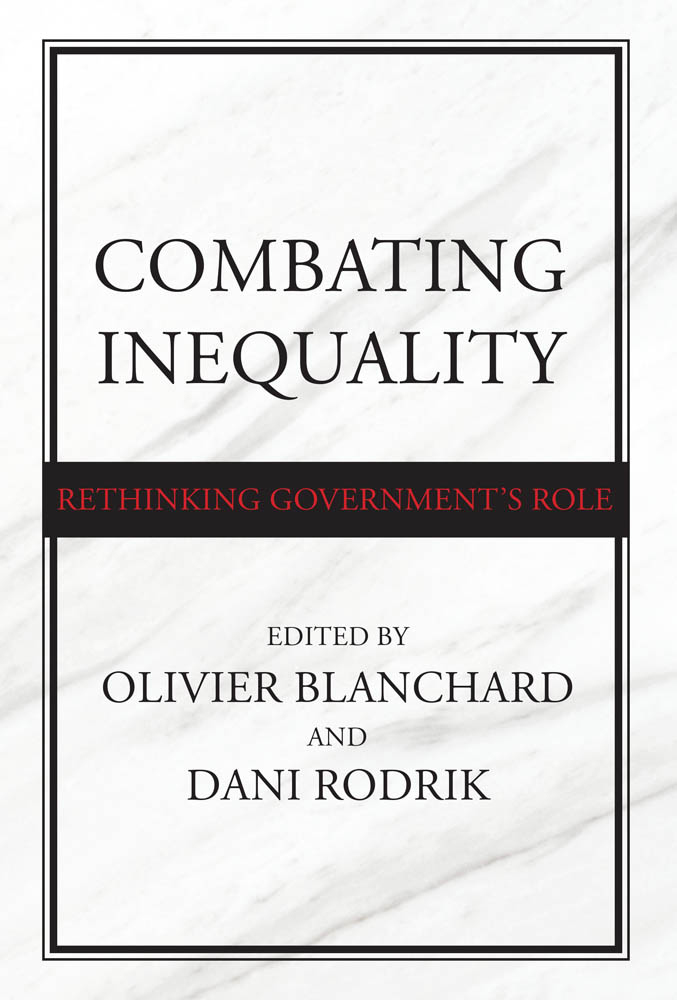

2021 Massachusetts Institute of Technology and Peterson Institute for International Economics

All rights reserved. No part of this book may be reproduced in any form by any electronic or mechanical means (including photocopying, recording, or information storage and retrieval) without permission in writing from the publisher.

Library of Congress Cataloging-in-Publication Data is available.

Names: Blanchard, Olivier (Olivier J.), editor. | Rodrik, Dani, editor.

Title: Combating inequality : rethinking governments role / edited Olivier Blanchard and Dani Rodrik.

Description: Cambridge, Massachusetts : The MIT Press, [2021] | Includes bibliographical references and index.

Subjects: LCSH: Income distributionGovernment policy. | EqualityEconomic aspects. | EqualityGovernment policy.

A catalogue record of the book is available from the British Library.

Contents

- Olivier Blanchard and Dani Rodrik

- Lucas Chancel

- Peter Diamond

- Danielle Allen

- Philippe Van Parijs

- T. M. Scanlon

- Ben Ansell

- Sheri Berman

- Nolan McCarty

- Jesse Rothstein, Lawrence F. Katz, and Michael Stynes

- Tharman Shanmugaratnam

- David Autor

- Christian Dustmann

- Caroline Freund

- N. Gregory Mankiw

- Lawrence H. Summers

- Emmanuel Saez

- Daron Acemoglu

- Philippe Aghion

- Laura DAndrea Tyson

- Marianne Bertrand

- Richard B. Freeman

- William Darity Jr.

- David T. Ellwood

- Heidi Shierholz

- Jason Furman

- Hilary Hoynes

- Wojciech Kopczuk

- Stefanie Stantcheva

- Gabriel Zucman

List of Figures

Income inequality rises at different speeds after a historical decline. Western Europe is the average of France, the United Kingdom, Germany, and Sweden. Distribution of pretax national income per adult. Source: Author based on WID.world (2019). See www.wid.world/methodology for data series and notes.

Inequality in the United States and the European Union, 19802017: the Great Divide. Source: Blanchet, Chancel, and Gethin (2019), combing surveys, tax data, and national accounts for Europe. US series are based on Piketty, Saez, and Zucman (2018). See Blanchet, Chancel, and Gethin (2019) for data series and notes.

The rise of private wealth and the fall of public wealth in rich countries, 19702015.

Source: Alvaredo, Chancel, Piketty, Saez and Zucman (2018). See wir2018.wid.world for data series and notes.

Top 1% personal wealth share in rich countries, 19102014. Source: Author, based on data from WID.world (2019). See www.wid.world/methodology for data series and notes.

Global income inequality between countries versus within country, 19802018. Distribution of pretax income per adult measured at purchasing power parity. Source: Author, based on WID.world (2019) and own updates. See wir2018.wid.world/methodology for sources and notes.

Absolute mobility in the United States, 19702014. Child income is measured at age 30, while parent income is measured as the sum of the spouses incomes for families in which the highest earner is between ages 25 and 35. Source: Chetty et al. (2017, figure 1B).

Share of women by fractiles of labor income for top groups in France, 19702012. Source: Garbinti, Goupille, and Piketty (2018). See www.wid.world/methodology for data series and notes.

Pretax income growth of the bottom 50% in the United States and Western Europe, 19802017. Distribution of pretax income per adult. Source: Blanchet, Chancel, and Gethin (2019). See www.wid.world/methodology for data series and notes.

College attendance rate and parent income rank in the United States for children born in 19801982. Source: Chetty et al. (2014). See www.equality-of-opportunity.org/ for data series and notes.

Top income tax rates in rich countries, 19002017. Source: Alvaredo, Chancel, Piketty, Saez, and Zucman (2018). See wir2018.wid.world for data series and notes.

A virtuous circle: political equality as the basis of justice.

House prices in 2015 and support for Remain (remaining in the European Union) in the 2016 EU referendum.

Changes in house prices and support for the Danish Peoples Party.

Political polarization and economic inequality. The figure plots the measure of polarization in the US House of Representatives from McCarty, Poole, and Rosenthal (2016) against the Gini index of family income and the Piketty and Saez (2003, updated) measure of the income share of the top 1% of taxpayers. The Gini index is a measure of inequality that ranges from 0 (pure equality) to 1 (complete concentration of income).

Concentration of federal campaign contributions. Contribution data updated from Bonica et al. (2013). The solid line tracks the share of campaign contributions in all federal elections donated by the top 0.01% of the voting-age population. The dashed line tracks the share of contributions from the top 400 donors.

Commuting zone level bin scatters of decadal change in manufacturing employment to population rate among workers without college versus China shock exposure during 19902007. This figure plots the estimated decadal change in the fraction of non-college-educated adult CZ residents ages 16 to 64 who are employed in manufacturing against the predicted change in import exposure per worker between 1990 and 2007. Each point in the bin scatter represents one-thirtieth of non-college-educated adults at the start of the decade. Regression line is fit to 722 CZ level observations weighted by the number of adult CZ residents at the start of the decade.

Manufacturing share of employment, 19902017. Source: Haver Analytics (2019).

Coefficient of variation of regional disposable income, 1995 and 2014. Source: OECD (2016a).

Average tariffs. Simple average, applied rate, 19902017. Source: World Bank, World Development Indicators (2019a).

Current account balance, percent of GDP, 19902018. Source: World Bank, World Development Indicators (2019a).

Average scores of 15-year-old students on the PISA mathematics literacy scale, by education system, scores range from 0 to 1000, 20002015. Source: OECD (2016b).

Labor-adjustment policies, percent of GDP. Sources: OECD (2016b) and Bown and Freund (2019).

The top 0.1% wealth share, 19132016. The figure depicts various estimates of the share of wealth held by the top 0.1% of family tax units in the United States: (1) survey data combining the Survey of Consumer Finances (SCF) and the Forbes 400 list of wealthiest Americans; (2) the capitalization method; (3) the capitalization method with adjustments for capitalizing interest income and valuing pass-through businesses; (4) the estate multiplier method adjusted for accurate mortality differentials by wealth. Source: Saez and Zucman (2019a), figure 2(a).