Published in 2013 by Britannica Educational Publishing

(a trademark of Encyclopdia Britannica, Inc.)

in association with Rosen Educational Services, LLC

29 East 21st Street, New York, NY 10010.

Copyright 2013 Encyclopdia Britannica, Inc. Britannica, Encyclopdia Britannica, and the Thistle logo are registered trademarks of Encyclopdia Britannica, Inc. All rights reserved.

Rosen Educational Services materials copyright 2013 Rosen Educational Services, LLC. All rights reserved.

Distributed exclusively by Rosen Educational Services.

For a listing of additional Britannica Educational Publishing titles, call toll free (800) 237-9932.

First Edition

Britannica Educational Publishing

J.E. Luebering: Senior Manager

Adam Augustyn: Assistant Manager

Marilyn L. Barton: Senior Coordinator, Production Control

Steven Bosco: Director, Editorial Technologies

Lisa S. Braucher: Senior Producer and Data Editor

Yvette Charboneau: Senior Copy Editor

Kathy Nakamura: Manager, Media Acquisition

Brian Duignan, Senior Editor, Religion and Philosophy

Rosen Educational Services

Nicholas Croce: Editor

Nelson S: Art Director

Cindy Reiman: Photography Manager

Marty Levick: Photo Researcher

Brian Garvey: Designer, Cover Design

Introduction by Richard Barrington

Library of Congress Cataloging-in-Publication Data

Money and capital/edited by Brian Duignan.

p. cm.(Economics: taking the mystery out of money)

In association with Britannica Educational Publishing, Rosen Educational Services.

Includes bibliographical references and index.

ISBN 978-1-61530-898-9 (eBook)

1. Money. 2. Capital. 3. Monetary policy. I. Duignan, Brian.

HG221.M81557 2013

331.041dc23

2012028309

Cover Battrick/Shutterstock.com; cover (background), pp. i, iii, 1, 26, 60, 74, 88, 98 zphoto/ Shutterstock.com

S ometimes the most commonplace things are the least understood because they are so easy to take for granted. Money is a perfect example. Chances are that you handle money every day. Yet how much do you really know about it? Why are small pieces of metal and coloured bits of paper considered valuable in the form of currency, and how is that value exchanged with other types of money around the world? How can decisions about the availability of money either pump new life into the economy or choke off its attempts to grow? What will be the impact of new payment systems, as tangible currency is increasingly replaced by electronic money transfers?

All of this is likely to greatly affect your future, as money plays a big role in tying modern society together. Individuals have a responsibility for managing their personal finances, just as governments have a responsibility for implementing sound fiscal and monetary policies. Therefore, the topics in this book are crucial to helping you prepare for the future and can serve as a springboard into the study of a field that has always fascinated and challenged experts.

In essence, money is a convenience. It functions as a medium of exchange, which eliminates the need to match people interested in trading for each others goods in order for a transaction to take place. This book will discuss money both in the physical form of currency and more broadly as a system of capital and value transfers that makes up the modern global economy.

The monetary system facilitates transactions to a far greater degree than would be possible under a barter system, and, unlike credit, money doesnt require that the two parties in the transaction know anything about each other. However, this system works only if people in a society generally have faith in their monetary system. When people start to lose this faith, a currency can depreciate sharply, and high inflation results.

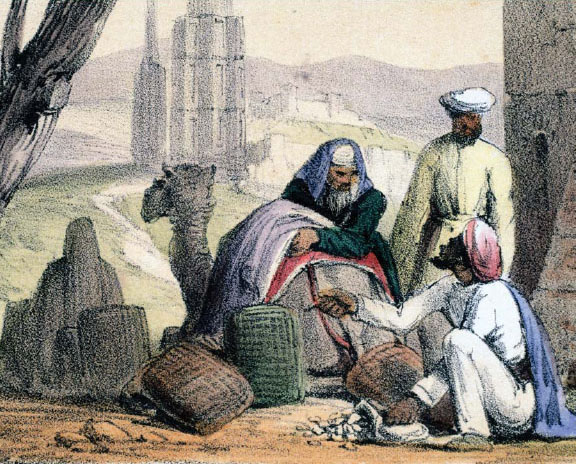

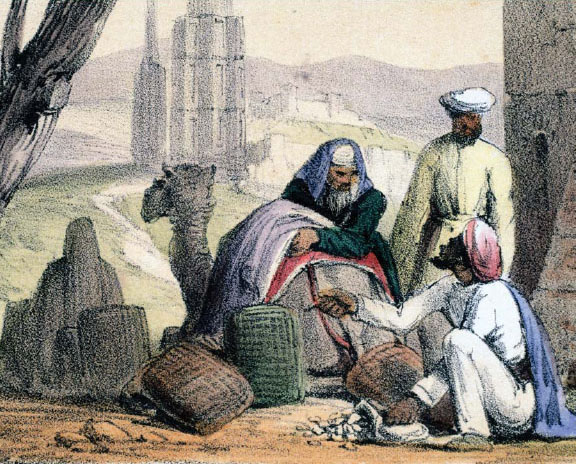

Lithograph by Benjamin Waterhouse Hawkins of Arabs trading cowry shells. Science & Society Picture Library/Getty Images

This faith in the system has become crucial as the physical form of money has evolved from material of intrinsic value to mere symbols of value. Metal coins have been in use since 2000 BCE, but over time the basis of their value has changed from the weight and quality of the metal they contained to simply what they represent in an agreed-upon monetary system. The evolution of money into a representation of value allowed for the development of paper money. Originally, paper money was a form of promissory note that could be exchanged for a specific amount of gold or silver, but as that system proved to be increasingly impractical, currency ultimately became purely a representation of value.

While basing currencies on specific amounts of gold or silver might seem to be a way of stabilizing them, variations in the value of gold relative to silver, or fluctuations in the availability of either metal, could cause disruptions in the value of currencies. These complications are magnified when money is being exchanged on a global basis among several different countries.

In the early 20th century, most developed economies were on the gold standard, which meant that they pegged the value of their currencies to a specified amount of gold. However, both World War I and the Great Depression required a more flexible system of determining the value of money, and by World War II the era of the gold standard was essentially over.

The gold standard was replaced at first by the Bretton Woods system, which began in 1944 as an attempt by 44 states or governments to set the value of currencies by mutual agreement. Though the Bretton Woods system ultimately broke down, it did give rise to the International Monetary Fund, which is a continuing example of efforts to manage global economic issues through multinational cooperation.

As important as multinational cooperation remains to managing the global economy, most currencies today are allowed to float, or change freely in value relative to other currencies depending on market perceptions of economic conditions within each country.

One ambition behind the euro, a European currency launched near the end of the 20th century, is to rival the U.S. dollar as the preferred currency for international trade. However, even with the prominence of these major currencies, there remain a great many other national currencies from all parts of the world. One currency, the Bitcoin, is not even issued by a specific country but instead is a virtual currency based on mathematical formulas. One premise behind the Bitcoin is that it is possible to create a monetary system not dependent on countries or traditional financial institutions, but without that backing the value of the Bitcoin has fluctuated wildly compared to those of major national currencies.

While currencies are the most tangible forms of money, they are only part of the modern monetary system. Bank deposits, credit, and electronic money all play critical roles in the storage and transfer of wealth, and understanding them is essential to understanding how money and capital work.

Bank deposits might seem to be simply money held in safekeeping by a bank, but the truth is more complicated than that. Banks make money by loaning out or investing much of the money that is entrusted to them for safekeeping, while keeping only a small portion of it on hand as reserves. This process greatly increases the amount of money that is available to fuel the economy, but it also introduces an element of risk to the systemif everybody wanted their money back from the bank at once, that money would not be immediately available.