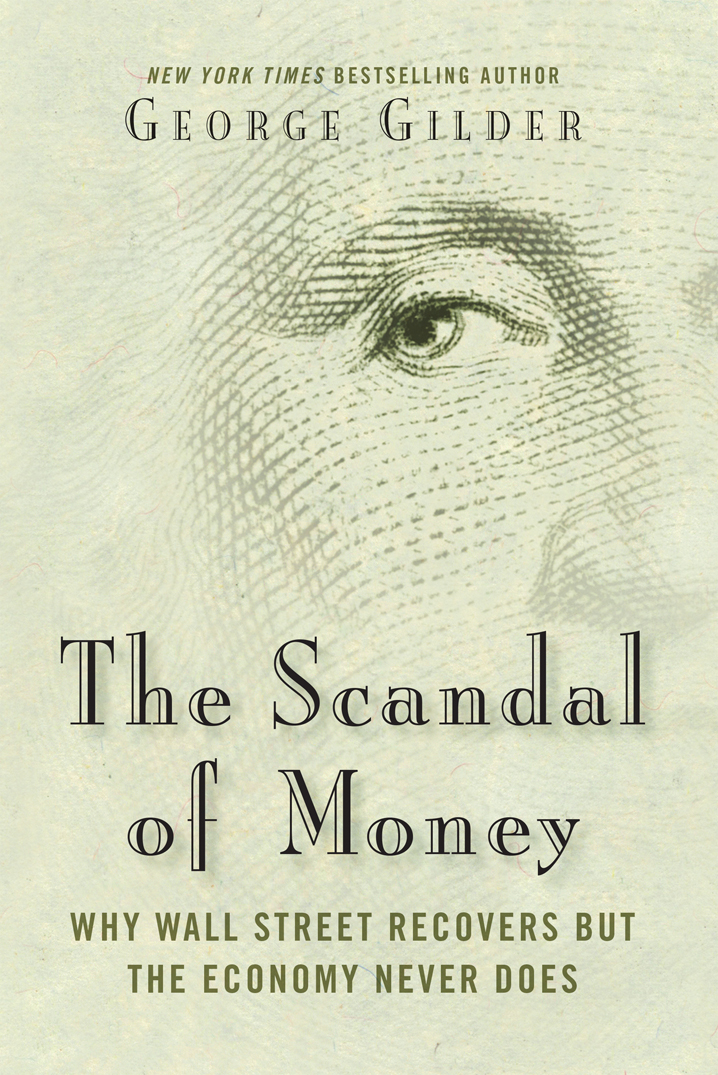

Copyright 2016 by George Gilder

All rights reserved. No part of this publication may be reproduced or transmitted in any form or by any means electronic or mechani-cal, including photocopy, recording, or any information storage and retrieval system now known or to be invented, without permission in writing from the publisher, except by a reviewer who wishes to quote brief passages in connection with a review written for inclu-sion in a magazine, newspaper, website, or broadcast.

Regnery is a registered trademark of Salem Communications Holding Corporation

First e-book edition 2016: 978-1-62157-566-5

Originally published in hardcover, 2016

Cataloging-in-Publication data on file with the Library of Congress

Published in the United States by

Regnery Publishing

A Division of Salem Media Group

300 New Jersey Ave NW

Washington, DC 20001

www.Regnery.com

Manufactured in the United States of America

10 9 8 7 6 5 4 3 2 1

Books are available in quantity for promotional or premium use. For information on discounts and terms, please visit our website: www.Regnery.com.

Distributed to the trade by

Perseus Distribution

250 West 57th Street

New York, NY 10107

To Bruce Chapman,

friend and guide for sixty years

Table of Contents

Guide

Contents

The source and root of all monetary evil [is] the government monopoly on the issue and control of money.

Friedrich Hayek

Humans dont decide what to build by making choices from some cosmic catalog of options given in advance; instead, by creating new technologies, we rewrite the plan of the world.

Peter Thiel, Zero to One (2014)

W ill conservatives win the coming economic debate? The nation depends on it. We deserve to win, after all. We have the best economic ideas, so we say, aligned with constitutional liberty and the American Dream. The economy is in trouble, and after two terms of President Barack Obama the Democrats are mostly to blame.

After a crash like the 2008 financial debacle, the U.S. economy typically takes off on a seven-year boom. Seven fat years was the harvest of President Ronald Reagan, who entered office in the face of Cold War setbacks and sky-high interest rates, inflation, malaise, unemployment, and poverty. Pursuing similar policies in faint rhetorical disguise and correcting Reagans second-term hike in capital gains tax rates, Bill Clinton delivered a seven-year echo boom of his own.

The Democrats now must answer the question: Why have Americans suffered seven years (and counting) of a famine of growththe slowest recovery from recession in a hundred years? Why are jobs increasing more slowly than the job force is shrinking, with lower growth in wages and larger gaps in income and wealth than we have seen since the Great Depression? Why are productivity growth numbers at sixty-five-year lows, down to less than a quarter of the postwar average, and business starts actually in decline?

Above all, if the Democrats have governed well, why are our young people demoralized as perhaps no previous American generation has been? Why is the real youth unemployment rate at 25 to 35 percent, even after shrinking the hours for a full-time job to thirty? Why do fewer young people than ever look forward to an entrepreneurial future, starting their own businesses and careers?

The crisis we face in 2016 is a fundamental challenge to capitalism and freedom. Will seven years of failure tip America into more of what failed? Or will a vigorous case for a new economics emerge that persuades the average American to renew his faith in freedom? Winning the election requires winning this debate. Why, after seven years of the Obama economy, is the average American worker facing a declining standard of living?

To Democrats, the answers are simple. The global financial crisis arose under a Republican administration and was inherited by President Obama. It plunged the nation into a Great Recession marked by an oppressively skewed distribution of wealth, with an estimated $5 trillion in bonuses for bankers over seven years and unemployment soaring above 10 percent in the face of a shrinking percentage of adults in the workforce.

Like most financial crises in history, they argue, this one required active governmental interventions, such as extended unemployment benefits and financial stimuli. But an $800 billion stimulus over three years represented less than 2 percent of the economy. As usual when there are widespread bank runs and financial turmoil, the Federal Reserve had to step in as lender of last resort, necessarily expanding governmental debts. Needed also was renewed regulation of systemic risks. But our debt levels remained under control compared with those of other countries and in the context of Americas world-leading gross domestic product (GDP). Under Obama, a record-breaking stock market and a thriving dollar confirmed other indications of able economic management.

Republicans respond to such claims with baffled incredulity. Yet the Democratic claims are mostly true. To the extent that the economic debate revolves around the usual indices of GDP growth and financial market revival compared with other countries and markets, the Democrats can hold their own. They argue that a more balanced economy fueled by redistributive tax and spending policy can close the growing gap between rich and poor. It can redress simmering middle-class anxieties and lower-class stagnation.

For Republicans to succeed, they first must win the debate. Today they are floundering. Many try to shirk the economic challenge. Intimidated by the media and the academy, they shrink from confronting the most devastating threats to our future. Though Republicans have more accomplished and articulate spokesmen than perhaps ever before, they have fallen into a rut of clichs and forlorn incantations that have not been fresh since the Reagan era. Although they offer inspirational anecdotes, they miss the larger picture.

Republicans have been running on tax-cut proposals since the era of Harding and Coolidge. Tax-rate reductions and simplifications are urgently needed. But again, there is no mention of the key problems of a global economy in declineof the acceptance by economic elites of inevitable and irremediable stagnation. We have not faced the fact that the Federal Reserves capacity to command growth is a god that has failed.

GREAT DEBATE

In mid-July 2015, for example, FreedomFest, the annual libertarian gathering in Las Vegas, hosted a long-awaited great debate pitting Paul Krugman, paladin of liberal economics and the most popular New York Times columnist, against Steve Moore, chief economist at the Heritage Foundation and once the most popular Wall Street Journal writer.

The debate had everything. The New York Times versus the Wall Street Journal, the Ivy League and mainstream media versus Fox News and the Heritage Foundation, academic liberalism versus supply-side think-tank activism, the most prestigious voice of liberal economics versus the tribune of the Koch brothers libertarianismall before an avid crowd of several thousand, pumped up by scores of speakers, just off the Vegas strip.

The topic of the debate was How can we restore the American Dream... for all?a question central to the election of 2016. But for many of the attendees, the immediate thrill was to witness the humiliation of Krugman, famous advocate of spending, taxes, debt, and regulations, and Moore promised to be up to the challenge. In nine years and perhaps a dozen debates at FreedomFest, on a wide range of economic topics, the flamboyant supply-sider had never lost. A master on stage, pirouetting deftly in argument, juggling numbers with aplomb, dramatically unveiling stark and colorful charts, climaxing with eloquent perorations to the crowd, he was a FreedomFest inspiration. By contrast, Krugman was dour and low-key.

![George Gilder - Men and Marriage [Sexual Suicide]](/uploads/posts/book/87550/thumbs/george-gilder-men-and-marriage-sexual-suicide.jpg)