David Rivera - Option Trading - Thinking Outside the Box! Intermediate To Advanced Futures Options Strategies

Here you can read online David Rivera - Option Trading - Thinking Outside the Box! Intermediate To Advanced Futures Options Strategies full text of the book (entire story) in english for free. Download pdf and epub, get meaning, cover and reviews about this ebook. year: 2011, publisher: David Rivera, genre: Art. Description of the work, (preface) as well as reviews are available. Best literature library LitArk.com created for fans of good reading and offers a wide selection of genres:

Romance novel

Science fiction

Adventure

Detective

Science

History

Home and family

Prose

Art

Politics

Computer

Non-fiction

Religion

Business

Children

Humor

Choose a favorite category and find really read worthwhile books. Enjoy immersion in the world of imagination, feel the emotions of the characters or learn something new for yourself, make an fascinating discovery.

- Book:Option Trading - Thinking Outside the Box! Intermediate To Advanced Futures Options Strategies

- Author:

- Publisher:David Rivera

- Genre:

- Year:2011

- Rating:5 / 5

- Favourites:Add to favourites

- Your mark:

- 100

- 1

- 2

- 3

- 4

- 5

Option Trading - Thinking Outside the Box! Intermediate To Advanced Futures Options Strategies: summary, description and annotation

We offer to read an annotation, description, summary or preface (depends on what the author of the book "Option Trading - Thinking Outside the Box! Intermediate To Advanced Futures Options Strategies" wrote himself). If you haven't found the necessary information about the book — write in the comments, we will try to find it.

David Rivera: author's other books

Who wrote Option Trading - Thinking Outside the Box! Intermediate To Advanced Futures Options Strategies? Find out the surname, the name of the author of the book and a list of all author's works by series.

Option Trading - Thinking Outside the Box! Intermediate To Advanced Futures Options Strategies — read online for free the complete book (whole text) full work

Below is the text of the book, divided by pages. System saving the place of the last page read, allows you to conveniently read the book "Option Trading - Thinking Outside the Box! Intermediate To Advanced Futures Options Strategies" online for free, without having to search again every time where you left off. Put a bookmark, and you can go to the page where you finished reading at any time.

Font size:

Interval:

Bookmark:

Option Trading Thinking Outside The Box

Intermediate to Advanced Futures Option Strategies

Copyright 2006 David Rivera, All Rights Reserved

Reproduction or translation of any part of this work by any means, electronic or mechanical, including photocopying, beyond that permitted by Copyright Law, without permission of the author, is unlawful.

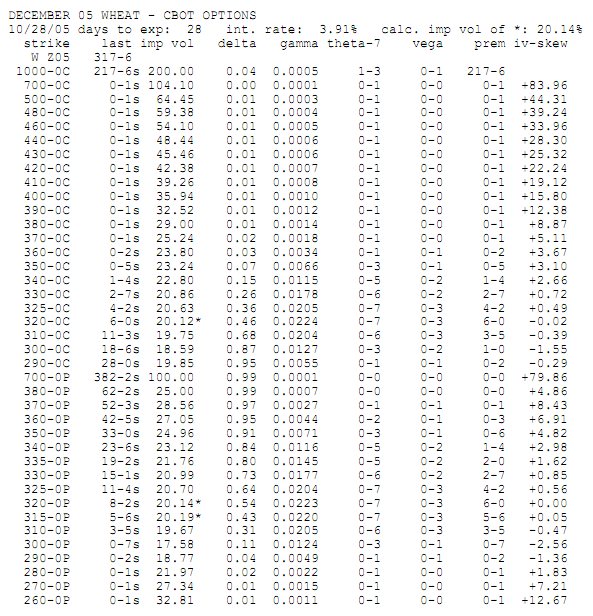

All charts and option quotes are courtesy of Barchart.com

Trade options like a pro, using Delta Neutral, Calendar Spreads, Option Scale Trading and other Option Secrets. Click below to learn about the best non-directional and directional option techniques.

Futures Options Secrets

Risk Disclosure Statement

The risk of loss in trading commodity futures and options can be substantial. Before trading, one should carefully consider their financial position to determine if futures trading is appropriate. One should realize that when trading futures and/or granting/writing options one could lose the full balance of their account. It is also possible to lose more than the initial deposit when trading futures and/or granting/writing options. All funds committed should be purely risk capital.

Past performance is not indicative of future results. David Rivera and deltaneutraltrading.com do not intend to give investment advice. The contents of this book are for informational purposes only.

TABLE OF CONTENTS

Although the bulk of this book is intended for those with knowledge of futures options trading, I will go over some basic terminology.

Strike price

In options, the strike price is the pre-determined price at which the option may be exercised. Strike price is also known as the exercise price. Strike is the price at which an option begins to have a settlement value at expiration. The strike price is set at the time the option contract originates.

An option is "in-the-money" when the current market price of the underlying futures contract exceeds the strike price of a call or is below the strike price of a put. Similarly, an option is "out-of-the-money" when the current market price of the underlying futures contract exceeds the strike price of a put or is below the strike price of a call.

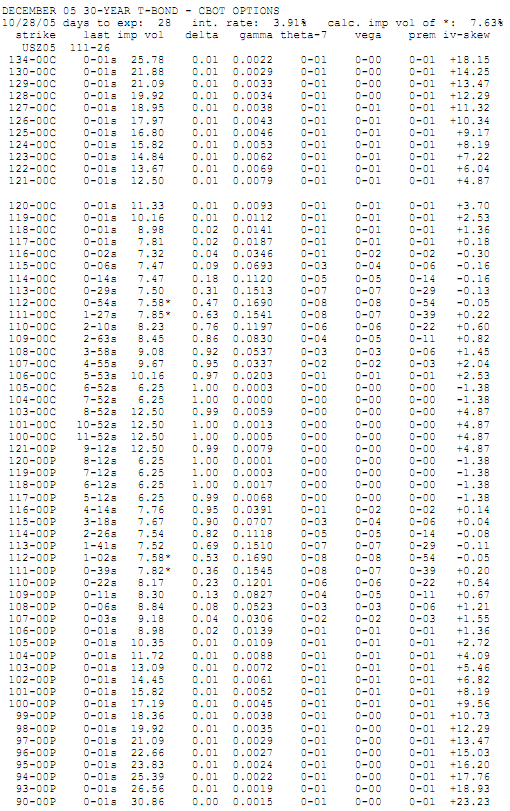

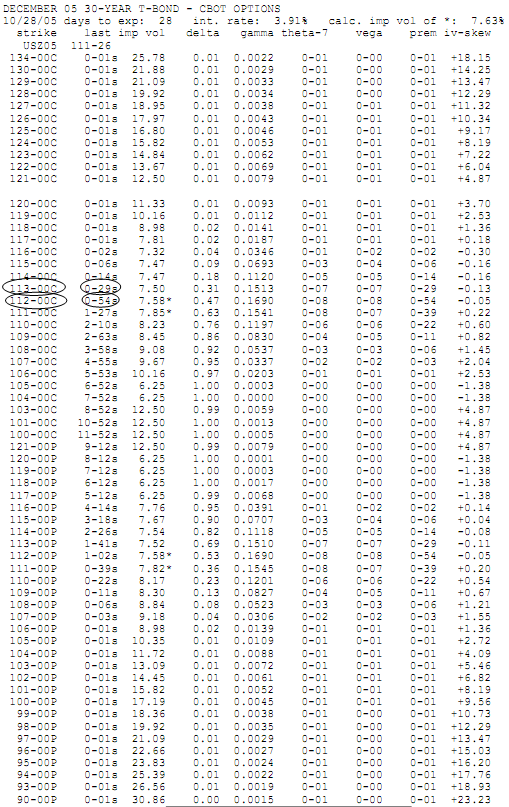

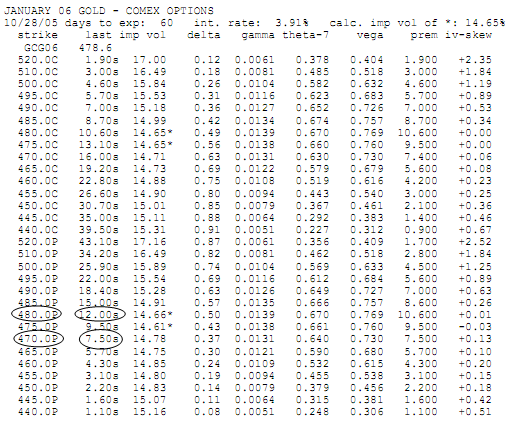

Futures options can be confusing because some options contracts are priced differently than their respective underlying futures. There are 32 ticks to a point in a bond futures contract but 64 ticks to a point in a bond options contract. A point in both futures and options is $1,000. So, for the futures, each tick is $31.25 (1000/32). For the options, each tick is worth $15.625 (1000/64). The grains are priced in cents. The futures have 4, cent ticks for each cent. The options have 8, 1/8 ticks for each cent. So, there are more ticks in the options than in the futures. Keep this in mind when calculating profit and loss. Refer to the quotes in the previous 2 pages to see how there are more ticks in the options markets for these markets compared to their respective futures markets.

Placing orders

You can buy an option by placing orders like:

Buy 1 December 3.00 Corn call for 10

Buy 1 December Corn 300 call for 15

Your broker will tell you the best way to place the order. You can trade online as well. You will enter all the necessary information in an order form. None of this is hard to learn.

Now you know how to place option orders and the terms involved, you can now learn how to place spread orders. Spread orders are when more than one option is involved in the trade. A typical spread is a credit or debit spread. A debit spread is when you buy and sell an option for a debit. In other words, the option you buy costs more than the option you sell. A credit spread is a trade in which the option you sell cost more than the option you buy.

Next is an example of a debit spread followed by a credit spread.

You can purchase a 112 call for -54 and sell a 113 call for -29. This is a debit spread since you are paying more for the option you are selling.

You can sell a 480 put for 12 and purchase a 470 put for 7.50. This is a credit spread since you are paying less for the option you are selling.

There are many futures options techniques that can be profitable. They can range from buying and selling options based on volatility to trading ratio backspreads based on the technical analysis of the underlying futures market.

One way is to trade spreads that can profit from time decay. You can sell options which you believe will lose more time value than the options you buy.

The key is to find techniques that have an advantage when you put the trade on. What I will discuss are futures options trades that have this advantage. Trades that have a special quality that you can spot before you enter into it. You will be able to see what options are cheaper or more expensive compared to another option. Not by price or volatility necessarily but by the price per day. Even though an option might be more expensive than another, it might be cheaper in terms of volatility or price per day. Keep your eyes open to things other than the price of the option. Look at the deltas and theta as well.

Before I explain some techniques to use based on delta and theta, I would like to define the terms in case you are not familiar with them.

Delta

Delta is the amount by which the option changes compared to the underlying asset. It is a measure of the probability that an option will expire in the money. Call deltas can be interpreted as the probability that the option will finish in the money. Put deltas can be interpreted as -1 times the probability that the option will finish in the money.

An at-the-money option, which has a delta of approximately 0.5, has roughly a 50/50 chance of ending up "in-the-money". If an at-the-money wheat call option has a Delta of .5 and if wheat makes a 10-cent move higher, the premium on the option will increase approximately by 5 cents (.5 x 10 = 5), or $250 (each cent in premium is worth $50).

If you buy an at the money call, you will have a delta of +50.

If you sell an at the money call, you will have a delta of -50.

If you buy an at the money put , you will have a delta of -50.

If you sell an at the money put, you will have a delta of +50.

Basically, the deltas will be determined by where you want the market to go. Think of it this way: If you sold an at the money call option, where would you want the market to move to? You would like it to go lower. So, you would have a delta of -50.

If you look at most at the money options, you will find that they are usually not at 50. That is because they are not exactly at the money. We still refer to these as the at the money options because they are the ones that are the closest to being there. It might have a delta of 47 or 53. Futures contracts have a delta of +100 for long contracts and -100 for short contracts.

Theta

Theta is defined as the change in the price of an option for a 1-day decrease in the time left for expiration. At-the-money options have the greatest time value and the greatest rate of time decay (theta). The further an option goes "in-the-money" or "out-of-the-money", the smaller is the theta. As volatility falls, the time value declines and hence theta also declines.

Next pageFont size:

Interval:

Bookmark:

Similar books «Option Trading - Thinking Outside the Box! Intermediate To Advanced Futures Options Strategies»

Look at similar books to Option Trading - Thinking Outside the Box! Intermediate To Advanced Futures Options Strategies. We have selected literature similar in name and meaning in the hope of providing readers with more options to find new, interesting, not yet read works.

Discussion, reviews of the book Option Trading - Thinking Outside the Box! Intermediate To Advanced Futures Options Strategies and just readers' own opinions. Leave your comments, write what you think about the work, its meaning or the main characters. Specify what exactly you liked and what you didn't like, and why you think so.