START TRADING OPTIONS

START TRADING OPTIONS

A Self-Teaching Guide for Trading Options Profitably

Kevin M. Kraus

Copyright 2006 by McGraw-Hill. All rights reserved. Except as permitted under the United States Copyright Act of 1976, no part of this publication may be reproduced or distributed in any form or by any means, or stored in a database or retrieval system, without the prior written permission of the publisher.

ISBN: 978-0-07-176993-8

MHID: 0-07-16993-5

The material in this eBook also appears in the print version of this title: ISBN: 978-007-145909-9, MHID: 007-145909-X.

All trademarks are trademarks of their respective owners. Rather than put a trademark symbol after every occurrence of a trademarked name, we use names in an editorial fashion only, and to the benefit of the trademark owner, with no intention of infringement of the trademark. Where such designations appear in this book, they have been printed with initial caps.

McGraw-Hill eBooks are available at special quantity discounts to use as premiums and sales promotions, or for use in corporate training programs. To contact a representative please e-mail us at bulksales@mcgraw-hill.com.

This publication is designed to provide accurate and authoritative information in regard to the subject matter covered. It is sold with the understanding that neither the author nor the publisher is engaged in rendering legal, accounting, futures/securities trading, or other professional service. If legal advice or other expert assistance is required, the services of a competent professional person should be sought.

From a Declaration of Principles jointly adopted by a Committee of the American Bar Association and a Committee of Publishers

TERMS OF USE

This is a copyrighted work and The McGraw-Hill Companies, Inc. (McGraw-Hill) and its licensors reserve all rights in and to the work. Use of this work is subject to these terms. Except as permitted under the Copyright Act of 1976 and the right to store and retrieve one copy of the work, you may not decompile, disassemble, reverse engineer, reproduce, modify, create derivative works based upon, transmit, distribute, disseminate, sell, publish or sublicense the work or any part of it without McGraw-Hills prior consent. You may use the work for your own noncommercial and personal use; any other use of the work is strictly prohibited. Your right to use the work may be terminated if you fail to comply with these terms.

THE WORK IS PROVIDED AS IS. McGRAW-HILL AND ITS LICENSORS MAKE NO GUARANTEES OR WARRANTIES AS TO THE ACCURACY, ADEQUACY OR COMPLETENESS OF OR RESULTS TO BE OBTAINED FROM USING THE WORK, INCLUDING ANY INFORMATION THAT CAN BE ACCESSED THROUGH THE WORK VIA HYPERLINK OR OTHERWISE, AND EXPRESSLY DISCLAIM ANY WARRANTY, EXPRESS OR IMPLIED, INCLUDING BUT NOT LIMITED TO IMPLIED WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE. McGraw-Hill and its licensors do not warrant or guarantee that the functions contained in the work will meet your requirements or that its operation will be uninterrupted or error free. Neither McGraw-Hill nor its licensors shall be liable to you or anyone else for any inaccuracy, error or omission, regardless of cause, in the work or for any damages resulting therefrom. McGraw-Hill has no responsibility for the content of any information accessed through the work. Under no circumstances shall McGraw-Hill and/or its licensors be liable for any indirect, incidental, special, punitive, consequential or similar damages that result from the use of or inability to use the work, even if any of them has been advised of the possibility of such damages. This limitation of liability shall apply to any claim or cause whatsoever whether such claim or cause arises in contract, tort or otherwise.

For Gayle Marie

for all your love and support

An investment in knowledge always pays the best interest

Benjamin Franklin

CONTENTS

CHAPTER 1

MARKET BASICS

In this chapter we begin with some basic market information and concepts. We define commodities and derivative contracts and explain supply and demand, market fundamentals, the exchanges, and futures trading. Your option education begins with the basics of derivative contracts and market economics. In we will cover:

What are commodities

What are commodities

Derivative contracts

Derivative contracts

Supply and demand

Supply and demand

Market fundamentals

Market fundamentals

The commodity exchanges

The commodity exchanges

Futures trading

Futures trading

WHAT ARE COMMODITIES?

Before beginning your option education we want to cover the basics of derivative contracts and basic market economics. First lets cover what commodities are and how they relate to the futures industry. Commodities are very simply things that are consumed or processed in the manufacture or production of products.

For example: ABC Steel company uses iron ore in the production of steel. Iron is a commodity, although it is not commonly traded on futures exchanges. A bakery company uses wheat from a grain miller in the production of bread. Wheat is a commodity commonly traded on futures exchanges. Most everything you look at or use is a commodity, many of them traded on commodity exchanges somewhere in the world. Everything from the gold in your ring to the milk in your refrigerator is a commodity.

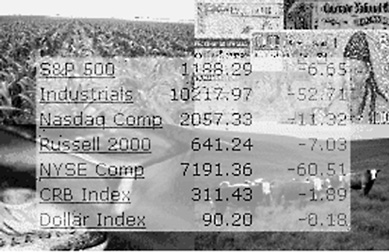

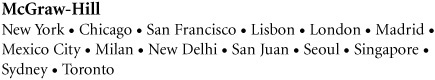

FIGURE 1-1

Commodities are typically described as agricultural or mining products; however, in todays market the term commodity has come to describe many agricultural, food, energy, mining, and financial products.

DERIVATIVE CONTRACTS

When people talk about trading commodities they are referring to trading derivative contracts, more commonly known as futures. Derivatives, or futures, are contract instruments between two parties for the exchange of a commodity whether it be a physical commodity like wheat or a financial instrument like a 10-year Treasury note or a foreign currency. The instrument must specify certain things in order to qualify as a futures contract:

Commodity

Commodity

Quantity

Quantity

Quality

Quality

Time of delivery

Time of delivery

Point of delivery

Point of delivery

Futures contracts do not specify the price. The price of the contract is determined in open market trade on a futures exchange. Here is an example of a current futures contract:

Next page

What are commodities

What are commodities