Contents

Copyright 2012 by Ben Stein. All rights reserved.

Published by John Wiley & Sons, Inc., Hoboken, New Jersey.

Published simultaneously in Canada.

No part of this publication may be reproduced, stored in a retrieval system, or transmitted in any form or by any means, electronic, mechanical, photocopying, recording, scanning, or otherwise, except as permitted under Section 107 or 108 of the 1976 United States Copyright Act, without either the prior written permission of the Publisher, or authorization through payment of the appropriate per-copy fee to the Copyright Clearance Center, Inc., 222 Rosewood Drive, Danvers, MA 01923, (978) 7508400, fax (978) 6468600, or on the Web at www.copyright.com . Requests to the Publisher for permission should be addressed to the Permissions Department, John Wiley & Sons, Inc., 111 River Street, Hoboken, NJ 07030, (201) 7486011, fax (201) 7486008, or online at www.wiley.com/go/permissions .

Limit of Liability/Disclaimer of Warranty: While the publisher and author have used their best efforts in preparing this book, they make no representations or warranties with respect to the accuracy or completeness of the contents of this book and specifically disclaim any implied warranties of merchantability or fitness for a particular purpose. No warranty may be created or extended by sales representatives or written sales materials. The advice and strategies contained herein may not be suitable for your situation. You should consult with a professional where appropriate. Neither the publisher nor author shall be liable for any loss of profit or any other commercial damages, including but not limited to special, incidental, consequential, or other damages.

For general information on our other products and services, or technical support, please contact our Customer Care Department within the United States at (800) 7622974, outside the United States at (317) 5723993 or fax (317) 5724002.

Wiley also publishes its books in a variety of electronic formats. Some content that appears in print may not be available in electronic books. For more information about Wiley products, visit our website at www.wiley.com .

Library of Congress Cataloging-in-Publication Data:

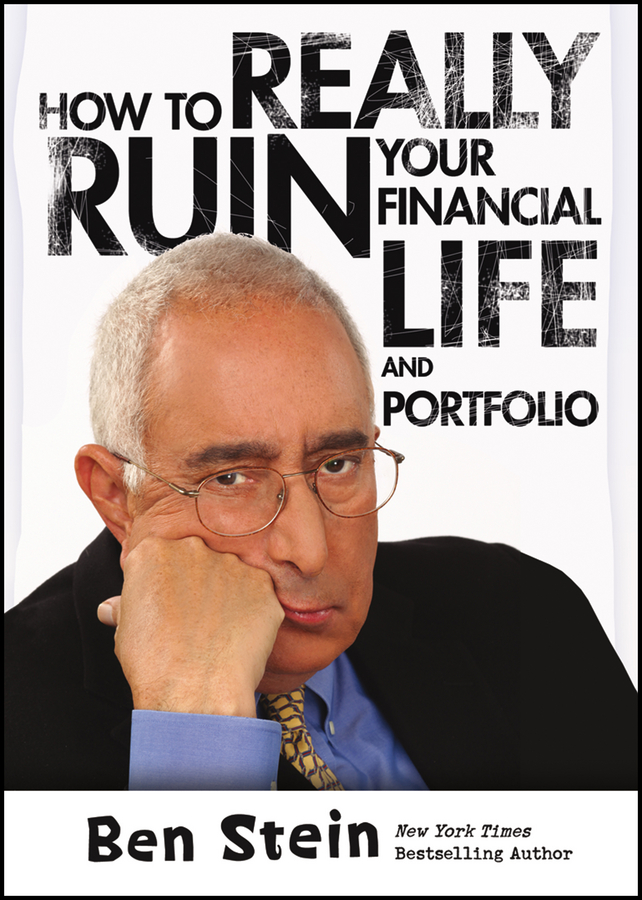

Stein, Benjamin, 1944- author.

How to really ruin your financial life and portfolio / Ben Stein.

pages cm

ISBN 9781118338735 (cloth); ISBN 9781118461488 (ebk); ISBN 9781118461457 (ebk); ISBN 9781118461464 (ebk)

1. Portfolio management. 2. Investments. 3. Finance, Personal. I. Title.

HG4529.5.S717 2012

332.024dc23

2012020166

FOR BIG WIFEY +

Acknowledgments

The first person I knew who was interested in investing was my mother. She had little training in it, but read Barrons, The Wall Street Journal , and Forbes voraciously. When she died, she left my sister and me a pretty darned good portfolio. She also left me with two fine admonitions: Buy on the rumor and sell on the news, and, Bulls make money and bears make money, but hogs get slaughtered. I am not quite sure what either of these mean in practical terms to the long-term, index-oriented investor, but they must mean something because my mother did leave a good portfolio.

My father, a famous economist, was the least interested in money of any man I have ever met, yet he had some excellent wisdom about money. Almost all of it could have been summed up under the simple heading: Be prudent. I rarely have been since he died in 1999, to my great cost.

My sister, far and away the most prudent Stein now living, and her equally prudent husband, Melvin, have often advised prudence upon me and I thank her and him. My first genius investor mentor was my first agent in Hollywood, George Diskant. His predictions about the economy were not always borne out, but he told me about BRK and that was worth plenty.

Other great influences were my spectacularly good money and banking teacher at Columbia, C. Lowell Harriss, and my superb econ teachers at Yale, Henry Wallich and James Tobin, inventor of the Fed model and Tobins Q, both designed to tell when the stock market is overvalued and when it is undervalued. Neither seems to have had much predictive value in recent years, but they are certainly correct in general direction.

It has been my great pleasure in the last 25 years to have had a great broker at Merrill Lynch in Kevin Hanley, and more lately in his brilliant colleague, Jerry Au. I have also been privileged to get a general introduction to the erudition of John Bogle. I keep a lot of my stash at Fidelity. I have also made the acquaintance of Ned Johnson and his lovely daughter, Abigail. The Johnsons and their company have done me much good. The Johnsons and John Bogle truly are the small investors best friends.

For about the last 10 years, I have been a pal and frequent dinner and speaking companion of Ray Lucia, a stunningly well-informed and articulate investment advisor (now retired). I have learned a huge amount from Ray and his brother Joe, whom I consider my own brothers.

If there is anyone smarter in speculation that Jim Rogers, and quicker to see whats happening, I dont know who that would be (unless its Warren Buffett.) I was on a show with him on Fox for many years and always learned from him and still do. The whole gang on that show, especially host Neil Cavuto, always challenge and impress me.

By an extraordinary twist of fate, I have become pals in the last several years with Warren E. Buffett, surely the greatest genius in investing and in life generally. He is light years ahead of where I will ever be, but he has inspired me and years of reading his annual reports have sparked some kindling in my woolly brain.

Finally, my closest friend, Phil DeMuth, has spent countless hours doing research on investing, often on vague lines I have suggested to him, but usually on his own thoughts. We talk of little else but investing, and it is always useful. Few men that I know have as good a friend as Phil and I am grateful.

Well, maybe that wasnt final.... The real acknowledgment is to life its own self. Life has flattened me so many times, lifted me up and laid me down low, given me a wildly false sense of security, then showed me who was boss, taught me so much fear and humility that I felt compelled to offer the lessons in this little book to those younger than I am. Experience keeps a dear [meaning expensive] school, said Ben Franklin, but a fool will learn in no other.

I am that foolbut like many a fool at a Kings Court, I have seen plenty and can share it. Maybe it can all be summed up by what my Pop said: Be prudent. But what is prudent? Maybe some idea of it can be gleaned from this book.

Introduction

Your basic human is not a great investor. Successful investing requires extreme patience; we humans are impatient. Rewarding investing requires nerves of steelor else perfect forgetfulness; we humans are frightened, nervous animals. Making money by investing requires singleness of purpose; we humans are scattered and distracted, pulled in all directions at once. The great investors carefully think through their moves, guided by eons of experience; we real-life human being investors are rash, impulsive gamblers.

Great investors are not swayed by fads and fancies. The ones with two feet and receding hair are wills-o-the-wisp, blown all about by what is happening at the moment.

The ones who make money over their lifetimes are steadfast of purpose, well informed, listen to wise guidance, reject counsels of impatience and despair. The real-life investor gobbles up misinformation, listens to fools and knaves, and gyrates wildly in his actions, almost always against his own best interest.