This book presents the ideas of its author. It is not intended to be a substitute for consultation with a financial professional. The publisher and the author disclaim liability for any adverse effects resulting directly or indirectly from information contained in this book.

Copyright 2018 by Howard Marks

All rights reserved

For information about permission to reproduce selections from this book, write to or to Permissions, Houghton Mifflin Harcourt Publishing Company, 3 Park Avenue, 19th Floor, New York, New York 10016.

hmhco.com

Library of Congress Cataloging-in-Publication Data

Names: Marks, Howard S., author.

Title: Mastering the market cycle : getting the odds on your side / Howard S. Marks.

Description: Boston : Houghton Mifflin Harcourt, 2018. | Includes index. | Identifiers: LCCN 2018006867 (print) | LCCN 2018008133 (ebook) | ISBN 9781328480569 (ebook) | ISBN 9781328479259 (hardback)

Subjects: LCSH: Investments. | Finance, Personal. | BISAC: BUSINESS & ECONOMICS / Personal Finance / Investing.

Classification: LCC HG4521 (ebook) | LCC HG4521 .M3214 2018 (print) | DDC 332.6dc23

LC record available at https://lccn.loc.gov/2018006867

All graphs courtesy of the author

Cover design by Mark R. Robinson

Author photograph Peter Murphy

v2.0918

With All My Love

to Nancy

Jane, Justin, Rosie and Sam

Andrew and Rachel

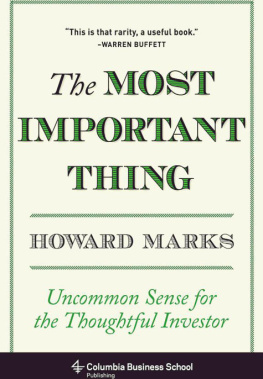

When I see memos from Howard Marks in my mail, theyre the first thing I open and read. I always learn something.

Warren Buffett

To access the full archive of memos and videos from Howard Marks, please visit www.oaktreecapital.com/insights.

Introduction

Seven years ago I wrote a book called The Most Important Thing: Uncommon Sense for the Thoughtful Investor, regarding where investors should direct their greatest attention. In it I said the most important thing is being attentive to cycles. The truth, however, is that I applied the label the most important thing to nineteen other things as well. There is no single most important thing in investing. Every one of the twenty elements I discussed in The Most Important Thing is absolutely essential for anyone who wishes to be a successful investor.

Vince Lombardi, the legendary coach of the Green Bay Packers, is famous for having said, winning isnt everything, its the only thing. Ive never been able to figure out what Lombardi actually meant by that statement, but theres no doubt he considered winning the most important thing. Likewise, I cant say an understanding of cycles is everything in investing, or the only thing, but for me its certainly right near the top of the list.

Most of the great investors Ive known over the years have had an exceptional sense for how cycles work in general and where we stand in the current one. That sense permits them to do a superior job of positioning portfolios for what lies ahead. Good cycle timingcombined with an effective investment approach and the involvement of exceptional peoplehas accounted for the vast bulk of the success of my firm, Oaktree Capital Management.

Its for that reasonand because I find something particularly intriguing about the fluctuations of cyclesand because where we stand in the cycle is one of the things my clients ask about mostand finally because so little has been written about the essential nature of cyclesthat I decided to follow The Most Important Thing with a book devoted entirely to an exploration of cycles. I hope youll find it of use.

Some patterns and events recur regularly in our environment, influencing our behavior and our lives. The winter is colder and snowier than the summer, and the daytime is lighter than the night. Thus we plan ski trips for the winter and sailing trips for the summer, and our work and recreation for the daytime and our sleeping at night. We turn on the lights as evening draws nigh and turn them off when we go to bed. We unpack our warm coats as the winter approaches and our bathing suits for the summer. While some people swim in the ocean in winter for exhilaration and some elect to work the night shift to free up their days, the vast majority of us follow the normal circadian patterns, making everyday life easier.

We humans use our ability to recognize and understand patterns to make our decisions easier, increase benefits and avoid pain. Importantly, we depend on our knowledge of recurring patterns so we wont have to reconsider every decision from scratch. We know hurricanes are more likely in September, so we avoid the Caribbean at that time of year. We New Yorkers schedule our visits to Miami and Phoenix for the winter months, when the temperature differential is a positive, not a negative. And we dont have to wake each day in January and decide anew whether to dress for warmth or cold.

Economies, companies and markets also operate pursuant to patterns. Some of these patterns are commonly called cycles. They arise from naturally occurring phenomena but, importantly, also from the ups and downs of human psychology and from the resultant human behavior. Because human psychology and behavior play such a big part in creating them, these cycles arent as regular as the cycles of clock and calendar, but they still give rise to better and worse times for certain actions. And they can profoundly affect investors. If we pay attention to cycles, we can come out ahead. If we study past cycles, understand their origins and import, and keep alert for the next one, we dont have to reinvent the wheel in order to understand every investment environment anew. And we have less of a chance of being blindsided by events. We can master these recurring patterns for our betterment.

Its my primary message that we should pay attention to cycles; perhaps I should say listen to them. Dictionary.com supplies two closely related but distinct definitions for the word listen. The first is to attend closely for the purpose of hearing. The second is to heed. Both definitions are relevant to what Im writing about.

In order to properly position a portfolio for whats going on in the environmentand for what that implies regarding the future of the marketsthe investor has to maintain a high level of attention. Events happen equally to everyone who is operating in a given environment. But not everyone listens to them equally in the sense of paying attention, being aware of them, and thus potentially figuring out their import.

And certainly not everyone heeds equally. By heed I mean obey, bear in mind, be guided by or take to heart. Or, in other words, to absorb a lesson and follow its dictates. Perhaps I can better convey this heeding sense for listening by listing its antonyms: ignore, disregard, discount, reject, overlook, neglect, shun, flout, disobey, tune out, turn a deaf ear to, or be inattentive to. Invariably, investors who disregard where they stand in cycles are bound to suffer serious consequences.

In order to get the most out of this bookand do the best job of dealing with cyclesan investor has to learn to recognize cycles, assess them, look for the instructions they imply, and do what they tell him to do. (See the authors note below regarding my use of male pronouns.) If an investor listens in this sense, he will be able to convert cycles from a wild, uncontrollable force that wreaks havoc, into a phenomenon that can be understood and taken advantage of: a vein that can be mined for significant outperformance.

A winning investment philosophy can be created only through the combination of a number of essential elements:

A technical education in accounting, finance and economics provides the foundation: necessary but far from sufficient.

A view on how markets work is importantyou should have one before you set out to invest, but it must be added to, questioned, refined and reshaped as you proceed.