Copyright 2019 by Thomas R. Ittelson

All rights reserved. Without limiting the rights under any copyright, no part of this document may be reproduced by any means, stored in or introduced into a retrieval system or transmitted in any form or by any means (electronic, mechanical, photocopying, recording, or otherwise), or for any purpose without the express written permission from the publisher.

ISBN: 978-0-9971089-7-2(paperback)

ISBN: 978-1-970050-00-4(hardcover)

ISBN: 978-1-970050-02-8(Amazon Kindle eBook)

ISBN: 978-1-970050-03-5(Apple iBook)

Mercury Group Press

P.O. Box 381350

Cambridge, MA 02238

www.mercurygrouppress.com

617-285-1168

Limits of Liability & Disclaimer of Warranty: The author is not an accountant nor an attorney and does not represent himself as either. (In fact, he is a Harvard-trained biochemist and entrepreneur.) The publisher and the author have attempted to make diligent efforts in preparing this book. However, they make no representations or warranties with respect to the accuracy or completeness of the contents of this book and specifically disclaim any implied warranties of merchantability or fitness for a particular purpose. Neither the publisher nor the author shall be liable for any loss of profit or any other commercial damages, including but not limited to special, incidental, consequential, or other damages

OREO Cookie Photo Credit: Copyright Viktor Kunz 2017

Digital book(s) (epub and mobi) produced by Booknook.biz.

Contents

Preface

If you can read a nutrition label or a baseball box score, you can learn to read basic financial statements. If you can follow recipes or apply for a loan, you can learn basic accounting. The basics are not difficult, and they are not rocket science.

Just as a CPR class teaches you how to perform the basics of cardiac pulmonary resuscitation, this brochure will explain how to read the basic parts of a financial statement. It will not train you to be an accountant (just as a CPR course will not make you a cardiac doctor), but it should give you the confidence to be able to look at a set of financial statements and make sense of them.

(From the U.S. Security and Exchange Commission (SEC) Beginners Guide to Financial Statements.

https://www.sec.gov/reportspubs/investor-publications/investorpubsbegfinstmtguidehtm.html

Accounting is the language of business. A companys financial statements the topic of this book are the summary communications to its owners (and the taxing government) of its accounting information: its sales, costs, expenses, profits, assets, and liabilities.

Businesses exist to make a profit. Financial statements describe numerically how the profit is made. Businesses own things and owe things. Financial statements show what and how much.

Accounting rules help to ensure that financial information is understandable and comparable to that of other companies and that all companies operate to an acceptable minimum standard of ethics.

Non-Financial Managers

I wrote this book to help non-financial folks salespeople, researchers, manufacturing folks, engineers, HR staff, and the like appreciate the numbers of business. Such an understanding should make you better able to do your jobs, or at least better appreciate what makes for good business performance. Perhaps this book will make your job more fun too!

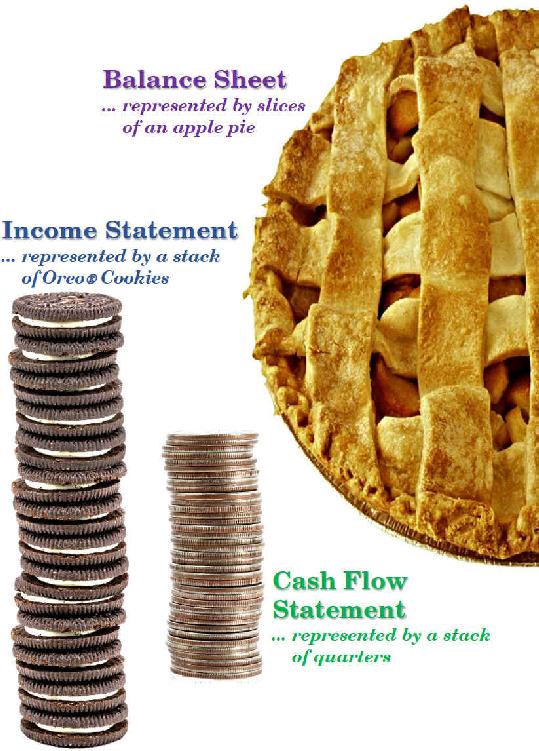

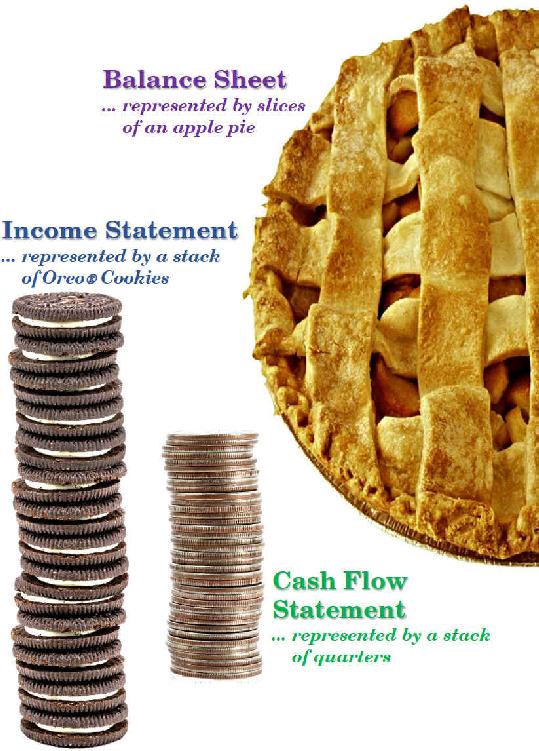

Writing for the novice, I translate the morass of detailed accounting numbers into pictures that are both simple and elegant, if not actually delicious. The 40+ pages in this book will give you all you need to understand how your business is doing and to be able to explain it to others in plain English. I do recommend having cookies or a slice of pie available while reading. Just saying.

Investors

Ultimately, good financial performance drives investment value and stock price. Financial statements document that performance for all to see. Financial statements are the primary tool that companys use to communicate that performance good or bad to investors and other sources of capital (think banks) that companies need to court.

To be a savvy investor, I think you must understand financial statement reporting. This books easy to read format should benefit investors, most of whom do not have a financial background. Who knows, perhaps this book will help make you rich!

I have also written a much more detailed 285-page accounting textbook published by Career Press:

Financial Statements: Step-by-Step Guide to Understanding and Creating Financial Reports (ISBN: 978-1-60163-023-0)

https://www.amazon.com/dp/1601630239

Currently in its 2nd edition, with over 200,000 copies in print, this book is popular as a secondary text in both undergraduate accounting and business school finance classes. As with this picture book, no previous accounting knowledge is required. Read both books together! They complement each other.

Email me with questions. Im happy to help: .

Big 3 Financial Statements

Introduction(What is on the menu.)

Financial statements are simply summaries and structured presentations of the various events (business transactions) that affect a companys financial performance. The owners of the company (shareholders), creditors, and the government (think IRS) are very interested in this stuff

Business transactions are anything that transfers money to or from the company, or transfers goods and services to or from the company. Transactions can also record future financial obligations that the company may assume, or also rights that the company is granted from others. (More on these rights and obligations later.)

Financial statements document the movement of cash and goods and services into and out of the enterprise. That is all financial statements are about. It is no more complicated. Everything else is details. Dont sweat the details.

The Big 3 Statements

Three numeric presentations document a companys financial performance and financial strength. Why three statements? Well, each paints a different, essential picturethe three-legged stool of company reporting. See .

The Income Statement shows the manufacturing (or service offerings) and selling actions of the company that result in profit or loss during a period of time (called the period). The Income Statement gives a very important perspective on the companys performance its profitability.

The Cash Flow Statement details the movements of cash into and out of the company for the period. You need money to make money. Running out of cash is bad. Duh.

The Balance Sheet records at the end of a period, what the company owns and what it owes, including the owners stake called shareholders equity.

I will describe each statement separately (with pictures) and then show how they interact. It will be fun!

Not Rocket Science

This financial reporting stuff is not rocket science. You have learned all the math required to master financial statements by the end of the fourth grade mostly addition and subtraction. However, you will need to learn and use the specialized vocabulary, which can be confusing. You will also need to understand the structure and appreciate the purpose of the three major numeric statements that describe a companys financial condition.