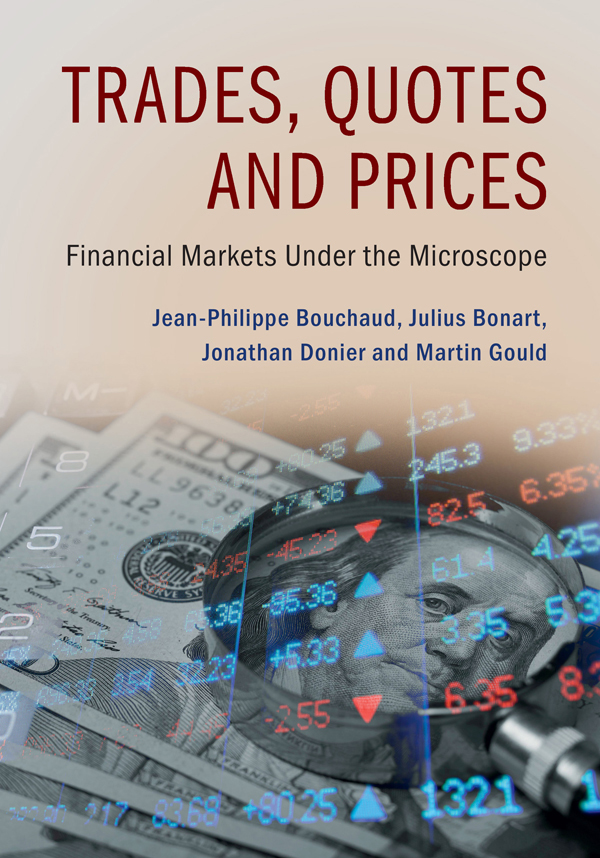

TRADES, QUOTES AND PRICES

The widespread availability of high-quality, high-frequency data has revolutionised the study of financial markets. By describing not only asset prices, but also market participants actions and interactions, this wealth of information offers a new window into the inner workings of the financial ecosystem. In this original text, the authors discuss empirical facts of financial markets and introduce a wide range of models, from the micro-scale mechanics of individual order arrivals to the emergent, macro-scale issues of market stability. Throughout this journey, data is king. All discussions are firmly rooted in the empirical behaviour of real stocks, and all models are calibrated and evaluated using recent data from NASDAQ. By confronting theory with empirical facts, this book for practitioners, researchers and advanced students provides a fresh, new and often surprising perspective on topics as diverse as optimal trading, price impact, the fragile nature of liquidity, and even the reasons why people trade at all.

JEAN-PHILIPPE BOUCHAUD is a pioneer in Econophysics. He co-founded the company Science & Finance in 1994, which merged with Capital Fund Management (CFM) in 2000. In 2007 he was appointed as an adjunct Professor at cole Polytechnique, where he teaches a course on complex systems. His work includes the physics of disordered and glassy systems, granular materials, the statistics of price formation, stock market fluctuations, and agent based models for financial markets and for macroeconomics. He was awarded the CNRS Silver Medal in 1995, the Risk Quant of the Year Award in 2017, and is the co-author, along with Marc Potters, of Theory of Financial Risk and Derivative Pricing (Cambridge University Press, 2009).

JULIUS BONART is a lecturer at University College London, where his research focuses on market microstructure and market design. Before this, he was a research fellow at CFM and Imperial College London, where he investigated price impact, high-frequency dynamics and the market microstructure in electronic financial markets. Julius obtained his PhD in Statistical Physics from Pierre et Marie Curie University (Paris).

JONATHAN DONIER completed a PhD at University Paris 6 with the support of the Capital Fund Management Research Foundation. He studied price formation in financial markets using tools from physics, economics and financial mathematics. After his PhD, he continued his research career in a music industry start-up that later joined Spotify, where he now serves as a Senior Research Scientist.

MARTIN GOULD currently works in the technology sector. Previously, he was a James S. McDonnell Postdoctoral Fellow in the CFMImperial Institute of Quantitative Finance at Imperial College, London. Martin holds a DPhil (PhD) in Mathematics from the University of Oxford, Part III of the Mathematical Tripos from the University of Cambridge, and a BSc (Hons) in Mathematics from the University of Warwick.

TRADES, QUOTES AND PRICES

Financial Markets Under the Microscope

JEAN-PHILIPPE BOUCHAUD

Capital Fund Management, Paris

JULIUS BONART

University College London

JONATHAN DONIER

Capital Fund Management, Paris

& University Paris 6

MARTIN GOULD

CFMImperial Institute of Quantitative Finance

University Printing House, Cambridge CB2 8BS, United Kingdom

One Liberty Plaza, 20th Floor, New York, NY 10006, USA

477 Williamstown Road, Port Melbourne, VIC 3207, Australia

314321, 3rd Floor, Plot 3, Splendor Forum, Jasola District Centre,

New Delhi 110025, India

79 Anson Road, #06-04/06, Singapore 079906

Cambridge University Press is part of the University of Cambridge.

It furthers the Universitys mission by disseminating knowledge in the pursuit of

education, learning, and research at the highest international levels of excellence.

www.cambridge.org

Information on this title: www.cambridge.org/9781107156050

DOI: 10.1017/9781316659335

Jean-Philippe Bouchaud, Julius Bonart, Jonathan Donier and Martin Gould 2018

This publication is in copyright. Subject to statutory exception and to the provisions of relevant collective licensing agreements, no reproduction of any part may take place without the written permission of Cambridge University Press.

First published 2018

Printed in the United Kingdom by TJ International Ltd. Padstow Cornwall

A catalog record for this publication is available from the British Library.

Library of Congress Cataloging-in-Publication Data

Names: Bouchaud, Jean-Philippe, 1962 author. | Bonart, Julius, author.

Donier, Jonathan, author. | Gould, Martin, author.

Title: Trades, quotes and prices : financial markets under the microscope /

Jean-Philippe Bouchaud, Capital Fund Management, Paris, Julius Bonart,

University College London, Jonathan Donier, Spotify, Martin Gould, Spotify.

Description: New York : Cambridge University Press, 2018. |

Includes bibliographical references and index.

Identifiers: LCCN 2017049401 | ISBN 9781107156050 (hardback)

Subjects: LCSH: Capital market. | Stocks. | Futures. | Investments.

BISAC: SCIENCE / Mathematical Physics.

Classification: LCC HG4523.B688 2018 | DDC 332.64dc23

LC record available at https://lccn.loc.gov/2017049401

ISBN 978-1-107-15605-0 Hardback

Cambridge University Press has no responsibility for the persistence or accuracy of URLs for external or third-party Internet Web sites referred to in this publication and does not guarantee that any content on such Web sites is, or will remain, accurate or appropriate.

Leading physicist and hedge fund manager Jean-Philippe Bouchaud and his co-authors have written an impressive book that no serious student of market microstructure can afford to be without. Simultaneously quantitative and highly readable, Trades, Quotes and Prices presents a complete picture of the topic, from classical microstructure models to the latest research, informed by years of practical trading experience.

Jim Gatheral, Baruch College, CUNY

This book describes the dynamics of supply and demand in modern financial markets. It is a beautiful story, full of striking empirical regularities and elegant mathematics, illustrating how the tools of statistical physics can be used to explain financial exchange. This is a tour de force with the square root law of market impact as its climax. It shows how institutions shape human behaviour, leading to a universal law for the relationship between fluctuations in supply and demand and their impact on prices. I highly recommend this to anyone who wants to see how physics has benefited economics, or for that matter, to anyone who wants to see a stellar example of a theory grounded in data.

Doyne Farmer, University of Oxford

This is a masterful overview of the modern and rapidly developing field of market microstructure, from several of its creators. The emphasis is on simple models to explain real and important features of markets, rather than on sophisticated mathematics for its own sake. The style is narrative and illustrative, with extensive references to more detailed work. A unique feature of the book is its focus on high-frequency data to support the models presented. This book will be an essential resource for practitioners, academics, and regulators alike.