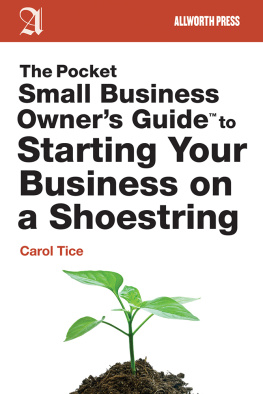

The Pocket

Small Business

Owners Guide to

Taxes

Brian Germer

This book is dedicated to my wife and best friend, my two children, and my family for all the love and support.

Copyright 2012 by Brian Germer

All rights reserved. Copyright under Berne Copyright Convention, Universal Copyright Convention, and Pan American Copyright Convention. No part of this book may be reproduced, stored in a retrieval system, or transmitted in any form, or by any means, electronic, mechanical, photocopying, recording or otherwise, without the express written consent of the publisher, except in the case of brief excerpts in critical reviews or articles. All inquiries should be addressed to Allworth Press, 307 West 36th Street, 11th Floor, New York, NY 10018.

This book is designed to provide accurate and authoritative information with respect to the subject matter covered. It is sold with the understanding that the publisher is not engaged in rendering legal, accounting, or other professional services. If legal advice or other expert assistance is required, the services of a competent attorney, accountant, or other professional person should be sought. While every attempt is made to provide accurate information, the author and publisher cannot be held accountable for any errors or omissions.

Allworth Press books may be purchased in bulk at special discounts for sales promotion, corporate gifts, fund-raising, or educational purposes. Special editions can also be created to specifications. For details, contact the Special Sales Department, Allworth Press, 307 West 36th Street, 11th Floor, New York, NY 10018 or info@skyhorsepublishing.com.

15 14 13 12 11 5 4 3 2 1

Published by Allworth Press

An imprint of Skyhorse Publishing, Inc.

307 West 36th Street, 11th Floor, New York, NY 10018.

Allworth Press is a registered trademark of Skyhorse Publishing, Inc., a Delaware corporation.

www.allworth.com

Cover design by Brian Peterson

Library of Congress Cataloging-in-Publication Data

Germer, Brian.

The pocket small business owners guide to taxes / by Brian Germer.

p. cm.

Includes index.

ISBN 978-1-58115-920-2 (pbk. : alk. paper)

1. Small businessTaxationUnited States. 2. Small businessUnited StatesAccounting.

I. Title.

HD2346.U5G47 2012

343.73068dc23

2012022755

Printed in the United States of America

Table of Contents

Are You Self-Employed or an Employee?

Self-Employment Tax and the Corporate Equivalent

Income Tax

Payroll Taxes

Penalties, Fees, and Other New Revenue Raisers

State and Local Taxes

What is Taxable Business Income?

What is Not Taxable Income?

When Does it Become Taxable Income?

Service Business Income Reporting Issues

What is Cost of Goods Sold?

How Do I Track Inventory and Cost of Goods Sold?

What Can Be Deducted?

What Cannot Be Deducted?

When Can the Deductions Be Taken?

How Much Can Be Deducted?

What is a Fixed Asset?

When Does Depreciation Begin?

What Assets Cannot Be Depreciated?

What is the Section 179 Deduction?

What is Bonus Depreciation?

What is MACRS Depreciation?

Special Cases

Repairs vs. Improvement

Sale, Disposals, and Trade-ins

How Should I Classify Payments to Workers?

Do I Need an Employer Identification Number?

What is Taxable Employee Compensation?

When is Payroll Reported and Deducted?

Which Payroll Taxes Are Employers Subject To?

When Are Payroll Tax Deposits Due?

What Payroll Tax Reports Are Required?

Why is Accounting Important?

The Essential Accounting Basics

What is an Accounting System?

What are Accounting Methods?

When is an Accounting Method Selected?

The Cash Basis Method

The Accrual Basis Method

Can I Change Accounting Methods?

Avoid Tax Reporting Over-Complication

How Should I Keep My Records?

The $200 Accounting Solution Myth

Strategies for Efficient Setup of Accounting Software Files

Maintaining Organized and Accurate Books

What Your Tax Professional Should Provide

Business Structure Considerations

Business Structure Options

S Corporation Basics

The Most Popular Tax Benefit of the S Corporation

What are Distributions?

What are Shareholder Loans?

Shareholder Basis: The Key to Deductible Losses

Reporting Health Insurance for Shareholders

Late Filing Penalties

Self-Employment Tax

Basis for LLC Members

Late Filing Penalties

The Correct Way to Maximize Your Deductions

What is Deductible?

What Qualifies As Business Use of a Vehicle?

Maximizing Your Business Miles?

How is the Vehicle Deduction Calculated?

Which Method Provides the Larger Deduction?

Depreciation and Disposal Considerations

All Vehicles Are Not Treated Equally

Maximizing Your Vehicle Depreciation Deduction

Bonus Depreciation

Disposition of Vehicles

Travel vs. Local Transportation Expenses

What is Considered Traveling Away From Home?

Where is Your Tax Home?

What is Deductible?

Many Ways to Travel, Many Different Rules

What Entertainment Can Be Deducted?

Two Tests of Deductibility

Limitations on Meals and Entertainment

How Much Can I Deduct?

Personal vs. Business Entertainment

Country Clubs and Golf and Athletic Clubs

Entertainment Expense Recordkeeping

Why Set Up a Retirement Plan?

Understanding the Basics of Retirement Plans

The Individual Retirement Account (IRA) Alternative

Qualified Plan Contribution Limits and Tax Considerations

Simplified Employee Pension Plans (SEPs)

Solo 401k (Individual 401k)

SIMPLE IRAs

The 401k

Profit Sharing Plan (PSPs)

Defined Benefit Plan (DBPs)

Other Options for High-Income Business Owners

How Do I Setup a Retirement Plan?

Tax Credit for Starting a New Plan

What Qualifies as an Office in Home?

Corporations and the Office in Home Deduction

Calculating the Office in Home Deduction

Advantage to Renters

The Depreciation Tax Trap

The HIRE ActMake Sure You Didnt Miss It!

Small Business Health Care Tax Credit

Eligible Business Structures

Eligible Family Employees

How the Strategy Works

How Much Should I Pay Them?

Reduced Tax Savings for the Ineligible

Introduction

Over and over again courts have said there is nothing sinister in so arranging ones affairs as to keep taxes as low as possible. Everyone does so, rich or poor; and all do right, for nobody owes any public duty to pay more than the law demands...

Judge Learned Hand

The above quote perfectly encapsulates the most effective way for small business owners to maximize deductions and keep taxes as low as possible, and that is done by first finding what the law demands and then arranging ones affairs to meet what the law requires. Too many small businesses owners do not take the time to dig in and learn tax deduction rules, and so they end up failing to take advantage of important deductions they are permitted to take, while taking other deductions they are not even entitled to. Even worse, many small business owners keep very poor records to document the deductions they do claim, which is a recipe for disaster if they are ever audited.