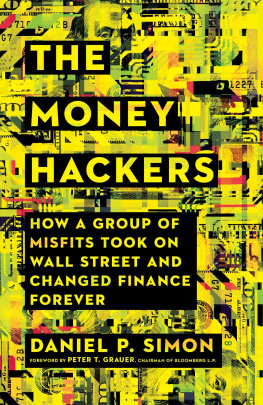

Cover design: Wiley

Cover image: AF-studio / Getty Images

Copyright 2018 by Yoshitaka Kitao. All rights reserved.

Originally published in Japanese in 2017 by Nikkei Publishing Inc.

Published by John Wiley & Sons, Inc., Hoboken, New Jersey.

Published simultaneously in Canada.

No part of this publication may be reproduced, stored in a retrieval system, or transmitted in any form or by any means, electronic, mechanical, photocopying, recording, scanning, or otherwise, except as permitted under Section 107 or 108 of the 1976 United States Copyright Act, without either the prior written permission of the Publisher, or authorization through payment of the appropriate per-copy fee to the Copyright Clearance Center, Inc., 222 Rosewood Drive, Danvers, MA 01923, (978) 7508400, fax (978) 6468600, or on the web at www.copyright.com. Requests to the Publisher for permission should be addressed to the Permissions Department, John Wiley & Sons, Inc., 111 River Street, Hoboken, NJ 07030, (201) 7486011, fax (201) 7486008, or online at www.wiley.com/go/permissions.

Limit of Liability/Disclaimer of Warranty: While the publisher and author have used their best efforts in preparing this book, they make no representations or warranties with respect to the accuracy or completeness of the contents of this book and specifically disclaim any implied warranties of merchantability or fitness for a particular purpose. No warranty may be created or extended by sales representatives or written sales materials. The advice and strategies contained herein may not be suitable for your situation. You should consult with a professional where appropriate. Neither the publisher nor author shall be liable for any loss of profit or any other commercial damages, including but not limited to special, incidental, consequential, or other damages.

For general information on our other products and services or for technical support, please contact our Customer Care Department within the United States at (800) 7622974, outside the United States at (317) 5723993, or fax (317) 5724002.

Wiley publishes in a variety of print and electronic formats and by print-on-demand. Some material included with standard print versions of this book may not be included in e-books or in print-on-demand. If this book refers to media such as a CD or DVD that is not included in the version you purchased, you may download this material at http://booksupport.wiley.com. For more information about Wiley products, visit www.wiley.com.

ISBN 978-1-119-52372-7 (Hardcover)

ISBN 978-1-119-52370-3 (ePDF)

ISBN 978-1-119-52380-2 (ePub)

ISBN 978-1-119-52376-5 (obk)

Preface

Because I would like this book to be different than introductory books written by academics and commentators in the field of finance, I have focused on corporate managers that struggle day and night to bring about a FinTech revolution.

I consider these people warriors trying to achieve this revolution. I decided to have these warriors (managers) describe their visions of the future and candidly write about what types of strategies and weapons (technologies) they will use to realize them. I am not an editor and have not given contributors to this book any instructions or expressed my opinion to them in advance.

I wrote Chapters 1 and 2 and decided to make these chapters extremely strategic and practical because I am a part of the SBI Group management. I did not have other contributors read my drafts because I did not want them to feel influenced by them.

Even when the drafts for all chapters were completed, I purposefully put off writing the preface because I waited with bated breath for the appearance of concrete evidence that indicates how close this revolution is to affecting all of us.

That evidence is the successful completion of a verification test conducted by a certain consortium. The results were announced on March 2, 2017, and were widely covered by various media outlets the following day. Efforts were led by the Japan Bank Consortium, of which 42 banks (61 banks as of the end of December 2017), more than one-third of Japanese banks, are members. This group successfully conducted a verification test of RC Cloud, a settlement platform that makes use of blockchain technology for low-value, high-frequency payments, and is working to commercialize the platform within this year.

This platform is a cloud-hosted next-generation settlement infrastructure developed by US-based Ripple Labs Inc., an SBI joint venture partner, and is the first such platform in the world. The platform makes it possible to make low-cost (about one-tenth of traditional costs) payments in near real time. Work is currently underway to develop a payment app for mobile devices, and a true payment revolution is set to occur in 2018.

This coincides with the dramatic growth of the robo-advisory service offered by WealthNavi Inc. in partnership with SBI SECURITIES. Applications for accounts exceeded 37,000 in only a little more than a year since the service was launched at the end of January 2017, and customers have deposited more than 28.1 billion yen in assets.

These two developments definitively show that unless financial institutions are quick to introduce the latest technology and increase customer convenience, they will become less competitive and find it difficult to survive.

All financial institutions must be aware that the FinTech revolution will have an impact that vastly exceeds that of the Internet revolution. Our customers are also sure to abandon loyalty to traditional individual financial institutions and become extremely focused on increasing their own benefits.

There will probably be a steady outflow of customers from financial institutions that cannot quickly adapt, and the existing financial order will be destroyed within a short time. This will add to the financial revolution that is occurring simultaneously throughout the world.

The 17 managers who contributed to this book, including myself, have renewed our resolution to write our own future, and we are confident that the full realization of this revolution will be for the good of all people.

I would like to express my deep appreciation to all those who were involved in publishing this book.

Yoshitaka Kitao

Contributors

Yoshitaka Kitao, Representative Director, President, and CEO

SBI Holdings, Inc.

(Preface, )

Kazuhisa Shibayama, Founder and CEO

WealthNavi Inc.

()

Yosuke Tsuji, Cofounder and CEO

Money Forward, Inc.

()

Hiroki Maruyama, Cofounder and Representative Director

infcurion group, Inc.

()

Masami Komatsu, Founder and CEO

Music Securities, Inc.

()

Yuta Tsuruoka, CEO

BASE, Inc.

()

Russell Cummer, President and Representative Director

Exchange Corporation K.K.

()

Yoshiki Yasui, Founder and CEO

Origami Inc.

()

Yasuhiro Kuda, CEO

Liquid Inc.

()

Kariya Kayamori, Cofounder and CEO

QUOINE Pte. Ltd.

()

Takashi Okita, Representative Director

SBI Ripple Asia Co., Ltd.

()

David E. Rutter, CEO

R3

()

Hironobu Yoshikawa, CEO and Founder

Treasure Data Inc.

()

Tomohiro Amino, Representative Director and CEO

GiXo Ltd.

()

Ryosuke Konishi, Representative Director and CEO/CTO

Generic Solution Corporation

()

Daisuke Sasaki, Representative Officer

freee K.K.

()

Naofumi Tsuchiya, President and CEO

Goodpatch Inc.

()

Kiyokazu Okubo, Executive Officer

Next page

![Chris Skinner [Chris Skinner] - ValueWeb: How fintech firms are using bitcoin blockchain and mobile technologies to create the Internet](/uploads/posts/book/119678/thumbs/chris-skinner-chris-skinner-valueweb-how.jpg)