Contents

Guide

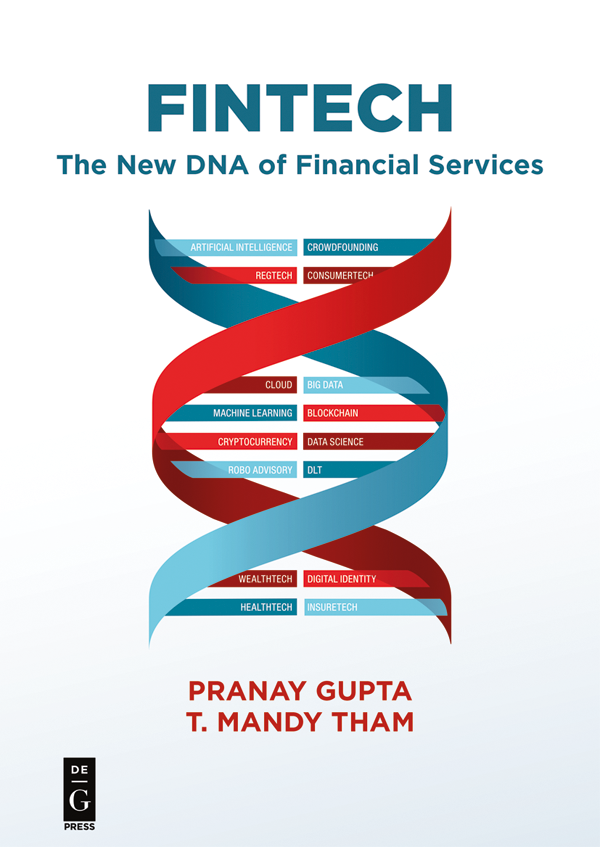

Pranay Gupta and T. Mandy Tham

Fintech

ISBN 978-1-5474-1708-7

e-ISBN (PDF) 978-1-5474-0090-4

e-ISBN (EPUB) 978-1-5474-0092-8

Library of Congress Control Number: 2018962040

Bibliographic information published by the Deutsche Nationalbibliothek

The Deutsche Nationalbibliothek lists this publication in the Deutsche Nationalbibliografie;

detailed bibliographic data are available on the Internet at http://dnb.dnb.de.

2019 Pranay Gupta and T. Mandy Tham

Published by Walter de Gruyter Inc., Boston/Berlin

www.degruyter.com

Dedicated to my wife Nupur and my daughter Aanya

Pranay

Dedicated to my parents and loved ones including my mentors and students who have taught me great humility

Mandy

About De|G PRESS

Five Stars as a Rule

De|G PRESS, the startup born out of one of the worlds most venerable publishers, De Gruyter, promises to bring you an unbiased, valuable, and meticulously edited work on important topics in the fields of business, information technology, computing, engineering, and mathematics. By selecting the finest authors to present, without bias, information necessary for their chosen topic for professionals , in the depth you would hope for, we wish to satisfy your needs and earn our five-star ranking.

In keeping with these principles, the books you read from De|G PRESS will be practical, efficient and, if we have done our job right, yield many returns on their price.

We invite businesses to order our books in bulk in print or electronic form as a best solution to meeting the learning needs of your organization, or parts of your organization, in a most cost-effective manner.

There is no better way to learn about a subject in depth than from a book that is efficient, clear, well organized, and information rich. A great book can provide life-changing knowledge. We hope that with De|G PRESS books you will find that to be the case.

Every revolutionary idea passes through three stages:

- Its completely impossible.

- Its possible, but its not worth doing.

- I said it was a good idea all along.

Arthur C. Clarke

Acknowledgments

We acknowledge the help and support of all companies and individuals who have partnered with us in this project to create a book which has wide applicability to many audiences. Despite the pressures of business, especially for start-up firms who have contributed to this book, these individuals have devoted their time, energy, and expertise in their individual fields to help create this text, which we hope will form the basis of many courses for investment professionals and students of any discipline to understand and appreciate the developing world of fintech.

We also specifically acknowledge Mr. Sopnendu Mohanty of the Monetary Authority of Singapore for his guidance and unwavering support for this project.

About the Authors

Pranay Gupta CFA

Pranay has over 25 years of experience in Europe, UK, US and Asia in managing portfolios across all liquid asset class investments across global markets. His areas of experience and interest include multi-asset allocation solutions, risk management, and the deployment of data science and fintech in the financial services industry. He has advised several sovereign wealth funds and plan sponsors across the world on these subjects.

As head of multi-asset strategies at Fullerton Fund Management (a subsidiary of Temasek Holdings), Pranay was responsible for strategic and tactical allocation globally for the liquid assets portfolio. Prior to that he was the chief investment officer at Lombard Odier and ING Investment Management Asia Pacific, where he led an investment team of over 300 investment professionals across 12 countries, to manage over US$85bn of institutional and retail assets. Previously, Pranay has held senior positions at Axial Investment Management in London, managing a US$55bn closed life insurance portfolio, at APG Investments in the Netherlands managing a US$25bn multi-asset multi-strategy fund, and Societe Generale in Hong Kong and JP Morgan Investment Management in New York. His recent book Multi-Asset Investing: A Practitioners Framework , proposes that the basic structure of institutional and individuals portfolios needs to evolve from asset class segmented active management, toward a multi-asset class multi-allocation framework.

As a mechanical engineer from IIT Delhi specializing in CAD/ CAM, Pranay used robotic manipulator techniques for the design of automobile suspension systems for Suzuki Motor Co. Japan, fluid dynamic modelling techniques for the simulation of oil wells for Dowell Schlumberger and production planning control systems for missile manufacture. Using large-scale databases, Pranay has designed, developed and implemented advanced analysis and portfolio management systems for various organizations. These state-of-the-art diagnostics platforms have been used to manage and monitor portfolios with assets of over US$400bn using quantitative analysis of big data, portfolio evaluation to re-engineer investment processes and in creating customized multi-asset client solutions for asset owners of all sizes and sophistication. Pranay has also used heuristic time series modelling, neural network and artificial intelligence techniques to manage over $1bn in pension assets. Pranay currently serves on the advisory board of StashAway, the first licensed retail robo-advisor in Singapore.

Pranay has served as an external curriculum director for the CFA Program, has authored CFA curriculum readings in portfolio management, and has been chairman of the Finance and Investment Committee at the CFA Institute Research Foundation. He currently serves as a research consultant at the Centre of Asset Management Research and Investments at the National University of Singapore and conducts the Reserve Management program for sovereign wealth funds, pensions, central banks and regulators from across the world at the Nanyang Technological University.

Dr. Mandy Tham

Mandy is currently an assistant professor of finance (education) at the Singapore Management University. She delivers years of experience as a curriculum developer designing and obtaining industry accreditation for wealth management courses customized to both institutions of higher learning and financial institutions. She teaches in both English and Mandarin, on both undergraduate and postgraduate programs in areas such as derivatives, investment and wealth advisory.

Her research interests span investments to behavioral finance and she has published in top journals such as the Journal of Financial Economics , Management Science and the Journal of Financial and Quantitative Analysis . Her research work has won awards such as the CFA Best Paper award and the TCW Best Paper award, and was published by Harvard Business Review and featured by Forbes. Besides academic research, she works closely with practitioners to write in-house cases and other literary works.