Emerging FinTech

Emerging FinTech

Understanding and Maximizing Their Benefits

Paul Taylor, MBA, MBCS, FRSA CMgr FCMI

Emerging FinTech: Understanding and Maximizing Their Benefits

Copyright Business Expert Press, LLC, 2022.

Cover design by Charlene Kronstedt

Interior design by Exeter Premedia Services Private Ltd., Chennai, India

All rights reserved. No part of this publication may be reproduced, stored in a retrieval system, or transmitted in any form or by any meanselectronic, mechanical, photocopy, recording, or any other except for brief quotations, not to exceed 400 words, without the prior permission of the publisher.

First published in 2022 by

Business Expert Press, LLC

222 East 46th Street, New York, NY 10017

www.businessexpertpress.com

ISBN-13: 978-1-63742-247-2 (paperback)

ISBN-13: 978-1-63742-248-9 (e-book)

Business Expert Press Service Systems and Innovations for

Business and Society Collection

First edition: 2022

10 9 8 7 6 5 4 3 2 1

Description

Financial Services and Technology (FinTech) have collaborated for decades with mutual benefit, and it is not unreasonable to expect this co-operation to continue, especially with the development of emerging technologies.

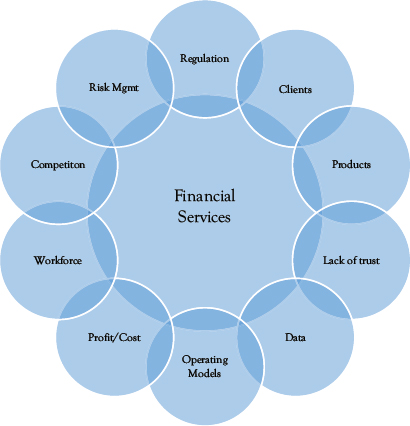

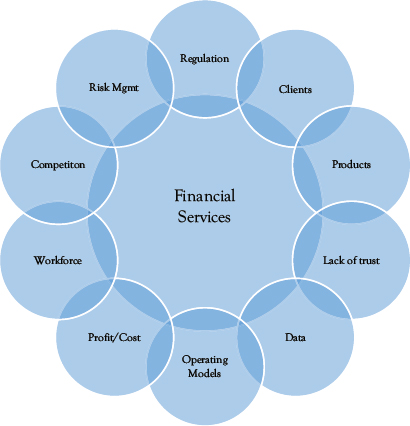

However, both industries are facing challenges. Financial Services suffer from regulation, client, and risk pressures. Emerging technologies suffer from their inherent complexity and implementation challenges.

It is imperative that Financial Services firms understand emerging technologies to ensure they are implemented effectively to support both current business and future challenges.

This book takes a pragmatic and critical review of Emerging Technologies exploring

What the technologies are?

How they can be used?

How they can be implemented pragmatically?

How they could help address future challenges?

This book provides an overview of emerging technologies within Financial Services to allow firms to understand their real benefits and how to pragmatically implement them for maximum benefit.

Keywords

financial services; banking; investment management; asset management; insurance; technology; emerging technology; regulation; clients; products; lack of trust, data; operating models; profit; cost; workforce; competition; risk management; remote working; self-servicing; machine learning; robotic process automation; Internet-of-Things, IoT; natural language processing, NLP; digital currency; cloud computing; big data; green computing; climate change; ESG; trading; payments; FinTech; technology; future challenges

Contents

This book discusses and explores 10 emerging technology trends and their impact on the Financial Services industry.

The structure of the book can be split into four main parts:

Part OneBackground and Context Setting

The first part starts (in below. This chapter is not meant to provide an in-depth overview but to provide sufficient context for the rest of the book.

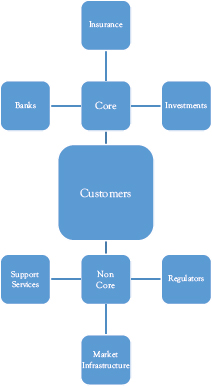

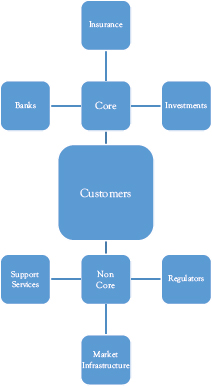

Figure 1.1 High-level summary of the industry

below.

Figure 1.2 The four stages of the financial services technology evolution

This first part then concludes (in below.

Figure 1.3 Summary of the challenges of impacting the financial services industry

Part TwoExploring the Impact of the 10 Emerging Technology Trends

The second part is the main part of this book. It contains 10 chapters (from below.

Figure 1.4 Summary of the 10 technology trends

The structure of each chapter is similar. Initially, an overview of the technology is given with the benefits it can provide at a general level. Then each chapter will discuss how the technology is currently being used within the Financial Services industry followed by a discussion on the pragmatic challenges of implementing and using the technology. This leads to how the technology either helps with or hinders the key industry . Each chapter then ends with a case study followed by a small summary of the key points to aid understanding.

Part ThreeWrap Up and Looking to the Future

The third and final part is a summary of the book outlining the key themes and challenges going forward.

This chapter provides a summary of the Financial Services industry. It is not meant to provide an in-depth overview but to provide sufficient context for the rest of the book.

A Simple Definition

The Financial Services industry is a wide and complex area (which this chapter will hopefully demonstrate) which means providing a precise definition can be challenging. Therefore for this book, it will be defined as follows:

The Financial Industry consists of many Financial Services Organizations providing financial services products/services to their customers and consumers.

The Financial Services Organizations that provide these services cover many firms such as banks, credit card providers, investment managers plus others.

The products/services provided cover offerings such as bank accounts, investment products, credit cards, investment advice, capital funding plus others.

These customers and consumers who receive these products/ services will cover everything from individual retail customers to large multinational organizations, local/national governments and pension funds.

Why Is Financial Services Critical?

It is safe to say that the Financial Services industry is critical to the dayto-day operations of the global economy.

The movement of money must happen and if it does not happen then there will be material issues. For example, imagine the situation if invoices, salaries, or pensions were not being paid? There would be uproar, possible rioting, and a general breakdown of society.

Likewise, many activities legally need insurance in place to allow them to happen. For example, a pilot and airline need insurance to fly a plane, people need insurance to drive a car, and people often need to take out insurance before going on holiday.

How Big Is the Financial Services Industry?

Unfortunately, obtaining accurate statistics on the size of the Financial Services industry (or any industry for that matter) is challenging. This is because most assessments are performed using different measurements, using different methodologies, using differing timescales, using different assumptions, and are often performed for different purposes.

However, some high-level statistics can be quoted to demonstrate the size of the global Financial Services industry.

Forbes in 2019 created a list of worlds largest public firms in revenue generation which showed Banking as the third biggest industry by sales globally (at USD 4.424 trillion) and Insurance as the sixth biggest industry by sales globally (at USD 2.611 trillion). The top industry was Oil and Gas (at USD 4.797 trillion) with Technology (also a topic of this book) coming in second at USD 4.726 trillion. Therefore, if Banking and Insurance were combined under the umbrella of Financial Services then it would be the largest industry by sales globally.