Peter Seilern - Only the Best Will Do: The compelling case for investing in quality growth businesses

Here you can read online Peter Seilern - Only the Best Will Do: The compelling case for investing in quality growth businesses full text of the book (entire story) in english for free. Download pdf and epub, get meaning, cover and reviews about this ebook. year: 2019, publisher: Harriman House Limited, genre: Business. Description of the work, (preface) as well as reviews are available. Best literature library LitArk.com created for fans of good reading and offers a wide selection of genres:

Romance novel

Science fiction

Adventure

Detective

Science

History

Home and family

Prose

Art

Politics

Computer

Non-fiction

Religion

Business

Children

Humor

Choose a favorite category and find really read worthwhile books. Enjoy immersion in the world of imagination, feel the emotions of the characters or learn something new for yourself, make an fascinating discovery.

- Book:Only the Best Will Do: The compelling case for investing in quality growth businesses

- Author:

- Publisher:Harriman House Limited

- Genre:

- Year:2019

- Rating:4 / 5

- Favourites:Add to favourites

- Your mark:

- 80

- 1

- 2

- 3

- 4

- 5

Only the Best Will Do: The compelling case for investing in quality growth businesses: summary, description and annotation

We offer to read an annotation, description, summary or preface (depends on what the author of the book "Only the Best Will Do: The compelling case for investing in quality growth businesses" wrote himself). If you haven't found the necessary information about the book — write in the comments, we will try to find it.

Peter Seilern: author's other books

Who wrote Only the Best Will Do: The compelling case for investing in quality growth businesses? Find out the surname, the name of the author of the book and a list of all author's works by series.

Only the Best Will Do: The compelling case for investing in quality growth businesses — read online for free the complete book (whole text) full work

Below is the text of the book, divided by pages. System saving the place of the last page read, allows you to conveniently read the book "Only the Best Will Do: The compelling case for investing in quality growth businesses" online for free, without having to search again every time where you left off. Put a bookmark, and you can go to the page where you finished reading at any time.

Font size:

Interval:

Bookmark:

Only the Best Will Do

The compelling case for investing in quality growth businesses

Peter Seilern

This book is gratefully dedicated to my partners, past and present.

Warren Buffett, who knows a thing or two about stock market investing, describes a moment of epiphany when after years as a Benjamin-Graham-style value investor he finally came to appreciate that it is better to pay a fair price for an outstanding business than an excellent price for a poor or mediocre one. He attributed this insight to his longstanding friend and business colleague Charlie Munger, although he has also referenced a number of other influential investors, such as John Maynard Keynes and Philip Fisher, in support of that idea.

Yet there is something deeply entrenched in human nature that seems to militate against more investors pursuing a strategy which experience directs has so many positives and so few negatives going for it. How strange is it, after all, to believe that it might be a mistake to invest in something other than the best? Nobody with a long-term perspective and the freedom to choose would knowingly set out to pick a work of art, a case of wine, or (dare one suggest?) a spouse on any other basis.

It is to the credit of my friend Peter Seilern that, from his earliest days in the investment business, he has never doubted the wisdom of investing exclusively in high-quality growth companies which not only pass a demanding set of financial criteria, but crucially also offer the investor a high degree of confidence that they will go on doing so for many years into the future. The potential longevity of a quality growth companys ability to go on making high returns on capital is the key insight that makes it in reality a low, not a high, risk investment.

It is an article of faith for Peter, bordering on zealotry, that for every kind of investor avoiding a permanent loss of capital is every bit as important as maximising investment returns. Constructing a portfolio of what he calls quality growth stocks is the only true way to minimise the risk of losses while simultaneously maintaining a high probability of above average long-term returns. This is not, in general, the approach of the great majority of investors, both private and professional, for whom the pursuit of uncertain larger gains today frequently trumps the security of more reliable returns tomorrow.

In Keynes immortal words, few stock market investors are immune from the gambling instinct and as a result must pay to that propensity the appropriate toll. Well, maybe it is more than a few who have a more enlightened view today, as evidenced by the increasing amount of money which flows every week into passively managed index funds, the epitome of dullness, but instruments, suitably priced, whose main attraction is that they offer nothing but reliable second quartile performance over time.

Yet why settle for second best when you can still go one better? That is the challenge which Peter throws out to all of us in this important and timely addition to the canon of readable and authoritative investment literature. For him, the best really does mean the best. The universe of investable businesses which pass his demanding criteria (the ten golden rules he describes in chapter 3) numbers just a tiny fraction of more than 50,000 companies whose shares are listed on leading public stock exchanges around the world.

All are well-known names with long histories and deep and liquid markets for their shares. There is nothing to stop anyone with money to invest from owning them. If you had done so at almost any point over the past 30 years, the risk-adjusted returns you would have witnessed by now would have convincingly thumped the performance of both index funds and all but a handful of professionally managed funds. Quality growth companies, you would think, are an ideal match for pension funds and any institutional investor with real long-dated liabilities. Yet regulators and actuaries, unable to distinguish one equity from another, blindly refuse to think so.

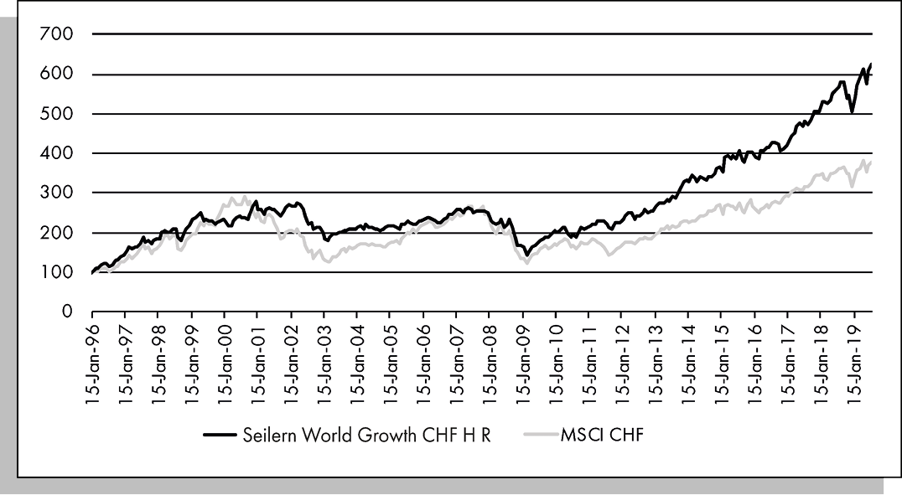

The track record of the funds managed by Peters own investment management firm, Seilern Investment Management, bears testimony to the success of his approach. His fund with the longest continuous track record has outperformed the MSCI World index by approximately 2.25% per annum, compounded over 23 years, sufficient to grow an initial portfolio of 10,000 Swiss Francs into a sum more than six times that amount. This is despite the period encompassing two of the most severe bear markets in living memory (200003 and 200709). The comparable sum that would have been generated by the world index is 3.75 times the original investment. The past ten years have been particularly rewarding for his methods, with annualised returns of more than 13% per annum.

Seilern World Growth vs MSCI World

Source: Seilern Investment Management, Bloomberg

Yet the funds have also been less volatile than the market as a whole, and if that is your favoured measure of risk (which it should not be, of course risk is a richer and more complex concept than that) then you should be doubly happy. In practice, even the best companies can sometimes become too expensive to justify ownership. Sometimes, too, they lose their mojo through some combination of management incompetence, complacency and the arrival of vigorously disruptive newcomers with a technological or some other form of competitive edge. That is capitalism for you.

So you still have to be selective and on the ball. It is only the cream of the crop that eventually make it into Peters funds. If and when a company passes his rigorous quality growth tests, his average holding period is ten years or more. Unlike most of his peers, instead of looking ceaselessly for the next big thing, the analysts at Seilern Investment Management spend the majority of their time drilling ever deeper into the operations and accounts of the companies they do own in order to be sure that their competitive strengths are not being eroded, competed away or disguised from view. If the price of freedom is eternal vigilance, the same is true of investing in quality growth companies.

*

I can vouch for the fact that Peters principles, which he outlines and justifies in this book, have not altered a jot in the two decades that I have known him. It is, in fact, 30 years since this modest, largely unsung exemplar of what a fund manager should be first set up a small office in London to pursue his ambition of turning his insights into a sustainable investment management business. Today his firm has some $1.5 billion under management, but the road to commercial success has not always been linear. Not for him the easy road of many fund management firms, prioritising asset accumulation over sustained performance and the clients best interest.

Personal and professional modesty should not be mistaken for the absence of deeply held convictions. Peter has strong views not only about the inherent superiority of his quality growth investment approach, but also about many of the theories and assumptions to which finance academics and the majority of professional investors hold dear. Some of his strictures are laid out in the pages that follow. He remains a passionate advocate of European integration, for reasons which, as with his aversion to unnecessary risk, I suspect are strongly rooted in his Austrian family background.

Font size:

Interval:

Bookmark:

Similar books «Only the Best Will Do: The compelling case for investing in quality growth businesses»

Look at similar books to Only the Best Will Do: The compelling case for investing in quality growth businesses. We have selected literature similar in name and meaning in the hope of providing readers with more options to find new, interesting, not yet read works.

Discussion, reviews of the book Only the Best Will Do: The compelling case for investing in quality growth businesses and just readers' own opinions. Leave your comments, write what you think about the work, its meaning or the main characters. Specify what exactly you liked and what you didn't like, and why you think so.