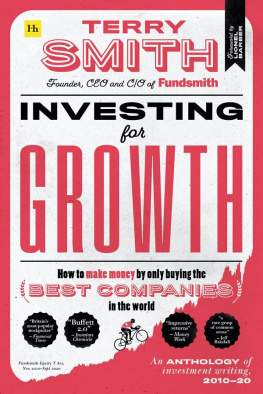

Terry Smith - Investing for Growth

Here you can read online Terry Smith - Investing for Growth full text of the book (entire story) in english for free. Download pdf and epub, get meaning, cover and reviews about this ebook. year: 2020, genre: Romance novel. Description of the work, (preface) as well as reviews are available. Best literature library LitArk.com created for fans of good reading and offers a wide selection of genres:

Romance novel

Science fiction

Adventure

Detective

Science

History

Home and family

Prose

Art

Politics

Computer

Non-fiction

Religion

Business

Children

Humor

Choose a favorite category and find really read worthwhile books. Enjoy immersion in the world of imagination, feel the emotions of the characters or learn something new for yourself, make an fascinating discovery.

- Book:Investing for Growth

- Author:

- Genre:

- Year:2020

- Rating:5 / 5

- Favourites:Add to favourites

- Your mark:

- 100

- 1

- 2

- 3

- 4

- 5

Investing for Growth: summary, description and annotation

We offer to read an annotation, description, summary or preface (depends on what the author of the book "Investing for Growth" wrote himself). If you haven't found the necessary information about the book — write in the comments, we will try to find it.

Investing for Growth — read online for free the complete book (whole text) full work

Below is the text of the book, divided by pages. System saving the place of the last page read, allows you to conveniently read the book "Investing for Growth" online for free, without having to search again every time where you left off. Put a bookmark, and you can go to the page where you finished reading at any time.

Font size:

Interval:

Bookmark:

Investing

for

Growth

How to make money by only buying the best companies in the world

An anthology of investment writing, 201020

TERRY SMITH

Foreword by LIONEL BARBER

For Hendrix and Felix

Contents

Foreword by

Lionel Barber

I n November 2011, one year after launching Fundsmith, Terry Smith asked me whether the Financial Times would consider publishing his obituary-commentary on the death of Smokin Joe Frazier, the former heavyweight boxing champion with the murderous left hook.

This was an unusual request, but all good newspaper editors know that readers enjoy an element of surprise. Besides, I knew that Terry was passionate and, more importantly, knowledgeable about boxing. (He once tried to entice me into the ring to raise money for charity, an offer wisely declined on my part.)

The ensuing tribute in the FT captured one of lifes essential truths. What made Frazier so great, Terry wrote, was his link to the men he fought George Foreman and Muhammad Ali and the significance the bouts had. We would all do well to remember that we are defined by those with whom we compete be they boxer, banker or politician.

Those who have come to appreciate Terry Smith, as I have over the past 15 years, know that he is a man who is fiercely competitive, whether cycling uphill in the French Alps, kickboxing on a beach patio, or squaring up against rival brokers and fund managers. He too has been defined by his opponents, the great, the good and the not so good. But what sets him apart is not just his formidable winning streak, but the principles on which he has chosen to take a stand.

During a career in financial services stretching more than four decades, Terry has been as lethal as Smokin Joe in cornering competitors. He has reserved a special place for those who, in his eyes, are guilty of incompetence, obfuscation or misleading investors via sophisticated marketing or creative accounting. He is the unabashed champion of quality which, he argues, is synonymous with true value.

Terry has always put his money where his (considerable) mouth is. He single-handedly organised the campaign to build a London memorial to Sir Keith Park, the Kiwi flying ace and unsung hero of the Battle of Britain. He built up Tullett Prebon as a pre-eminent inter-dealer broker and then walked away to launch Fundsmith, where his commitment to invest in sound businesses has proved a winning, if still somewhat unfashionable, formula. Or as he puts it, succinctly:

a good company with good products or services, strong market share, good profitability, cash flow and product development.

Fundsmith was launched a decade ago in less-than-propitious circumstances. True, the 200709 global financial crisis had abated, thanks to unprecedented intervention by central banks. But the economic recovery was far from secure, and Europe was in the middle of a full-blown sovereign debt crisis. In the following years, Fundsmith would come to thrive and challenge many of the (lazy) assumptions about the fund management industry.

Myth number one: algorithms have taken over the world and there is no serious alternative to passive investing, exemplified by the rise of exchange-traded funds (ETFs). These funds have indeed grown exponentially, ostensibly offering far more reliable returns compared to so-called active investing. But Fundsmith has demonstrated that there is a profitable niche in the market alongside the titans of BlackRock, Fidelity and Vanguard.

Myth number two: so-called value investing has run its course. Chief witness for the prosecution is Neil Woodford, long hailed as Britains Golden Boy. Woodford certainly had his moments at Invesco; but after striking out on his own in 2014, his record looks more similar to that of another golden boy: Billy Walker, the British heavyweight from Stepney, known as the Blond Bomber who eventually gave up his gloves for a brief career in movies. In fact, Woodfords demise owes more to hubris and an unhealthy reliance on illiquid stocks. It does not spell the end of the savvy stock picker.

Myth number three: asset allocation trumps all considerations and, almost by implication, the addition of a small/mid-cap element to a portfolio constitutes an unacceptable level of risk. In fact, as Terry argued in a myth-busting FT column in August 2018, there is no doubt that adding a small/mid-cap element to a portfolio can achieve the seemingly impossible feat of generating additional return while reducing risk. No doubt Terry had half an eye on the launch of Smithson, his small-to-mid-cap fund; but once again the subsequent performance of the fund speaks for itself.

Myth number four: blue-chip companies deserve a measure of respect which makes them impregnable or untouchable. Terry has shown time and again a willingness to challenge conventional wisdom. He has taken on national champions such as IBM in the US and Tesco in the UK, relentlessly probing their underlying performance and profitability. In retrospect, his critical analysis has proven remarkably prescient.

There is, I believe, a certain correlation between Terrys without fear and without favour approach to stock-picking and my own approach to journalism. We are both students of history as well as practitioners of direct verbal communication and unfussy written prose. My early editorship was indeed partly defined by my first encounters with Terry in late 2005 when we settled a messy legal dispute which I inherited from my predecessor.

What Terry has taught me, and I suspect many others, is that there is little to be gained from venturing into the speculation business. Many things are inherently unknowable. This, of course, does not prevent many people, especially journalists, from becoming armchair forecasters. In the age of social media, where news and views are spread at scale in real time, too many are tempted to opine about the future, not simply to anticipate but also to attempt to influence events. This is not an argument against free speech, more a health warning about vacuous pronouncements and the (relative) value of talking heads.

This offers me a perfect excuse for not commenting on what may lie in store for Fundsmith over the next decade. As a Big Picture person, who worries about the state of liberal democracy, I must remain silent for now. Nor do I have much wisdom to offer about Brexit and what it means for the UK. Finally, as an amateur economist, I have little to contribute to the debate about the return of inflation. I would merely add that, in the spirit of Sir Isaac Newtons third law of physics, at some point the extraordinary actions of the central banks must produce an opposite (if not necessarily equal) reaction.

In the meantime, only three words matter for investors and admirers alike.

Happy Birthday, Fundsmith.

lionel barber

Editor, Financial Times 20052020

The lessons of the first ten years

Introduction by Terry Smith

I decided to publish this book to mark the tenth anniversary of Fundsmiths foundation. It comprises articles that I have published over that period together with my annual letters to investors in the Fundsmith Equity Fund.

At the outset Fundsmith believed that direct communication with our investors was important because it gave us the best chance of explaining our investment strategy, how we were performing and what we are doing, without the intervention of intermediaries. This is particularly important when things dont go well, which is inevitable from time to time, as it might prevent our investors taking actions which are injurious to themselves and our fund. To this end we not only publish an annual letter to investors, we also hold an annual meeting at which investors can pose questions and see us answer them live and in public. This is not mandatory and we are the only mutual fund in the UK which does it. It has become the best attended annual general meeting in the UK. This book is intended to contribute to that tradition of direct communication.

Font size:

Interval:

Bookmark:

Similar books «Investing for Growth»

Look at similar books to Investing for Growth. We have selected literature similar in name and meaning in the hope of providing readers with more options to find new, interesting, not yet read works.

Discussion, reviews of the book Investing for Growth and just readers' own opinions. Leave your comments, write what you think about the work, its meaning or the main characters. Specify what exactly you liked and what you didn't like, and why you think so.