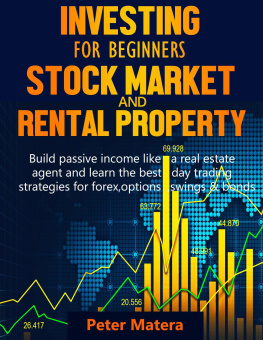

STOCK MARKET INVESTING FOR BEGINNERS: 6 BOOKS IN 1

Best Strategies and Tactics for Building Income by Trading Stocks, Bonds, Options, Forex, Cryptocurrencies, and more

Dave Raymond

Copyright 2020 - All rights reserved.

The content contained within this book may not be reproduced, duplicated or transmitted without direct written permission from the author or the publisher.

Under no circumstances will any blame or legal responsibility be held against the publisher, or author, for any damages, reparation, or monetary loss due to the information contained within this book. Either directly or indirectly.

Legal Notice:

This book is copyright protected. This book is only for personal use. You cannot amend, distribute, sell, use, quote or paraphrase any part, or the content within this book, without the consent of the author or publisher.

Disclaimer Notice:

Please note the information contained within this document is for educational and entertainment purposes only. All effort has been executed to present accurate, up to date, and reliable, complete information. No warranties of any kind are declared or implied. Readers acknowledge that the author is not engaging in the rendering of legal, financial, medical or professional advice. The content within this book has been derived from various sources. Please consult a licensed professional before attempting any techniques outlined in this book.

By reading this document, the reader agrees that under no circumstances is the author responsible for any losses, direct or indirect, which are incurred as a result of the use of information contained within this document, including, but not limited to, errors, omissions, or inaccuracies.

BOOK 1: STOCK TRADING FOR BEGINNERS

Table of Contents

BOOK 2: FOREX TRADING

Table of Contents

BOOK 3: OPTIONS TRADING

Table of Contents

BOOK 4: DAY TRADING

Table of Contents

BOOK 5: SWING TRADING

Table of Contents

BOOK 6: CRYPTOCURRENCY TRADING

Table of Contents

Stock Trading for Beginners

A Beginners Guide to Learn How to Invest in the Stock Market. Research Best Investments for Your Portfolio and Learn How to Manage Risk

Dave Raymond

Introduction

A share of stock is, first of all, a claim on the part ownership of an underlying company. It gives the shareholders to the right to lay a claim on the earnings, dividends and the gains of a company. Both individuals and institutions can buy shares in all publicly traded companies listed on the stock exchange commission.

Types of Shares

Basically, there are two types of shares: common shares and preference shares. Common shares enable shareholders to have voting rights and exercise their opinion about the election of directors, auditors or any other thing during the annual general meeting (AGM). Shareholders with preference shares do not usually exercise voting rights, but they have the right to receive dividends and asset locations when the underlying company has been sold.

Shares are a form of equity financing, used to raise money from the general public into a publicly traded company. When investors buy shares, they own a percentage stake of the underlying company.

The Pricing of Shares

The pricing of shares in the stock market is regulated by the supply and demand forces of the market (buying/selling). For instances, when the buyer of sellers of an underlying stock outnumber those buying, the price of shares is likely to go high.

On the other hand, when the number of sellers outnumbers the number of those buying, the price of shares is likely to go down. Nonetheless, there are regulatory bodies, which ensure fairness in the pricing of various stocks. Apart from the supply and demand forces of the market, financial reports and company growths also contribute to the price of shares in the stock market.

Unlike investors who like to buy and hold stocks for a long period of time, traders prefer to make short term profits in the stock market by trading on the difference in the market. In the market, there is a bid price and an offer price. The bid price is what the buyers are proposing to sell the shares of stocks, while the offer price is what sellers are willing to sell the shares. The distinction between the bid price and the offer price creates a spread. For a trade to take place, either the bid price or offer price will be accepted by the parties.

Types of Stock Market

There are two main types of stock markets: the primary stock market and the secondary market. The variation between these two financial markets is actually determined by the size of the underlying companies doing their listing on them. The main role of In addition to this, the regulation and fees involved in the listing also determine which companies use in their listing.

The Primary Stock Market: The primary stock market is where many companies get listed when they release their initial public offering (IPO). The primary stock market is preferred by small and medium-sized companies looking to leverage equity financing to raise capital to expand and grow their company.

By listing and selling shares of the company to the general public, the initial shareholders cash in on their initial stake in the company. There are various stock exchange markets in countries providing a listing of various stocks.

The Secondary Stock Market: This is the large the stock market where trillions of shares are sold on a daily basis. Most often, the companies that are listed on the stock market do not trade their own shares in the market. The shares of stock that are being traded on the secondary stock exchange is simply common shares of other shareholders in the underlying company.

The secondary stock market has a high amount of exposure and access to large institutional investors and this is why many companies aspire to have their companies listed there. Some of the secondary stock markets include the following the NASDAQ, the New York Stock Exchange, and the American Stock Exchange.

The Bond Market

The bond market is where long term debt securities or financial instruments are traded by the general public. The bond market involves the bond issuer, the entity engaged in the buying of the debt security and the bondholder, the entity engaged in the selling of debt security. Bonds are basically are a type of loans.

The Dynamics of Bonds

When you buy a bond, youre agreeing to loan your money to the issuer with the promise of receiving a fixed income interest rate at regular intervals prior to or at maturity. A bond has a coupon, which is known as the interest rate required to be by paid to the issuer for the underlying debt security.

The interest rate is paid either annually, or biannually. The maturity is the expiration date for which the associated bond is expected to yield the stated returns for the bondholder.

Difference between Bonds & Stocks

Stocks are a type of equity financing vehicles where investors share in the profit and loss of the project or company in which the funds are being invested. On the other hand, bonds are credit financing vehicles where the creditors do not share in the profit and loss of the project or the company in which the funds are being invested.

Chapter 1

Introduction to the Stock Market

Stocks is just the nickname for "shares of stock" or equities, which represents units of ownership of a certain corporation. So, if you held even just ten shares out of the tens of millions of shares of Intel, Inc., you wouldn't be lying if you said you're one of the owners of Intel, Inc. Seriously, you are! The only issues left for discussion is how much of the company you own, which judging by having on ten shares isn't much. But still, you can have bragging rights.