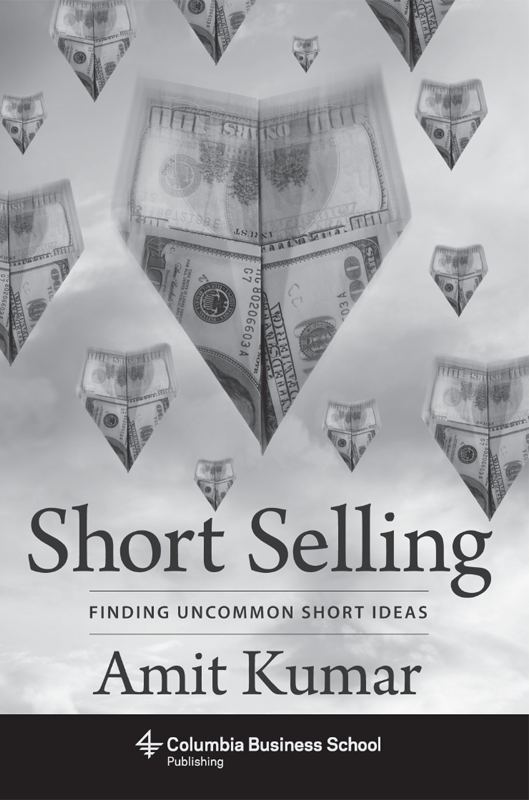

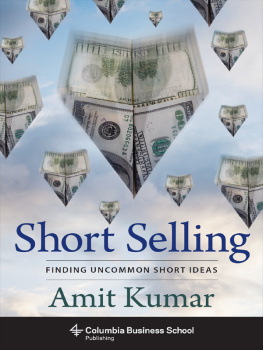

Short Selling

Columbia University Press

Publishers Since 1893

New York Chichester, West Sussex

cup.columbia.edu

Copyright 2015 Columbia University Press

All rights reserved

E-ISBN 978-0-231-53884-8

Library of Congress Cataloging-in-Publication Data

Kumar, Amit (Certified Financial Analyst)

[Short stories from the stock market]

Short selling: Finding uncommon short ideas / Amit Kumar.

pages cm

Originally published in 2012 as: Short stories from the stock market : uncovering common themes behind falling stocks to find uncommon short ideas.

Includes bibliographical references and index.

ISBN 978-0-231-17224-0 (cloth : alk. paper) ISBN 978-0-231-53884-8 (ebook)

1. Short selling. 2. StocksPrices. 3. Investments. I. Title.

HG6041.K86 2015

332.63'228dc23

2015005506

A Columbia University Press E-book.

CUP would be pleased to hear about your reading experience with this e-book at .

COVER IMAGE: Getty Images / Mike Kemp

COVER DESIGN: Milenda Nan Ok Lee

References to Internet Web sites (URLs) were accurate at the time of writing. Neither the author nor Columbia University Press is responsible for URLs that may have expired or changed since the manuscript was prepared.

To my Guru, family, friends, and clientsmy sources of strength.

Contents

Word of Caution!

Short selling is not for the faint of heart. While fortunes have been made shorting, many have also been lost. Shorting stocks is for the financially experienced and sophisticated investors with a strong stomach for losses. It can be potentially very dangerous to your wealth. Although this book may be a helpful guide to finding successful short ideas, when it comes to actually shorting them, you are on your own. Please consult with your financial advisor before taking any action.

Who Should Read This Book?

The book provides a research framework for individual and professional investors, finance students and professors, stock market reporters, and other stock enthusiasts to find uncommon short ideas and avoid common traps and hot stocks. Investors and professional analysts will find this book useful to uncover and pitch new short ideas.

Finance students seeking careers as professional analysts can benefit from this book. Finance professors can draw upon various examples and the shorting framework in the book to complement traditional textbooks on equity analysis. Market reporters, stock bloggers, and other stock market enthusiasts will find the book useful to watch for common themes behind short ideas that may have been overlooked by the stock market.

Why Should You Read This Book?

There is a natural psychological bias toward buying stocks. The Dow Jones Industrial Average (DJIA) has continued rising from the 100 range in the 1920s to the 14,000 range in 2007, generating a compounded annual return of around 6 percent. Shorting stocks against this backdrop may seem like sailing against the tide. Rising tides often lift even the least sail-worthy boats.

Short sellers have profited from less worthy stocks since the 1600s, when exchange-based trading began in Amsterdam; however, books on short selling are few and far between. Good investment books expound on downside risks in long ideas; however, risk analysis can always find one risk or another with any long idea.

Shorting stocks is not exactly the opposite of buying stocks, and risk analysis of long ideas may not always detect clear signals to short. It takes more to uncover short ideas. I present a short selling framework in this book that uncovers the common themes behind falling stocks to find uncommon short ideas.

While shorting is inherently risky, investors can profit from well-researched short ideas. When a short thesis points out problems endemic to a specific industry, investors can short both stocks and sector funds in that industry to beat market returns. While investors may not always choose to act on short ideas, they can still avoid losses by using this framework to analyze weaknesses in their existing portfolio.

Structure of the Book and Content

I have divided the book into three parts: explains that history can be a good compass to navigate an ongoing crisis and that recession and crises can result in tightening credit cycles that expose vulnerabilities in certain business models.

contains an exclusive interview with Mark Roberts and samples of Off Wall Street research on short ideas.

describes the mechanics of short selling and how short selling is not the opposite of buying stocks.

I have used case studies throughout the book to illustrate the shorting framework in practice. I have drawn examples from my past research as well as research contributed by Off Wall Street, a short-focused research firm with a successful track record that spans two decades.

I would like to thank a number of friends who read early versions of my book and provided their valuable feedback. I am grateful to Jereme Axelrod, Pankaj Nevatia, Ajay Singh, Pallav Gupta, Vinodh Nalluri, and Amit Gupta for giving useful and detailed suggestions.

Special thanks to Mark Roberts from Off Wall Street for his exclusive interview for this book. I am also grateful to Mark for sharing some of his exceptional past work in researching short ideas. Many thanks to Jean-Marie Eveillard for sharing his insights on value investing.

I would like to thank Bill Ackman for taking the time to read the first edition of the book and sharing his valuable feedback, as well as agreeing to interview for the current edition.

I owe thanks to my professors at Columbia Business School: Bruce Greenwald, whose framework on barriers to entry in an industry is immensely useful; and Suresh Sundaresan, whose lectures on advance derivatives went over my head in the classroom, but shortly after helped me make sense of the ensuing financial crisis.

I also want to thank the great investors who visited Columbia Business School and lent their insights, shared their mistakes, and took questions. Their lectures shaped my research process and helped me to understand the psychology of investing. Special thanks to Jim Chanos, whose lecture helped me see the distinction between going long and selling short.

Last but not least, I am thankful to my wife for her loving support.

Deep appreciation to my daughter, who eagerly asked every day, Is your book ready, Dad? and kept me inspired to complete the book. To my parents, brothers, and familythank you for your confidence and support.

Its common for promoters to cause a stock to become valued at 5 to 10 times its true value, but rare to find a stock trading at 10 to 20percent of its true value. So you might think short selling is easy, but its not.

WARREN BUFFETT

ENRON IS A POSTER CHILD for accounting fraud and financial shenanigans. Jim Chanos, an early short seller of Enron in 2001, first noticed the stock in a Wall Street Journal article on gain-on-sale accounting practices at large energy trading firms. In congressional testimony, he said that he became interested in Enron because the gain-on-sale approach allowed management to estimate future profitability and tempted them to create earnings out of thin air.

In his meeting with Wall Street analysts, Chanos had found that their buy ratings were not backed by analysis and were marred by conflicts of interest. These ominous signs, coupled with Enrons rich valuation, made Enron a perfect short for Chanos. Short sellers like Chanos have played the role of the canary in the coal mine for the stock market.