Table of Contents

Guide

Pages

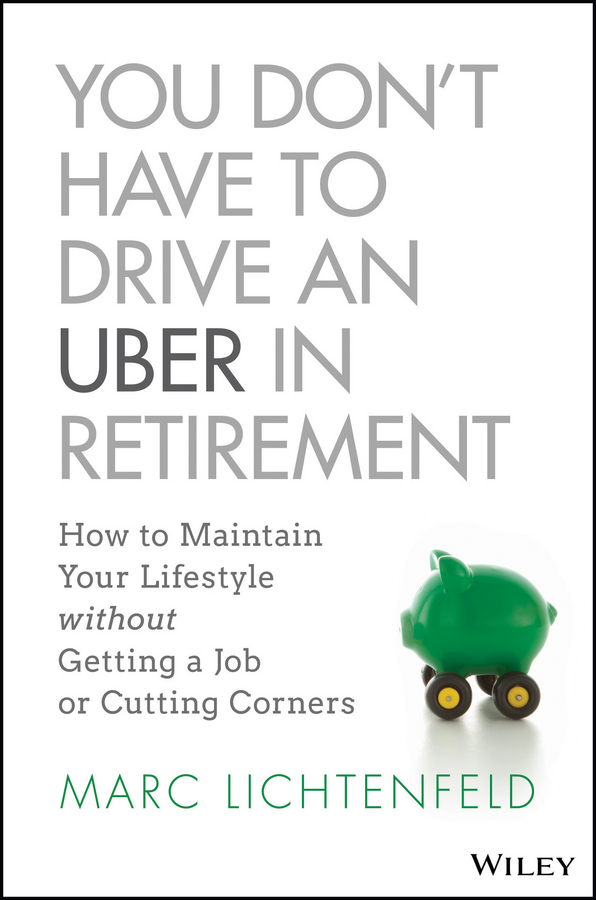

You Dont Have to Drive an Uber in Retirement

HOW TO MAINTAIN YOUR LIFESTYLE WITHOUT GETTING A JOB OR CUTTING CORNERS

Marc Lichtenfeld

A must-read for anyone looking to retire comfortablyLichtenfeld provides unique ideas that will literally put thousands of dollars in your bank account starting right now.

Frank Curzio,

President and CEO, Curzio Research

Every investor who wants to live life on his or her terms needs to read this book. It's clearly written, easy to understand and filled with profitable advice - in plain English.

Keith Fitz-Gerald,

Chief Investment Strategist,

MoneyMorning.com and Money Map Press

Marc's book of creative ideas for building income and accumulating wealth is a godsend for retirees today. This book is a must-read!

Zach Scheidt,

Agora Financial

Copyright 2018 by John Wiley & Sons, Inc. All rights reserved.

Published by John Wiley & Sons, Inc., Hoboken, New Jersey.

Published simultaneously in Canada.

No part of this publication may be reproduced, stored in a retrieval system, or transmitted in any form or by any means, electronic, mechanical, photocopying, recording, scanning, or otherwise, except as permitted under Section 107 or 108 of the 1976 United States Copyright Act, without either the prior written permission of the Publisher, or authorization through payment of the appropriate per-copy fee to the Copyright Clearance Center, Inc., 222 Rosewood Drive, Danvers, MA 01923, (978) 750-8400, fax (978) 646-8600, or on the Web at www.copyright.com. Requests to the Publisher for permission should be addressed to the Permissions Department, John Wiley & Sons, Inc., 111 River Street, Hoboken, NJ 07030, (201) 748-6011, fax (201) 748-6008, or online at www.wiley.com/go/permissions.

Limit of Liability/Disclaimer of Warranty: While the publisher and author have used their best efforts in preparing this book, they make no representations or warranties with respect to the accuracy or completeness of the contents of this book and specifically disclaim any implied warranties of merchantability or fitness for a particular purpose. No warranty may be created or extended by sales representatives or written sales materials. The advice and strategies contained herein may not be suitable for your situation. You should consult with a professional where appropriate. Neither the publisher nor author shall be liable for any loss of profit or any other commercial damages, including but not limited to special, incidental, consequential, or other damages.

For general information on our other products and services or for technical support, please contact our Customer Care Department within the United States at (800) 762-2974, outside the United States at (317) 572-3993, or fax (317) 572-4002.

Wiley publishes in a variety of print and electronic formats and by print-on-demand. Some material included with standard print versions of this book may not be included in e-books or in print-on-demand. If this book refers to media such as a CD or DVD that is not included in the version you purchased, you may download this material at http://booksupport.wiley.com. For more information about Wiley products, visit www.wiley.com.

Library of Congress Cataloging-in-Publication Data:

Names: Lichtenfeld, Marc, author.

Title: You don't have to drive an Uber in retirement : how to maintain your lifestyle without getting a job or cutting corners / by Marc Lichtenfeld.

Description: Hoboken, New Jersey : John Wiley & Sons, Inc., [2017] | Includes index. |

Identifiers: LCCN 2017057205 (print) | LCCN 2017059020 (ebook) | ISBN 9781119347187 (pdf) | ISBN 9781119347163 (epub) | ISBN 9781119347149 (cloth)

Subjects: LCSH: Retirement income. | RetireesFinance, Personal. | Retirement.

Classification: LCC HG179 (ebook) | LCC HG179 .L4853 2017 (print) | DDC 332.024/014dc23

LC record available at https://lccn.loc.gov/2017057205

Cover Design: Wiley

Cover Image: ICHIRO/Getty Images

To Mom and Dad.

Thank you for your love, support, and for leading by example.

Foreword

By Mark Skousen

Editor, Forecasts & Strategies

An investment in knowledge pays the best interest.

Ben Franklin

Although I have not retired yet I'm still teaching economics, writing an investment newsletter, and speaking at conferences I'm concerned, like all of you, that my wife and I have enough to live on when and if we decide to retire.

I also just signed up for Social Security, so I'm glad to see that apparently I made the right choice, according to Marc Lichtenfeld. Among the many tips he provides in his excellent, comprehensive study, he suggests that if you wait until the optimal time, you'll get 8% more per year compared to what you'll get paid if you sign up at an earlier time. If you live to the average lifespan, you will be ahead by thousands. Moreover, retirees are active and living longer, so you will be even more ahead.

What is the key to successful retirement when defined as maintaining a fulfilling lifestyle in your mature years? Stay active and healthy, exercise, play sports, eat right, socialize a lot with family and friends, meet new friends, keep learning, do volunteer work, be involved in your community, run for office, attend church or other religious/spiritual activities, read books and newspapers, check your email, text your friends; but don't spend all your time watching TV, playing video games, or hitting a white ball around the green hills of America every day. Diversify!

That's quite a laundry list, but the whole idea is to keep your mind, body, and soul lively and engaged.

Despite the title, Lichtenfeld is not against working in retirement. He makes a point that you may want to have a part-time job, but it should be voluntary: You don't have to drive for Uber, but you may want to. Retirement can get boring fast if you don't have something engaging to do.

Lichtenfeld shows a variety of other ways to boost your income in retirement, beyond your pension and Social Security checks. You should have an investment account with a brokerage firm, including an individual retirement account (IRA) or 401k plan. He shows you how to increase your income by switching to high-quality companies that pay a high and rising dividend, what he calls Perpetual Dividend Raisers. I call it the SWAN strategy: Sleep Well at Night! Don't miss that section.

In fact, you may want to read another one of his books called Get Rich with Dividends. And you may want to subscribe to his newsletter, The Oxford Income Letter, to keep current and find new ways to invest.

He also writes about using put and call options in a conservative way to earn more monthly income. And that's not all: He gives you sound advice when being tempted to earn more money by loaning money to family members, lending funds to friends and neighbors, and buying tax liens.

Speaking of loaning money to relatives, I was once approached by a younger brother who wanted to borrow $5,000. Instead of loaning it to him directly, together we went to a local bank, where I deposited $5,000 into a bank CD; and then the bank loaned my brother the $5,000, with a lien on the CD. This strategy increased the chances that my brother would pay off the loan, because if he didn't, it would go on his credit rating. Guess what? He paid off the loan, early!

Next page