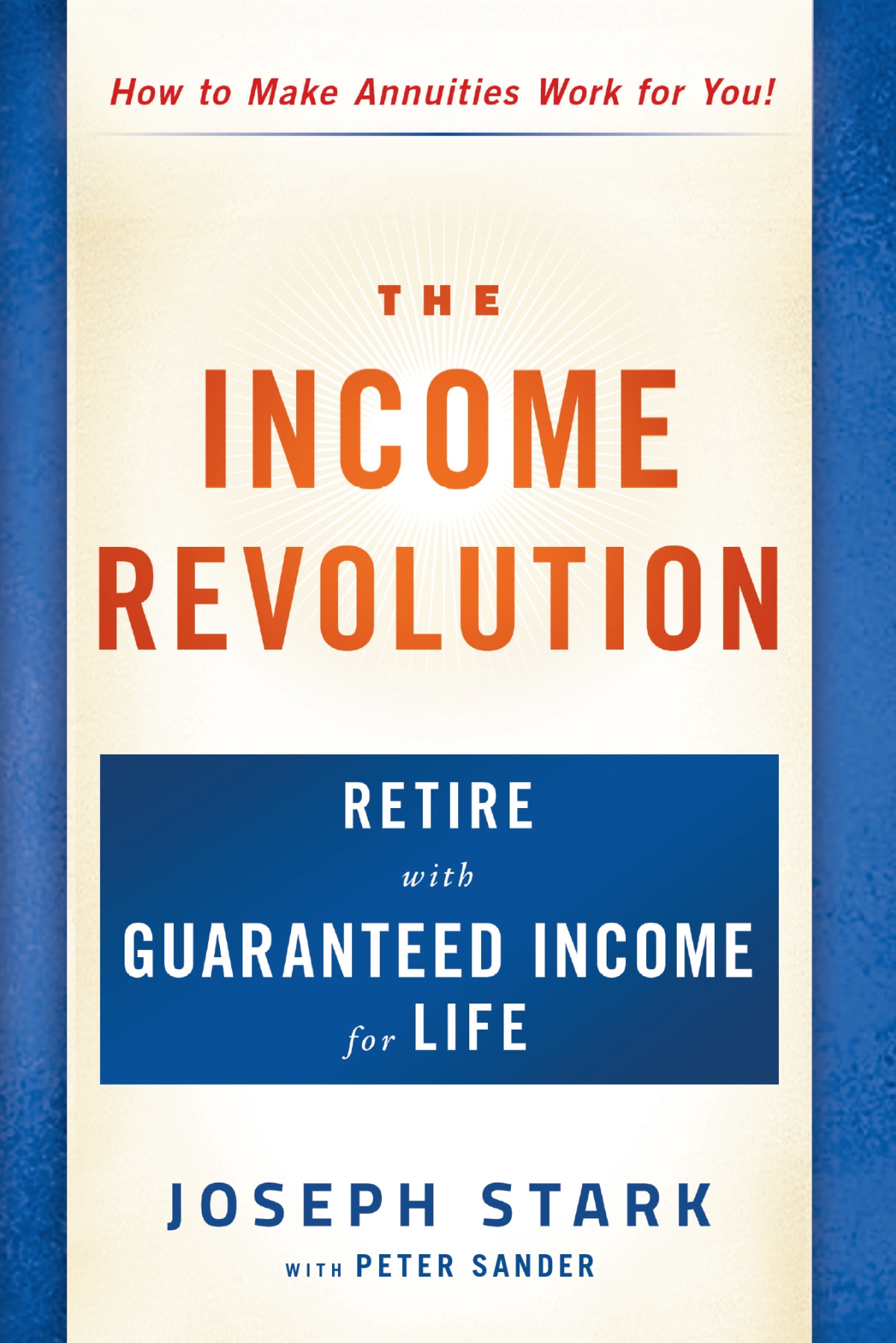

T HE I NCOME R EVOLUTION

J OSEPH S TARK

WITH P ETER S ANDER

Humanix Books

The Income Revolution

Copyright 2016 by Humanix Books

All rights reserved

Humanix Books, P.O. Box 20989, West Palm Beach, FL 33416, USA

Library of Congress Cataloging-in-Publication Data is available from the Library of Congress

No part of this book may be reproduced or transmitted in any form or by any means, electronic or mechanical, including photocopying, recording, or by any other information storage and retrieval system, without written permission from the publisher.

Cover Design: Paul McCarthy Design

Interior Design: Scribe Inc.

Humanix Books is a division of Humanix Publishing, LLC. Its trademark, consisting of the word Humanix, is registered in the Patent and Trademark Office and in other countries.

Disclaimer: Annuities are long-term insurance contracts designed for retirement. As a result, there may be fees or penalties for early withdrawals, including surrender charges, and if taken prior to age 59, withdrawals may be subject to a 10 percent federal additional tax.

We suggest that you consult with your financial adviser, tax adviser, or other financial professional before making any decisions that could impact your tax situation.

Annuity guarantees are backed by the financial strength and claims-paying ability of the issuing insurance company; they are not insured by the FDIC.

A fixed indexed annuity is not a registered security or stock market investment and does not directly participate in any stock or equity investments or index. The applicable index is a factor that in part determines the interest to be credited.

Creditor protection rules vary from state to state, and while IRA annuities are generally protected from creditors, nonqualified annuity contracts may or may not be protected. We do not provide legal advice and recommend that you consult your legal advisor for details on annuity creditor protection in your state.

ISBN: 978-1-63006-066-4 (Hardcover)

ISBN: 978-1-63006-067-1 (E-book)

CONTENTS

T he recent Great Recession was devastating.

During and in the aftermath of the 20089 Great Recession, we all witnessed a staggering percentage of American wealth vanish into thin air. Estimates by the US Treasury placed the losses in US household wealth somewhere in the 16 trillion dollar range.

These losses had devastating effects on families and retirees. Many people at or near retirement were forced to make life-altering decisions, including extending their working years (if work was available), downsizing their homes, and cutting back on their style of living.

More than ever before in my 30-year career in retirement income planning and the insurance industry, I realized that for those who dont have the amount of time necessary to recover from 37 percent losses or more (which is most of us), its essential to protect at least a certain amount of your assets.

This was something that I had always believed and preached. But watching it unfold before my eyes in a matter of months left an indelible impression and underscored the value of proper retirement income planning. An impression that lasts to this day.

Were Living Longer than Ever

Just 100 years ago, the human life expectancy was about 50 years. So you can see how, in those days, planning for income in retirement may not have been a top priority.

Things sure have changed. For a variety of reasons, including advances in health care and improving lifestyles, we are living longer than ever before.

Today we currently have 38 people living in the United States who are age 110 or older! By the end of this century, there will be 26 million of us (optimistically, Im including myself) age 100 or older walking the planet. In the near future, what was once an anomaly will become commonplace!

As Ill show later in , the trajectory of living longer is quite apparent upon examining a life-expectancy table. The upshot is that today, more than any time in history, locking in income that will last a lifetimeeven if you live to be 120should be a top priority for anyone serious about the quality of their retirement years. With the good news of longevity comes the responsibility of preparing for it.

Retirement: When It Works and When It Doesnt

Id like to share a tale of two couples.

Our first couple, Mr. and Mrs. Smith, are both within a year of retiring. Theyve worked hard and saved hard and have accumulated $500,000, part of which is in a company-sponsored 401(k) plan, and the rest is in a personal savings account. Outside of Social Security, they will rely on this sum to fund their retirement years.

As they considered their approaching retirement and how they would fund it, they became concerned about exposing all their retirement assets to the volatility of the market. While the market had had its ups and downs inside their 401(k) plan, over several decades in the aggregate, it had served them fairly well.

But now, faced with a short retirement horizon, they became concerned that they wouldnt have enough time to recover from a bad year in the market like they saw in 2008just before starting to rely on income from their nest egg. They scheduled meetings with their trusted legal and tax advisors as well as with an independent insurance professional.

In the end, the Smiths decided on a strategy that would protect much of their principal from market corrections. Protecting the purchasing power of their principal and keeping pace with inflation was also very important.

Finally, to address longevity risk, they wanted to be sure they had a protected monthly lifetime income stream in place. This income would supplement Social Security, help pay their fixed expenses, and last as long as they both lived. The Smiths purchased annuities with part of their retirement nest egg.

Our second couple, Mr. and Mrs. Martin, are very similar to the Smiths in that theyve accumulated $500,000 in their retirement accounts and personal savings. They, too, faced making decisions about how to allocate the money to generate income in order to supplement their Social Security.

The Martins decided on a mixture of financial vehicles that left the bulk of their assets exposed to market volatility. Their choices also overlooked the effects of longevity and longevity risk on their retirement assets if either of the two were to live beyond their average life expectancy.

If the Martins are fortunate, the market will be kind to them. If not, they may not have the number of years necessary to recover from a significant market correction. Whats more, drawing down on their assets for income in a down market could compound the problem.

In addition, with no lifetime income stream in place to address longevity risk, they could be faced with changes in lifestyle, downsizing their home, or going back to work (if work is possible, which it may not be at that point in their lives). The Martins approached retirement with no guarantees. That may workbut it may not.

The Income Revolution (and Why I Wrote the Book)

These days, a sound retirement income strategy takes into account a variety of risks and variables. While outside of death and taxes there are no absolute certainties, you can increase your odds of having the retirement years of your hopes and dreams. By recognizing and addressing the risks to your nest egg and consulting with the right professionals, you can be confident that youve built a rock-solid strategy.

Next page