Nichols Chris - The Successful Lenders Field Guide: Commercial Lending Strategies That Maximize Value For Both Bank and Borrower

Here you can read online Nichols Chris - The Successful Lenders Field Guide: Commercial Lending Strategies That Maximize Value For Both Bank and Borrower full text of the book (entire story) in english for free. Download pdf and epub, get meaning, cover and reviews about this ebook. year: 2017, genre: Business. Description of the work, (preface) as well as reviews are available. Best literature library LitArk.com created for fans of good reading and offers a wide selection of genres:

Romance novel

Science fiction

Adventure

Detective

Science

History

Home and family

Prose

Art

Politics

Computer

Non-fiction

Religion

Business

Children

Humor

Choose a favorite category and find really read worthwhile books. Enjoy immersion in the world of imagination, feel the emotions of the characters or learn something new for yourself, make an fascinating discovery.

- Book:The Successful Lenders Field Guide: Commercial Lending Strategies That Maximize Value For Both Bank and Borrower

- Author:

- Genre:

- Year:2017

- Rating:5 / 5

- Favourites:Add to favourites

- Your mark:

- 100

- 1

- 2

- 3

- 4

- 5

The Successful Lenders Field Guide: Commercial Lending Strategies That Maximize Value For Both Bank and Borrower: summary, description and annotation

We offer to read an annotation, description, summary or preface (depends on what the author of the book "The Successful Lenders Field Guide: Commercial Lending Strategies That Maximize Value For Both Bank and Borrower" wrote himself). If you haven't found the necessary information about the book — write in the comments, we will try to find it.

Nichols Chris: author's other books

Who wrote The Successful Lenders Field Guide: Commercial Lending Strategies That Maximize Value For Both Bank and Borrower? Find out the surname, the name of the author of the book and a list of all author's works by series.

The Successful Lenders Field Guide: Commercial Lending Strategies That Maximize Value For Both Bank and Borrower — read online for free the complete book (whole text) full work

Below is the text of the book, divided by pages. System saving the place of the last page read, allows you to conveniently read the book "The Successful Lenders Field Guide: Commercial Lending Strategies That Maximize Value For Both Bank and Borrower" online for free, without having to search again every time where you left off. Put a bookmark, and you can go to the page where you finished reading at any time.

Font size:

Interval:

Bookmark:

FIRST EDITION

THE SUCCESSFUL LENDERS FIELD GUIDE

CHRISNICHOLS, EDKOFMAN&RICKRUSO

2017 by Chris Nichols, Ed Kofman and Rick Ruso

All rights reserved. Except as permitted under the U.S. copyright act of 1976, no part of this publication may be reproduced, distributed, or transmitted in any form or by any means (electronic, mechanical, photocopying, recording or otherwise), or stored in a database or retrieval system, without the prior written permission of the copyright owners and the publisher.

Requests for permission should be directed to cnichols@centerstatebank.com or mailed to Chris Nichols at:

CenterState Bank

1660 Olympic Blvd., Suite 315

Walnut Creek, CA 94596

www.centerstatebank.com

Printed in the United States of America

First Edition: January 2017

ISBN: 978-0-9979109-0-2

Nichols, Chris

Kofman, Ed

Ruso, Rick

The Successful Lenders Field Guide

SPECIAL SALES

The Successful Lenders Field Guide is available at special discounts for bulk purchases, sales promotions, or premiums. Special editions including personalized covers, excerpts from existing books, and corporate imprints can be created in quantity for special needs.

For more information, contact Chris Nichols by emailing:

TABLE OF CONTENTS

PREAMBLE

This publication is designed to be a practical guide for lenders, providing best practices in relationship management, business development and commercial loan structuring to meet the needs of both the borrower and the bank.

The Field Guide is not intended to educate bankers on credit analysisrather, the authors have distilled best practices of the most successful banks and lenders, given their collective decades of experience consulting for hundreds of institutions nationwide. This book explores various options available to commercial lenders and places those options within the context of the prevailing competitive environment. After reading this book, lenders will have more tools in their arsenal and be better equipped to maximize value for their clients and their banks. The objective of the book is to educate and inform commercial lenders to allow them to be more successful in their careers.

The authors focus on the many pitfalls of lending and propose solutions intended to enhance relationship retention rates and drive profitability. For example, many bankers make the mistake of presenting only one loan option because that is the option they have traditionally presented. Other bankers present only the option requested by the borrower; however, many borrowers do not know the multitude of options available to them and may not know what is best for their financing needs. The strongest lenders serve as trusted financial advisors, presenting ideas and structures that complement each borrowers unique situation. By better understanding your borrower, the market and various lending strategies, loans can be structured to reduce risk and maximize value for all parties involved.

These practices have been culled, developed and tested through each authors commercial lending experience and have also been garnered through interviewing and observing some of the banking industrys top commercial lenders over the last ten years. These techniques are now available to you in this book.

Happy lending.

LENDING IN THE DIGITAL AGE

1-1. Four Ideas To Refine The Art Of Selling Bank Products

Most bank calling officers could do a better job of effectively selling bank products. This is not because most calling officers cant sell but because the art and science of selling bank products is rarely taught. When selling is taught, it is often taught without an understanding of bankings special set of needs, including regulatory compliance, the component of credit and the emotional content of dealing with the most private informationa persons or companys financial position. While it is helpful to understand some traditional selling techniques, marketing banking serviceswhich are often both intimate and intangibleis not the same as selling a widget, something that is easily understood. Selling credit or deposit services is clearly different. If you are a banker looking to build a steady stream of business, you should start by understanding the unique challenges that come with selling banking services.

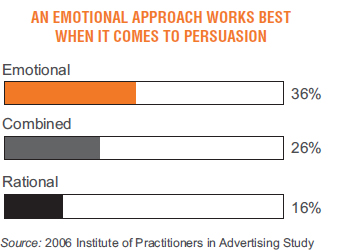

Idea Number One: The Emotional ApproachTell A Story

At the most basic level, too many bank business development officers fail by simply presenting the details of a bank product. Maybe it is the rate or the service, but many calling officers treat the process as checking the boxes and feel their job is just to go through the list of product characteristics. This is the difference between showing a bank product and selling a bank product. The reality is that good bank sales people dont sell as much as they guide. The strongest approach provides a planned path where the customer is led on a journey of self-discovery and gradual realization of needs.

The effective bank sales process starts with asking the proper questionsand listening!To understand the needs of your customers and uncover their goals, dreams, fears and pain points. Once gathered, bank calling officers must tell a story of how they can help.

The story can take many forms: a client who has been helped by the bank, a history of interest rates or a picture of what the future looks like because of the time or money you can save the prospect. Whatever approach you take, the goal is to string your logical sales points together in a tidy bundle with emotion woven throughout your story. To the extent you can work with visuals and leave behind or email material that reminds the prospect of the story, so much the better. Your prospect may not remember all the details of your financial product, but a good story illustrating the benefits will stick with a client for a long time.

Idea Number Two: The Why Of You

Bankers often make the mistake of talking to potential customers only in terms of what the bank can do for them. This typically leads to your banking services instantly becoming nothing more than a commodity. To the customer, your banks product suite sounds almost identical to every other banks product suite. To differentiate yourself, explain the WHY. For the most part, customers care less about what you do and more about how good you are at being you. That is, after you listen and learn about your potential customer, talk about the reason for your banks existence and the reason why you are in the banking business. The result will be much more memorable and much more meaningful.

Idea Number Three: The Role of Marketing And Advertising

Undoubtedly, personal connections are the largest factor driving sales in banking. However, the second biggest factor is you and your banks ability to establish a brand and market. If your bank wants more business, focus on the quality of your sales and marketing plan. If your bank has a haphazard and disjointed plan that includes placing a few ads, sponsoring a few events, sending a few statement stuffers and distributing a few brochures, no wonder you want more business.

With the current state of digital marketing, any bank can obtain a very positive return on marketing investment within two years of implementation as it tries various strategies and figures out what works best in its unique market.

Idea Number Four: Your Biggest Challenge

If you are losing business, probably that is not because of your competition but more likely because of your prospects indecision. We call this selling against a ghost, because most bank calling officers are unaware of what they are up against. The hurdle typically isnt the bank down the street. Instead, too many bank calling officers only stick to the status quo, failing to seek out new market information and to create new value for their customers. For the potential customer, doing nothing is much easier than completing loan applications or transferring deposit accounts. For the banker, competing against the unknown is a vague and frustrating proposition.

Next pageFont size:

Interval:

Bookmark:

Similar books «The Successful Lenders Field Guide: Commercial Lending Strategies That Maximize Value For Both Bank and Borrower»

Look at similar books to The Successful Lenders Field Guide: Commercial Lending Strategies That Maximize Value For Both Bank and Borrower. We have selected literature similar in name and meaning in the hope of providing readers with more options to find new, interesting, not yet read works.

Discussion, reviews of the book The Successful Lenders Field Guide: Commercial Lending Strategies That Maximize Value For Both Bank and Borrower and just readers' own opinions. Leave your comments, write what you think about the work, its meaning or the main characters. Specify what exactly you liked and what you didn't like, and why you think so.