Anna Michael - Risk Weighted Assets: Basel III (Banking Simplified Book 1)

Here you can read online Anna Michael - Risk Weighted Assets: Basel III (Banking Simplified Book 1) full text of the book (entire story) in english for free. Download pdf and epub, get meaning, cover and reviews about this ebook. year: 2019, genre: Business. Description of the work, (preface) as well as reviews are available. Best literature library LitArk.com created for fans of good reading and offers a wide selection of genres:

Romance novel

Science fiction

Adventure

Detective

Science

History

Home and family

Prose

Art

Politics

Computer

Non-fiction

Religion

Business

Children

Humor

Choose a favorite category and find really read worthwhile books. Enjoy immersion in the world of imagination, feel the emotions of the characters or learn something new for yourself, make an fascinating discovery.

- Book:Risk Weighted Assets: Basel III (Banking Simplified Book 1)

- Author:

- Genre:

- Year:2019

- Rating:3 / 5

- Favourites:Add to favourites

- Your mark:

- 60

- 1

- 2

- 3

- 4

- 5

Risk Weighted Assets: Basel III (Banking Simplified Book 1): summary, description and annotation

We offer to read an annotation, description, summary or preface (depends on what the author of the book "Risk Weighted Assets: Basel III (Banking Simplified Book 1)" wrote himself). If you haven't found the necessary information about the book — write in the comments, we will try to find it.

Anna Michael: author's other books

Who wrote Risk Weighted Assets: Basel III (Banking Simplified Book 1)? Find out the surname, the name of the author of the book and a list of all author's works by series.

Risk Weighted Assets: Basel III (Banking Simplified Book 1) — read online for free the complete book (whole text) full work

Below is the text of the book, divided by pages. System saving the place of the last page read, allows you to conveniently read the book "Risk Weighted Assets: Basel III (Banking Simplified Book 1)" online for free, without having to search again every time where you left off. Put a bookmark, and you can go to the page where you finished reading at any time.

Font size:

Interval:

Bookmark:

Risk weighted assets is the foundation for assessing the risk of unexpected losses of deposit taking financial institutions. As that sentence may have been hard to understand read it again after finishing the book.

This book provides a simple explanation for Risk Weighted Assets for novice bankers as well as bankers who are moving into the Risk domain of a financial institution. It is also relevant for any business having exposure to risk, especially credit risk.

Risk-weighted assets are arrived at from different risk perspectives. These are credit risk, interest rate risk, market risk and operational risk. The methodology used is primarily credit risk driven. The methodology is then extended to arrive at a similar dollar value for interest rate, market and operational risk.

Credit risk can lead to expected loss and unexpected loss. Expected loss is covered by loan-loss provisions and unexpected loss by equity arrived at by risk-weighting assets. Considering risk-weighted assets look at residual risk it is important to understand loan loss provisioning before we get into risk-weighted assets. In case you already understand loan-loss provisioning you can go straight to the chapter on credit risk weighted assets.

To understand expected risk and provisioning for expected losses we will go into the inputs required for Loan Loss Provision, namely Customer Credit Rating , Exposure Amount and Collateral Quality . We will also briefly discuss the changes introduced in IFRS 9.

Once an understanding of expected loss is gained we will look at the risk of unexpected losses inherent in Credit assets and the assessment using the Risk Weighted Assets method as prescribed by Basel III.

Following this we will expand Credit RWA to Interest Rate, Market and Operational Risk.

The key topics covered are as follows:

- Expected Loss and Loan Loss Provisions

- Credit Risk & CRWA

- Standardized and Advanced Approaches

- Interest Rate Risk & IRRWA

- Market Risk & MRWA

- Operational Risk & ORWA

- Summary

Credit Risk is the risk of not receiving an amount due to us because of a counterpartys lack of willingness or ability to pay the same. For example, if a loan is given to a corporate, how do you quantify the risk of not getting the principal and interest due to the bank. We say we have an exposure to Credit Risk. Just as exposure to the sun leads us to a risk of cancer, lending leaves us exposed to credit risk the risk of not getting our money back.

As a banks main business is lending, credit risk primarily includes risk of non-payment of principal and interest.

Credit Risk is quantified by calculating the average of losses seen historically on a loan with similar characteristics. This average is the Expected Loss and is calculated on an exposure over a specific period of time. In this chapter we will consider the Expected Loss over a 1-year horizon unless stated otherwise.

There are 3 drivers to Expected Loss. The first one is the willingness and ability of the borrower to pay the dues or the credit quality of the borrower. The credit quality of the borrower is assessed from the financials of the borrower and loan repayment history. This will tell you about the ability and willingness of a borrower to make his interest and principal repayments. The credit quality of the borrower gives you a view into the probability of a borrower defaulting on his loan. This is referred to as the Probability of Default (PD) . Each borrower is assigned a Credit Rating in accordance with the PD band that he falls into. The goal of Credit Assessment of a customer is to assign a Credit Rating to the customer aligned to Probability of Default.

Credit assessments are a topic in itself and will not be dealt with here.

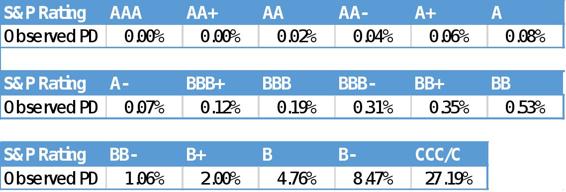

Below is shown a sample from S&P ratings and observed average default rates as of 28 th Dec 2017 :

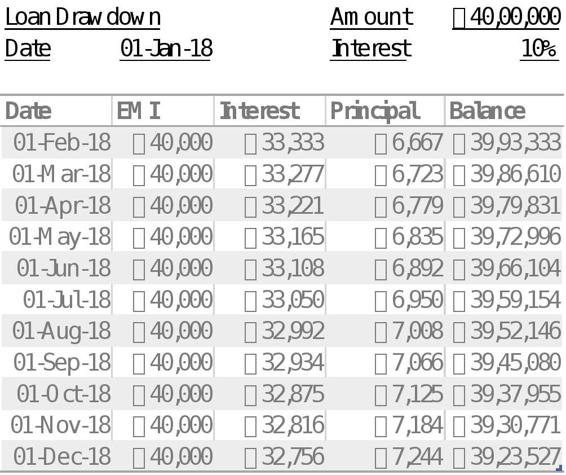

The second driver for Expected Loss is the Exposure at Default . This is the amount due to us at the time of default. One option for EAD could be to take the current loan outstanding amount. But we know the amount due to us can change between now and when the default happens. Let us take a simplified example to aid our understanding. A borrower has taken a loan of Rs 40 lacs. He is paying a monthly instalment of Rs 40,000 which includes interest at 10% p.a. Below is a table that shows the loan outstanding amount across the year.

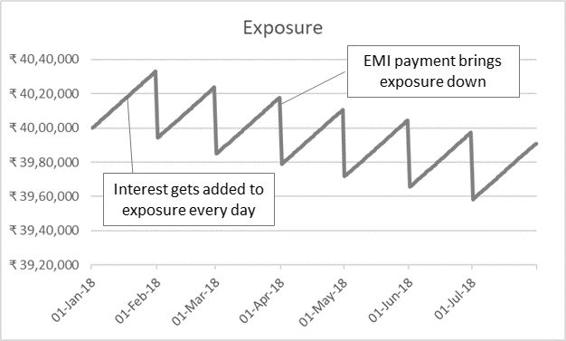

So yes, even if the loan amount today is 40 lacs, over the course of the next 1 year the outstanding loan amount will go down as the monthly payments are made. So, can we take the average of the daily outstanding loan amount?

Lets consider the date 1 st Feb 2018 before the EMI is paid. The borrower owes us the full 40 lacs as well the interest due for the first month which is Rs. 33,333. So, if he defaults on 1 st Feb 2018 the Exposure at Default would be 40,33,333. Therefore, the daily exposure amount should include the interest accrued or due upto that date. We would also need to consider any fees that could come due. The EAD could thus be calculated as the average of the daily exposures.

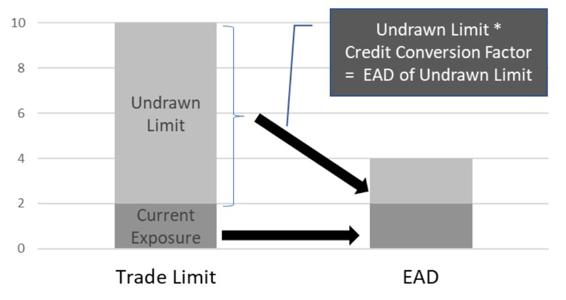

Exposure at Default (EAD) is estimated basis the specific characteristics of each asset class. What happens in the case of a Trade Limit of 10 lacs set up for a manufacturing company? Lets say currently the customer has drawn down an amount of 2 lacs. In that case should EAD be 2 lacs, the current exposure? But tomorrow the customer may drawdown up to 10 lacs or bring the balance down to zero. As seen in the last example EAD depends on the average of expected daily exposures over a period of 1 year. It seems logical to say that the current exposure of 2lacs has to be taken as well as a percentage of the undrawn amount. And thats exactly how EAD is calculated - the current drawn down amount plus a percentage of the undrawn limit.

The percentage is arrived at by analysing data for similar asset given to customers in that industry. The percentage applied to the undrawn limit is called the Credit Conversion Factor and lets you arrive at the required EAD.

There are other off-balance sheet instruments, as well, like guarantees where credit conversion factor is used.

In the last section we came to an understanding of Exposure at Default. So, if the customer defaults, is our Expected Loss equal to the Exposure at Default? Well, it depends on what mitigants you have put in place for such a scenario. First lets take the case of a Home Loan of 40 lacs. You would have taken the house as collateral . Hence you can sell the house in case of a default and recover some of the amounts due to you. You may expect to be able to recover 100% of the value considering your loan amount of 40 lacs is only 80% of the value of the house which was 50 lacs at the time of giving out the loan.

Font size:

Interval:

Bookmark:

Similar books «Risk Weighted Assets: Basel III (Banking Simplified Book 1)»

Look at similar books to Risk Weighted Assets: Basel III (Banking Simplified Book 1). We have selected literature similar in name and meaning in the hope of providing readers with more options to find new, interesting, not yet read works.

Discussion, reviews of the book Risk Weighted Assets: Basel III (Banking Simplified Book 1) and just readers' own opinions. Leave your comments, write what you think about the work, its meaning or the main characters. Specify what exactly you liked and what you didn't like, and why you think so.