Rick Nason - Small Business Finance and Valuation

Here you can read online Rick Nason - Small Business Finance and Valuation full text of the book (entire story) in english for free. Download pdf and epub, get meaning, cover and reviews about this ebook. year: 2021, genre: Business. Description of the work, (preface) as well as reviews are available. Best literature library LitArk.com created for fans of good reading and offers a wide selection of genres:

Romance novel

Science fiction

Adventure

Detective

Science

History

Home and family

Prose

Art

Politics

Computer

Non-fiction

Religion

Business

Children

Humor

Choose a favorite category and find really read worthwhile books. Enjoy immersion in the world of imagination, feel the emotions of the characters or learn something new for yourself, make an fascinating discovery.

- Book:Small Business Finance and Valuation

- Author:

- Genre:

- Year:2021

- Rating:4 / 5

- Favourites:Add to favourites

- Your mark:

- 80

- 1

- 2

- 3

- 4

- 5

Small Business Finance and Valuation: summary, description and annotation

We offer to read an annotation, description, summary or preface (depends on what the author of the book "Small Business Finance and Valuation" wrote himself). If you haven't found the necessary information about the book — write in the comments, we will try to find it.

Rick Nason: author's other books

Who wrote Small Business Finance and Valuation? Find out the surname, the name of the author of the book and a list of all author's works by series.

Small Business Finance and Valuation — read online for free the complete book (whole text) full work

Below is the text of the book, divided by pages. System saving the place of the last page read, allows you to conveniently read the book "Small Business Finance and Valuation" online for free, without having to search again every time where you left off. Put a bookmark, and you can go to the page where you finished reading at any time.

Font size:

Interval:

Bookmark:

Small Business Finance

Small Business Finance

Rick Nason, PhD, CFA

Dan Nordqvist, CPA, CMA, MBA, MSc

Small Business Finance

Copyright Business Expert Press, LLC, 2021.

All rights reserved. No part of this publication may be reproduced, stored in a retrieval system, or transmitted in any form or by any meanselectronic, mechanical, photocopy, recording, or any other except for brief quotations, not to exceed 250 words, without the prior permission of the publisher.

First published in 2021 by

Business Expert Press, LLC

222 East 46th Street, New York, NY 10017

www.businessexpertpress.com

ISBN-13: 978-1-95253-812-4 (paperback)

ISBN-13: 978-1-95253-813-1 (e-book)

Business Expert Press Finance and Financial Management Collection

Collection ISSN: 2331-0049 (print)

Collection ISSN: 2331-0057 (electronic)

Cover image licensed by Ingram Image, StockPhotoSecrets.com

Cover and interior design by S4Carlisle Publishing Services Private Ltd., Chennai, India

First edition: 2021

10 9 8 7 6 5 4 3 2 1

Printed in the United States of America.

Abstract

According to the U.S. Small Business Administration, over 99 percent of businesses are small or medium size yet the majority of books are focused on large corporations. This book aims to close that gap and also focus on the practitionersthe entrepreneurs, small business owners, consultantsand students aspiring to practice in this space.

Small businesses are the growth engine of the economy and it is important that we provide them with the tools for success. This book covers the financial aspects of a business, including those that are important to start, grow, and sustain an enterprise. We accomplish this by providing concepts, tools, and techniques that are important for the practitioner. The overall aim is to provide this information in straightforward way while also providing the depth required for areas that warrant it.

Keywords

small business finance; entrepreneurial finance; financial statements; discounted cash flow; time value of money; financial management; financing; capital budgeting; working capital management; risk management; business valuations; pricing; venture capital

Brief Contents

Acknowledgments

Over the years we have had the opportunity to collaborate with some amazing individuals and businesses who work tirelessly in the small business space. They are the backbone of our economy and this book is dedicated to them.

We want to thank our respective families for their patience as we have spent many hours away from them to make this book a reality.

CHAPTER 1

The Small Business Difference

Small businesses, whether they be sole proprietors, partnerships, family businesses, entrepreneurial ventures, or an innovator trying to challenge the current business status quo, all play an important part in the economy. Although it is the giant multinational corporations that seem to be the focus of attention, it is small businesses that drive the global economy.

There is a romantic sentiment to small businesses. The oft-repeated story of the origins of the giant Apple that started out as three friends starting out in their garage to create one of the worlds greatest and most innovative companies. Before that there was Henry Ford, working away as a sole proprietor trying to create a car for the masses. In virtually every industry, the story gets repeated of a business owner starting with limited resources but unlimited dreams to create a business that became a household name for generations.

The reality is however that most small businesses remain small. They may remain small for a variety of reasons, including lack of scope or scalability, lack of ambition or vision of the founders to expand beyond their existing base, contentedness of owners with current scope of operations, insufficient financing, being limited by competitive businesses, and lack of skill to exploit an opportunity.

This book is written explicitly for the small business owner and operator or those who desire to create and start their own small business. Small businesses obviously share many traits with their more notable big cousins, the publicly traded company or the large privately owned firm. However, small businesses also have many separate operating principles that are quite distinct from those of their larger relatives. This is especially so in the area of financial management.

These numbers attest that the cumulative importance of small businesses on the national economy is indeed very significant. The chapter continues to examine what makes small businesses special when it comes to the financial management of the business. Small businesses have more than just size to differentiate them. Their mode of operations is also a significant differentiating factor, and the differentiating financial factors are the reason for this book.

The Small Business Market

For our purposes, a small business is one that does not have publicly traded financial assets, such as stock or bonds, nor does it have institutionalized and syndicated bank loans. Although this still leaves the possibility of some very large private firms, our focus is on firms that have assets ranging from zero up to approximately five million dollars. Definitions for what constitutes a small business tend to vary widely by country or even by region. We are not going to concern ourselves with an exact definition but leave it up to the common sense and intuition of the reader.

A small business could consist of a single proprietor operating out of the basement of their home or an operation with over 100 employees with one or more manufacturing facilities. It could be a partnership providing professional services, an entrepreneur developing a new medical device or app, a seasoned professional who retired earlier to earn from their expertise as a consultant, an artist selling their art on the Internet, or a family business that has been in continuous operation for over a 100 years.

Small businesses exist in every industry and provide or produce every conceivable type of product or service. While most are highly specialized in what they do, some may offer a portfolio of services. What is unique about small businesses is that they are operated for the purposes and benefits of their owner and operators, rather than for the somewhat impersonal legal entity that constitutes the large corporation.

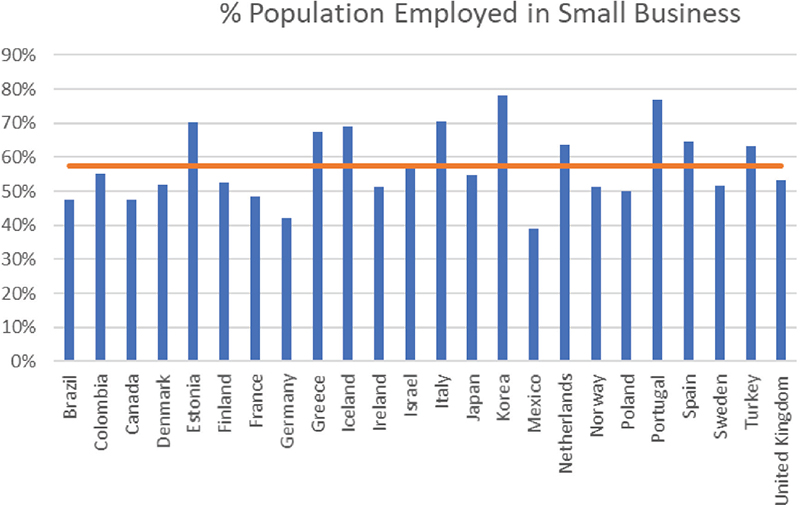

Small businesses are a very significant part of the economy, not just in North America but around the world. shows how critical small businesses are to employment around the globe.

Figure 1.1 Small business employment

The First Small Business Difference: Business Objectives

Small businesses differ in many ways from large corporations. These differences are what make small businesses so attractive to so many investors and entrepreneurs who wish to develop their own small business rather than work in a probably more stable and less risky large corporation. As previously mentioned, small businesses are run for the benefit of their owners and operators, rather than for the financial stakeholders, which is the case for larger corporations.

This is accomplished by maximizing the return on investment for the risk involved in the investments. Maximize shareholder wealth is a central tenet, if not the central tenet, of corporate finance. Conversely, maximize shareholder wealth is frequently not the central tenet of a small business.

Font size:

Interval:

Bookmark:

Similar books «Small Business Finance and Valuation»

Look at similar books to Small Business Finance and Valuation. We have selected literature similar in name and meaning in the hope of providing readers with more options to find new, interesting, not yet read works.

Discussion, reviews of the book Small Business Finance and Valuation and just readers' own opinions. Leave your comments, write what you think about the work, its meaning or the main characters. Specify what exactly you liked and what you didn't like, and why you think so.