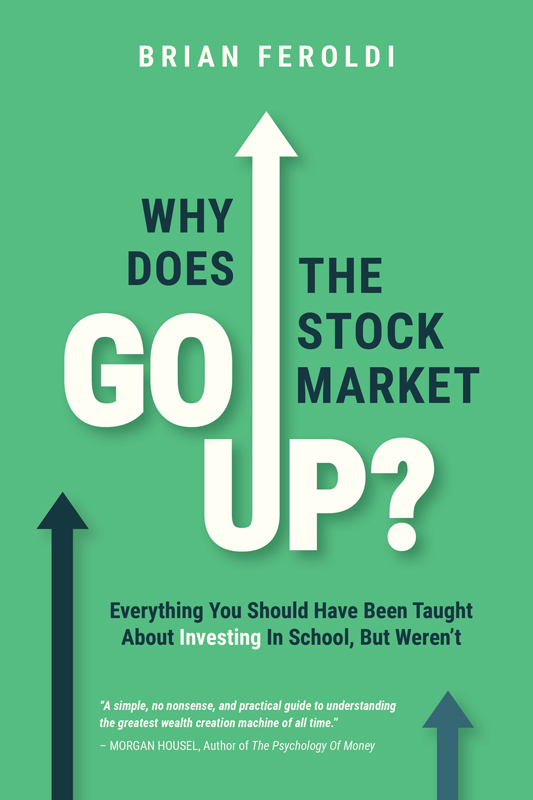

Copyright 2021 by Brian Feroldi. All rights reserved.

No part of this publication may be reproduced, distributed, or transmitted in any form or by any means, including photocopying, recording, or other electronic or mechanical methods, without the prior writer permission of the publisher, except in the case of brief quotations embodied in critical reviews and certain other noncommercial uses permitted by copyright law. For permission, write to the publisher, addressed Attention: Permission Coordinator, at the address below.

ISBN:

978-1-7350661-6-5 (Paperback)

978-1-7350661-7-2 (Hardcover)

978-1-7350661-5-8 (eBook)

Library of Congress Control Number: 2021947458

All content reflects our opinion at a given time and can change as time progresses. All information should be taken as an opinion and should not be misconstrued for professional or legal advice. The contents of this book are informational in nature and are not legal or tax advice, and the authors and publishers are not engaged in the provision of legal, tax, or any other advice.

Front cover image and book design by Giada Mannino

Printed by Choose FI Media, Inc., in the United States of America.

First printing edition 2021.

Choose FI Media, Inc.

P.O. Box 3982

Glen Allen, VA 23058

www.choosefi.com

Twitter Direct Messages: @choosefi

ATTENTION: Quantity discounts are available to your company, educational institution, or writing organization for reselling, educational purposes, subscription incentives, gifts, or fundraiser campaigns.

Email:

Twitter: @brianferoldi

YouTube: /brianferoldiyt

LinkedIn: /in/brianferoldi/

Instagram: @brianferoldi

Web: brianferoldi.com

DEDICATION

This book is dedicated to everyone that uses their free time to enhance their financial knowledge.

In other words, this book is dedicated to you.

GIVEAWAY

Thank you so much for buying this book. It means a lot to me.

As a special thank you for your purchase, please visit brianferoldi.com/thankyou to receive:

1.A full list of recommended free tools that can help you invest

2.A bonus chapter where I discuss my biggest investing mistakes of all time

3.A bonus interview where I talk with Brad Barrett and Jonathan Mendonsa of the ChooseFI podcast about the key concepts discussed in this book

TABLE OF CONTENTS

INTRODUCTION

I worked as a golf caddy in high school.

During a round, one of the golfers stopped at the clubhouse. When he returned, he told his fellow golfers Youre not going to believe this, but the Dow Jones is up 300 points today!

The other golfers replied with Youre kidding!, Wow!, and Thats amazing! They all seemed to be pleasantly surprised with this news.

Me? I was confused.

I had heard the term Dow Jones before, but I had no clue what it meant. I knew it had something to do with the stock market. I also knew that it was good news when it went up.

Beyond that, I was clueless.

I know that my experience is not unique. Many people hear about the stock markets daily moves in the news. And yet, most of us have no clue what any of it means.

Most people cant even answer basic questions like:

What is a stock?

What is the Dow Jones Industrial Average?

Why does the stock market go up and down?

Thats a tragedy, because the stock market is the greatest wealth creation machine of all time . It has helped millions of ordinary people to build wealth and reach their financial goals.

Whats more, most Americans have money in the stock market, even if they dont realize it . Tens of millions of Americans need the stock market to rise in order to fund their retirement, buy a house, pay for college, or achieve some other financial dream.

I am one of those weird people that is naturally interested in the stock market. That has led me to consume every bit of financial content that I could get my hands on over the last 20 years.

Ive read hundreds of books about investing. Ive listened to thousands of podcast episodes about money. Ive spent countless hours on message boards that discuss the nitty gritty details of the stock market.

That thirst for knowledge allowed me to answer all of the questions that I had about the stock market when I was a beginner.

And yet, during those decades of learning, Ive never come across a book that did a great job of answering the most important question that I had about the stock market:

Why does the stock market go up?

You cant invest with confidence if you dont know the answer to that question.

If you dont understand why the stock market goes up, then you wont know why it crashes sometimes or why it has always bounced back.

That missing answer is the reason why the book you are holding exists.

The mission of this book is to demystify the stock market. My aim is to explain how the stock market works in simple terms so that everyone can invest with confidence.

In other words, this is the book that I wish I had when I first started investing 20 years ago.

How To Use This Book

This book was designed to make it as easy as possible for anyone to understand the most important concepts about the stock market. Each short chapter answers one important question about the stock market and investing.

are designed to take you through a journey of discovery and understanding. Well regularly reference a made-up business called Best Coffee Company as an example. It is best to read these parts sequentially.

The last section of the book is titled Common Questions - Answered. This is a compilation of the most common questions that I have heard from new investors over the years. Please read these in any order that you wish, or simply use the section as a reference guide.

Once you are done with the book, keep it on your nightstand, bookshelf, or coffee table so that you can go back and review any of these chapters as you start to invest.

CHAPTER 1

WHY SHOULD I CARE ABOUT THE STOCK MARKET?

Most people do not care about the stock market. Its not hard to figure out why.

The stock market appears to move up and down randomly. It doesnt seem to be linked to whats happening in the real world at all.

The media only tends to make a big deal out of the stock market when it crashes, like it did most recently in 2000, 2008, and 2020.

The movie industry hasnt helped, either. Popular movies like The Big Short, Margin Call, Boiler Room , and The Wolf of Wall Street all make the stock market seem like a big gambling machine.

Ive heard people say things like:

The stock market is rigged.

Wall Street rips off Main Street.

The stock market is just a playground for the wealthy.

Thats a shame, because the truth is that the stock market is the greatest wealth creation machine of all time.

Let me repeat that: The stock market is the greatest wealth creation machine of all time .

The stock market has enabled millions of ordinary people to build wealth and achieve their financial goals.

To show how, well look at one example of how the stock market can help an average person realize their financial goals.

Lets say a fictitious person named Aaron started his career in 1981, which is the same year that 401(k)s were created. His starting salary was $26,000, which was just under the average family income in the U.S. at the time.

Aaron was OK with money, but he wasnt great. He lived paycheck-to-paycheck, but he always paid off his debt on time.

Thankfully, Aaron made one great financial decision. When he started his career, he put $400 per month into his companys 401(k). He invested it all in funds that grew at the same rate as the overall United States stock market.