John Boik - Monster Stock Lessons: 2020-2021

Here you can read online John Boik - Monster Stock Lessons: 2020-2021 full text of the book (entire story) in english for free. Download pdf and epub, get meaning, cover and reviews about this ebook. year: 2022, genre: Business. Description of the work, (preface) as well as reviews are available. Best literature library LitArk.com created for fans of good reading and offers a wide selection of genres:

Romance novel

Science fiction

Adventure

Detective

Science

History

Home and family

Prose

Art

Politics

Computer

Non-fiction

Religion

Business

Children

Humor

Choose a favorite category and find really read worthwhile books. Enjoy immersion in the world of imagination, feel the emotions of the characters or learn something new for yourself, make an fascinating discovery.

Monster Stock Lessons: 2020-2021: summary, description and annotation

We offer to read an annotation, description, summary or preface (depends on what the author of the book "Monster Stock Lessons: 2020-2021" wrote himself). If you haven't found the necessary information about the book — write in the comments, we will try to find it.

Monster Stock Lessons: 2020-2021 — read online for free the complete book (whole text) full work

Below is the text of the book, divided by pages. System saving the place of the last page read, allows you to conveniently read the book "Monster Stock Lessons: 2020-2021" online for free, without having to search again every time where you left off. Put a bookmark, and you can go to the page where you finished reading at any time.

Font size:

Interval:

Bookmark:

2022 by John Boik

All rights reserved. This book or any portion thereof may not be reproduced or used in any manner whatsoever without the express written permission of the publisher except for the use of brief quotations in a book review.

This text contains trademarks, service marks, or registered trademarks of StockMaster. Investors Business Daily and IBD are trademarks of Investors Business Daily, LLC.

This publication is designed to provide accurate and authoritative information in regard to the subject matter covered. It is sold with the understanding that the author is not engaged in rendering legal, accounting, futures/securities trading, or other professional investment advice services. This publication is for educational and research purposes only.

Monster Stock Lessons will walk you through the years of 2020 and 2021 in the stock market and analyze many of the leading stocks that reached monster stock status. Just to clarify, that was defined in Monster Stocks as follows:

A stock that at least doubles in price in a short time frame. A short time frame in the stock market, as far as history with monster stocks is concerned, usually lasts between 4 and 18 months. Most will land somewhere in the middle of that range as the meatiest part of a fast-advancing monster stock usually occurs between 6 and 12 months of its major move. And many of the truly giant monster stocks will triple, quadruple, or even move up a thousand percent or more in those short time frames.

The year 2020 produced many strong leading stocks after Q1, which had produced a steep bear market (defined as a decline of 20% or more from its recent highs) in one of the shortest periods of time in stock market history. But coming off that quick bear market was a handful of market leaders that drove the market higher through the remainder of 2020 and into 2021. That is why you should never give up on the market when it correctsyou will miss out on some of the best opportunities when the market turns up. For those who did give up near the end of Q1 in 2020, they certainly missed out on some great opportunities when dozens of stocks reached top-notch status in a short period of time. But many of the biggest leaders that became monster winners in 2020 didnt continue leading in 2021, even though the market kept its uptrend intact. You will see why it is critical to adhere to selling rules when they present themselves. You dont want to give back most of the profits you attained on the way up. We will analyze how and why that occurred so the lessons learned can be remembered in future market cycles. But while some leaders gave up their leading stock status from the prior year, there were others that thrived in 2021, during a somewhat choppy uptrend. We will see how the market generated new leaders as sector rotation was more commonplace in 2021 than in 2020.

Studying history in the market helps us understand how cyclical trends work and how new opportunities occur while also giving clues as to how leading stocks top and begin downtrends. And continuing uptrends always produce new leaders that take off and lead. One thing to note when analyzing these two yearsthe monster stock status, measuring a stock thats doubled or more in one year, will be looked at on a calendar basis. Im only doing it that way so you can see some leaders that doubled in a calendar year and how many times those opportunities arose. Of course, many leading stocks will double over time frames that cross over yearly calendar dates. But seeing it on the yearly calendar basis gives one a look into how many leaders are produced that way and how they provided big gains. And it only takes a few monster stocks a year, if handled correctly, to produce index beating returns, as you will soon see. You will never get the full move of a monster stock, and you never get them all. Your objective should be to recognize which stocks show the characteristics of past winners and trade them within their uptrend moves to garner a portion of the profits they offer on their incredible runs.

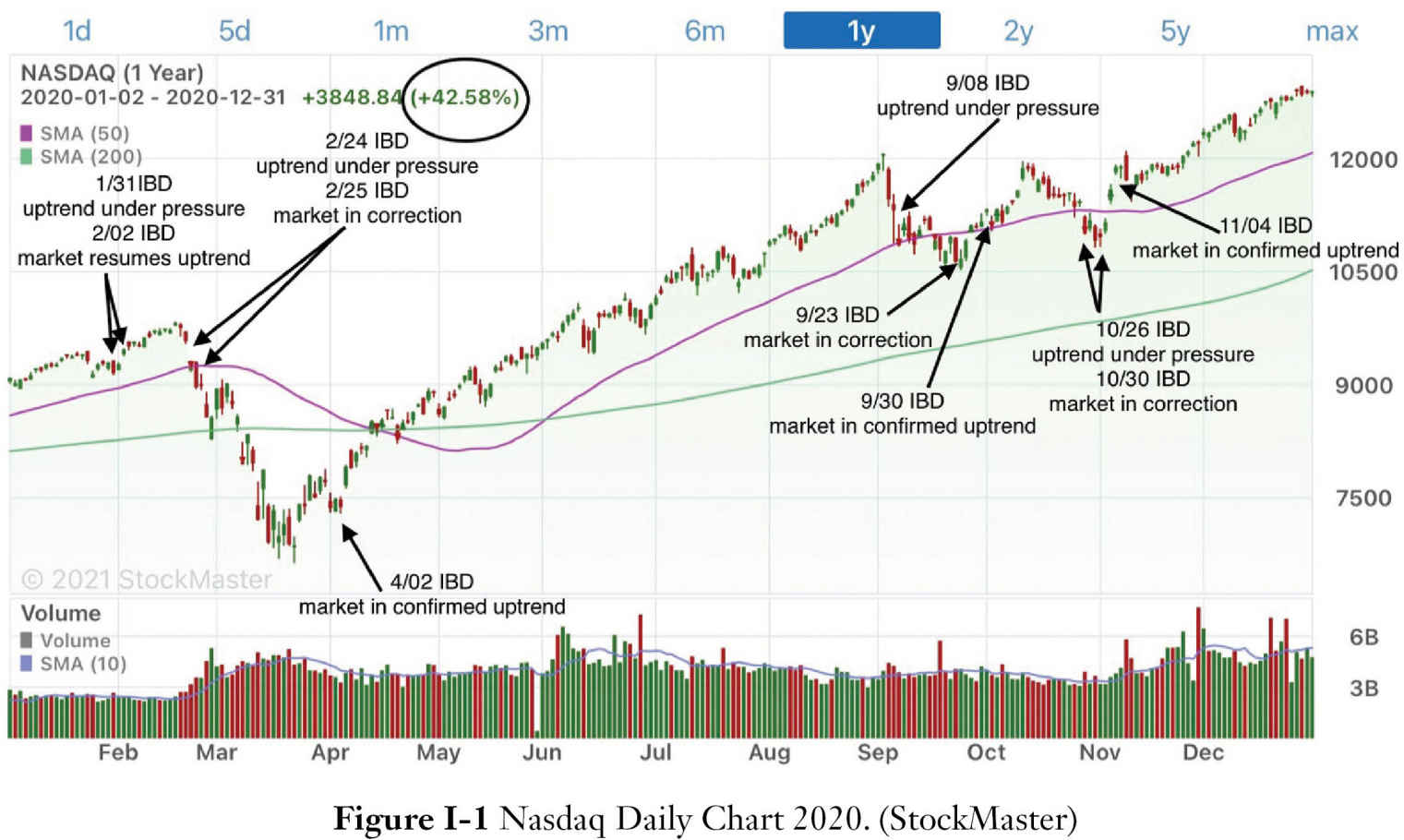

In analyzing the years of 2020 and 2021, I will provide you with several guideposts used to gauge the action of the market in general and the leading stocks. The main source of information Ive used is Investors Business Daily ( IBD ). Their decades of experience in analyzing the markets health day-to-day is invaluable. Figure I-1 shows the Nasdaq chart where IBD made market interpretation change calls during 2020 as the health of the market changed (confirmed uptrend, uptrend under pressure, market in correction, and uptrend resumes). These calls occur as the market changes and most stocks typically will follow the market. There were three instances in 2020 where IBD classified the market as market in correction. The first was near the end of February when heavy selling was starting to hit the market due to COVID-19 concerns. That was the start of the sharp but short bear market. There were two othersone at the end of September and one near the end of October. Both of those pullbacks in the market were short lived, and soon the market regained its upward momentum. The strong uninterrupted uptrend from April through August was where most of the best stock gains occurred. The last two months of the year were also very strong for leading stocks.

One of the other guideposts I use to check the overall health of the market is the net differential between 52-week new highs and new lows. There are many secondary market indicators out there, maybe too many. Some are good, some not so much. After years of research, the one I found that provides a guidepost to the market averages with consistent reliability is the ratio of 52-week new highs to new lows. I call the differential between the two the High Low Gauge or H/L/G. I track it every day and compare it to what the overall market averages are doing. Its important to point out that this is still a secondary indicator. Nothing beats daily observations of the price and overall volume action in the main market indexes along with the stocks that are leading an advance or coming under selling pressure during a decline. But the H/L/G has a solid history of matching or leading market action. If you think about it, it makes sense. You cant have a strong uptrending market without more stocks making new highs than those making new lows and vice versa. And there are different stages and degrees of market uptrends and downtrends. Some may be stronger or weaker than others. Some are choppy and much more difficult to maneuver through. Many times, the level or trend of positive and/or negative days or weeks in a row of the H/L/G helps determine the level of health of the overall market. There certainly are trends to it and levels of excessiveness and weakness within it have matched up to the action of the market with surprising accuracy. I wont go into all the details of those in this book. Dr. Alexander Elders book (see below) describes many of those levels.

Im not the first person to see this correlation by any means. The ratio has been around for decades and is used by many stock research firms regularly. Gilbert Haller wrote a book in 1965 called The Haller Theory of Stock Market Trends. His extensive study of the markets focused on the importance of the ratio of new highs to new lows. He states that he quickly charted a NH-NL Index covering several years, and found that it was indeed an important factor in measuring technical market strength or weakness. Figure I-2 is from his book. He calculated his ratio on a weekly basis. The year 1960 was mostly a down year for the market, with several large whipsawing trends in the middle of that year. You can see how his NH-NL Index correlated with that trend. The year 1961 produced a very strong uptrend through most of May and then the market corrected hard starting in late May, which lasted through late July. A strong bounce then led to choppy trading until December when another strong correction hit the market. You can clearly see in figure I-2 how his index of weekly net new highs and new lows correlated directly with the actions of the market during those two years, as just one example. He also followed the number of stocks that advanced and declined on a weekly basis and calculated what he called his Advance and Decline Index.

Font size:

Interval:

Bookmark:

Similar books «Monster Stock Lessons: 2020-2021»

Look at similar books to Monster Stock Lessons: 2020-2021. We have selected literature similar in name and meaning in the hope of providing readers with more options to find new, interesting, not yet read works.

Discussion, reviews of the book Monster Stock Lessons: 2020-2021 and just readers' own opinions. Leave your comments, write what you think about the work, its meaning or the main characters. Specify what exactly you liked and what you didn't like, and why you think so.