99 LESSONS FOR PROFITABLE STOCK TRADING

Success Tips For Making Money In The Stock Market

WONG YEE

RANK BOOKS

WWW.RANKBOOKS.COM

Ebook Edition 2013

Published and distributed by:

Rank Books

Blk 1002 Toa Payoh Ind Pk #07-1423 Singapore 319074

Tel: 65-62508180 Fax: 65-62506191

Website: www.rankbooks.com

Email:

ISBN 978-981-07-5875-2

Copyright Wong Yee

Cover Design and Typeset: Rank Books

www.rankbooks.com

All Rights Reserved. No part of this publication may be reproduced or copied in any form or by any means - graphic, electronic or mechanical, including photocopying, recording, taping or information retrieval systems - without written permission of Rank Books.

Conditions of Sale: This book is sold subject to the condition that it shall not, by way of trade or otherwise, be lent, resold, hired out or otherwise circulated without the publishers prior consent in any form of binding or cover other than that in which it is published and without a similar condition including this condition being imposed on the subsequent purchaser.

While every reasonable care is taken to ensure the accuracy of information printed, no responsibility can be accepted for any loss or inconvenience caused by any error or omission. The ideas, suggestions, general principles, examples and other information presented here are for reference and educational purposes only. This book is not in anyway intended to give investment advice or recommendations to trade stock or any other investment. The author or publisher shall have no liability for any loss or expense whatsoever relating to investment decisions made by the reader.

Introduction

Dare to venture into the stock market? In a surging bull market, it is not a professional game. Share prices are rising so fast that practically everybody makes money. However, in a bear market, it is indeed a professional game a case of the big investors winning at the expense of the small retail players. Thus, when the bull market ends, losses are inevitable. Its too late, all is lost.

A proftable stock trader is one who can make money in both bull and bear markets. In the bear market, when no one is buying, he is doing bargain hunting and he gets ready to sell his shares when the market is bullish. In the bullish market, he knows how to ride the bull trend and sell off ahead of others and not to get greedy.

This book teaches you practical lessons on stock investing and how not to make the same mistakes that 90% of investors made. I sincerely hope that readers will be enriched and enlightended in one way or another in their pursuit of becoming a profitable stock trader.

Books by the same Author

A Guide To Investment In Stocks And Shares (1984)

The Trend Principle (1986)

Charts Revolution: Stock Market Trends And Trading Principles (1988)

Practical Knowledge In Shares Investment (1993)

You Too Can Be Rich in Stock Market Investment (2012)

Contents

INTRODUCTION

Lesson 1 21

Lesson 22 36

Lesson 37 47

Lesson 48 73

Lesson 74 99

PART I

DOS & DONTS

| How knowledgeable is a remiser? |

There are quite a number of controversial issues regarding remisers. Generally, a remiser is a broker who is self-employed compared to a dealer who is employed by a stockbroking company. Under the Singapore Securities Act, you could sue a broker for giving the wrong advice if you lost money based on the said advice. Thus, it is a norm for a remiser not to give you any advice. What you should do is to do some homework and instruct your remiser accordingly as to when to buy or sell a particular stock.

A remisier is a self-employed broker, not an adviser.

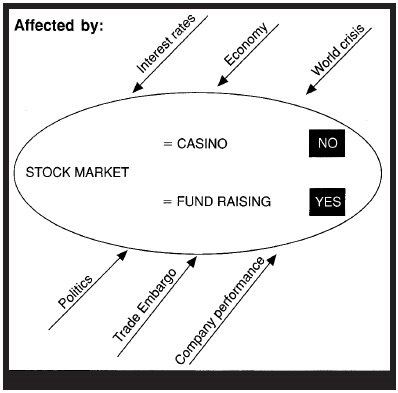

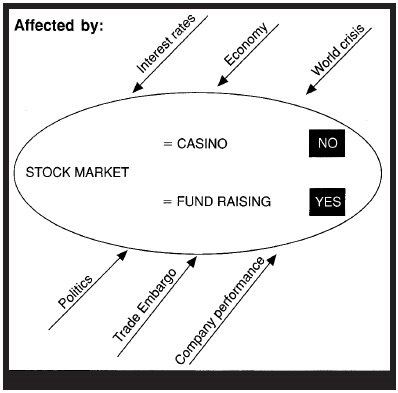

| It is often remarked that the stock market is a casino. All you need to do is to buy whatever you fancy and hope for the best. Is this true? |

Contrary to the above belief, the stock market is not a casino. It is a capital market where funds could be raised without paying any interest charges. The ups and downs of share prices will depend on issues such as world events and the performances of the respective listed companies. Therefore, to emerge a winner in this investment game, you need to do your homework well before getting yourself involved, otherwise, you may end up losing money.

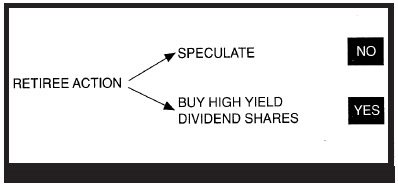

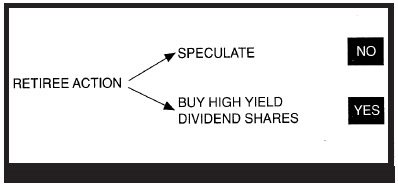

| I have just retired and have some cash with which I would like to invest in the stock market. What shares should I buy? |

As a retiree you should not speculate in shares. However, you could improve on your returns by buying shares that are able to give you a yield that is higher than the prevailing bank deposit interest rate. You need to hold on to it as dividend is paid on an annual basis. Nevertheless, you may sell your shares should you be able to reap more than 10% profit. Remember though, there is higher risk in holding shares than putting your money in the bank.

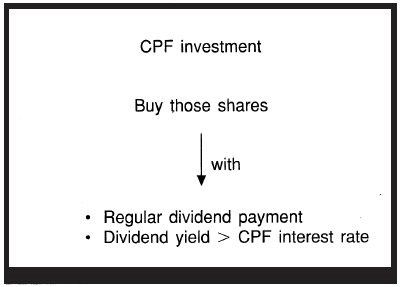

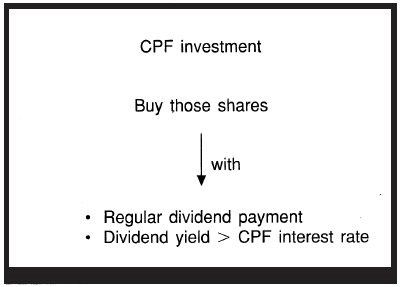

| I have funds in my CPF. Should I buy some shares? |

Sure, however, you need to adhere to two golden rules. Namely:

(a) Buy those shares that have been giving dividends regularly at least for the past 5 years and,

(b) Make sure the dividend yield of the shares that you buy is higher than the current CPF interest rate.

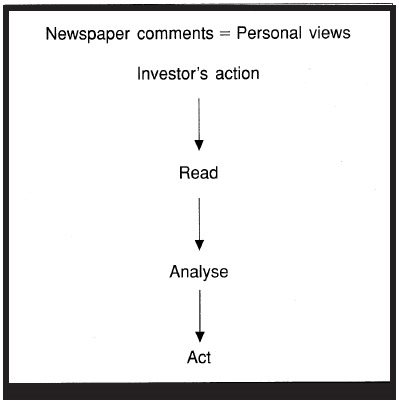

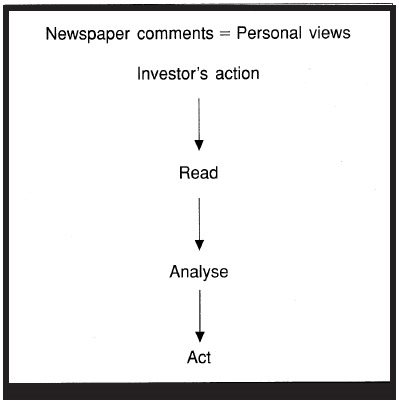

| Is it wise to follow newspaper comments? |

One must bear in mind that comments given are the personal views of the individual analyst. Each of us is entitled to our own views. Thus, each analyst has his own way of interpreting an event or data which need not necessarily be the gospel truth. Therefore, as an investor, you need to do some research and form your own views from the various comments given as to whether to buy or sell a particular stock.

| Is it wise to be a contrarian? |

Simply, a contrarian is a person who does things opposite from the masses. To be a perfect contrarian, one must be able to analyse the prevailing situation accurately. Once the mood of the crowd is determined, then one can proceed to do just the reverse of what the crowd is doing. In most circumstances the contrarian approach does work. In the context of share investment, to be a contrarian simply means that when most people are buying, you should be selling and vice versa.

Next page