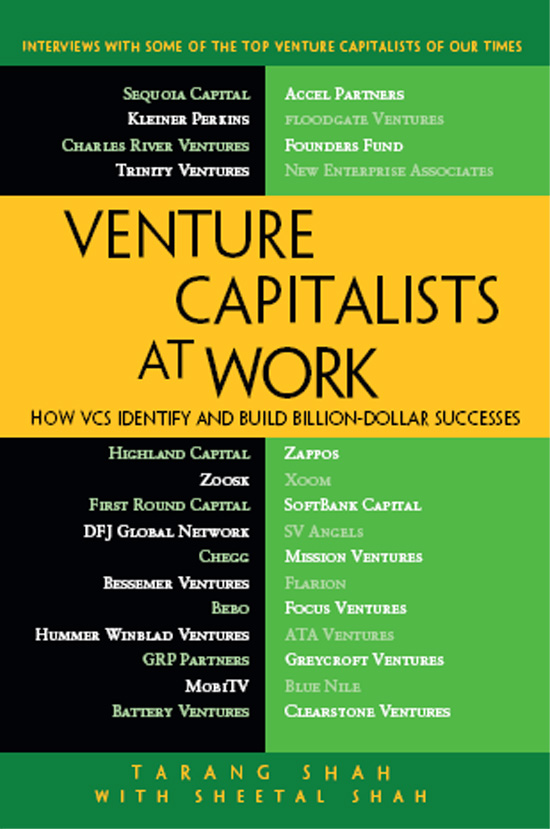

Venture Capitalists at Work

Copyright 2011 by Tarang Shah and Sheetal Shah

All rights reserved. No part of this work may be reproduced or transmitted in any form or by any means, electronic or mechanical, including photocopying, recording, or by any information storage or retrieval system, without the prior written permission of the copyright owner and the publisher.

ISBN-13 (pbk): 978-1-4302-3837-9

ISBN-13 (electronic): 978-1-4302-3838-6

Trademarked names may appear in this book. Rather than use a trademark symbol with every occurrence of a trademarked name, we use the names only in an editorial fashion and to the benefit of the trademark owner, with no intention of infringement of the trademark.

President and Publisher: Paul Manning

Lead Editor: Jeff Olson

Editorial Board: Steve Anglin, Mark Beckner, Ewan Buckingham, Gary Cornell,

Morgan Ertel, Jonathan Gennick, Jonathan Hassell, Robert Hutchinson,

Michelle Lowman, James Markham, Matthew Moodie, Jeff Olson, Jeffrey

Pepper, Douglas Pundick, Ben Renow-Clarke, Dominic Shakeshaft,

Gwenan Spearing, Matt Wade, Tom Welsh

Coordinating Editor: Jessica Belanger

Editorial Assistant: Rita Fernando

Copy Editor: Kimberly Burton

Compositor: Mary Sudul

Indexer: SPi Global

Cover Designer: Anna Ishschenko

Distributed to the book trade worldwide by Springer-Verlag New York, Inc., 233 Spring Street, 6th Floor, New York, NY 10013. Phone 1-800-SPRINGER, fax 201-348-4505, e-mail .

For information on translations, please contact us by e-mail at .

Apress and friends of ED books may be purchased in bulk for academic, corporate, or promotional use. eBook versions and licenses are also available for most titles. For more information, reference our Special Bulk SaleseBook Licensing web page at http://www.apress.com/bulk-sales.

The information in this book is distributed on an as is basis, without warranty. Although every precaution has been taken in the preparation of this work, neither the author(s) nor Apress shall have any liability to any person or entity with respect to any loss or damage caused or alleged to be caused directly or indirectly by the information contained in this work.

For our son Raj, our parents, and Gurudev

Contents

Foreword

There have been a number of books written on venture capital, but very few capture its heart and soul. Ostensibly, venture capital is about predicting the future. Venture capitalists predict a distinct type of future: one where a newcomer unexpectedly seizes a discontinuity, and transforms the way societies and businesses behave. The fastest-growing transformations at first appear innovative yet dubious. But they quickly mature into something that feelsfamiliar and perhaps obvious. Such were the cases for companies like You-Tube, Facebook, Groupon, LinkedIn, and Twitter, all mentioned in this book. In this sea of potential, what a venture capitalist does is assess the future of the start-ups that he or she meets.

But whats often underappreciated is that at its core, venture capital is intensely personal. It is an unnerving task. What is obvious is often less valuable. What is dubious might become the next big winner. To manage the ambiguity, a VC will use his or her history, expertise, and outlook as guideposts in decision making. He or she will draw upon his or her partnership for input and insight. However, in a world where a start-ups uniqueness often wins bigand conventionality might not win at alltheres a premium for original thinking. At the end of the day, its a deeply personal process that a venture capitalist goes through to render a decision.

Equally personal is what happens after funding a start-up. After funding, a venture capitalist then focuses on doing whatever he or she can to help improve the start-ups ability to thrive. Sometimes that means doing nothing at all. At other times, it means bringing institutional and personal resources to bear in ways that are handcrafted for that company. Start-ups are as deeply personal as the VCs and their firms. Imagine Facebook without Mark Zuckerberg: Might it look like Apple without Steve Jobs? What a good venture capitalist does is personalize the resources to reflect the people, culture, and situation at the start-up at that moment.

Given the deeply personal nature of venture capital and entrepreneurship, its no surprise that I would highly recommend Tarang Shahs book, Venture Capitalists at Work. This book captures the personalities and approaches of a number of leading VC practitioners as they discuss their work. It displays the heart and soul of the venture capital process, by offering an exclusive window into the voice of the practitioners. What youll find is that each VC has a unique point of view. Yet when you step back from this collage of discussions, youll sense some core fundamentals important to all successful start-ups. Fundamentals such as:

- Creating customer delight efficiently;

- Building passion into the teams culture;

- Scaling the company beyond $100 million in revenue; and

- Daring to be authentic so that you can dare to be great.

Each of the interviewees may prioritize these fundamentals differently, but all of the VCs have approaches on how to accomplish them. The variety of approaches simply reflects the personal uniqueness of investors and teams.

I find the depth and candidness of the interviews remarkable, but I guess not surprising. The rich material reflects the respect that we in the industry have for Tarang Shah. His reach within the tight venture capital industry is quite unusual but reflective of his character. As a side benefit from readingthis book, I believe theres a personal lesson in here on how to lead with integrity, sincerity, and goodwill, as my good friend Tarang does.

While aspiring venture capitalists should find this book as the go-to reference guide for developing ones own venture style, Venture Capitalists at Work should appeal more broadly to all entrepreneurs, as well as to followers of technology and technology investing. Entrepreneurs should benefit from having access to robust discussions on how to build fundamentally sound startups. Given that common start-up problems are discussed by several VCs, entrepreneurs facing those problems can extract from the interviews the nuances of approaches and tailor a solution that personally suits them. Further, there is a trove of real-life examples of successful decisions (and some less successful) that contributed to a start-ups success. If an entrepreneur can learn and benefit from one of these examples, they can save valuable time and resources.

By reading this book, technology enthusiasts and investors will develop a deep sense for how entrepreneurs, technology, and discontinuities manifest themselves into much larger, life-changing trends. Technology disruptions are happening at an accelerating pace. This book will help you see thesetrends as they emerge, and ride the waves more gracefully. Youll get answers to questions like, Why was Twitter funded? What contributed to its success? For investors, perhaps youll see answers to the question, Whats the next Twitter? For this last question, I believe the answers are in here.

Gus Tai

Trinity Ventures

Foreword

For years, I have been asked to contribute to various works on venture capital. And for the first time, I found the spirit and focus of Tarang Shah's interest in the topic to be exactly like mine. That spirit and focus is really about how to help entrepreneurs build great companies and drive real contributions to their customers and, ultimately, the world.