Contents

Landmarks

For Rebecca and Martin

Contents

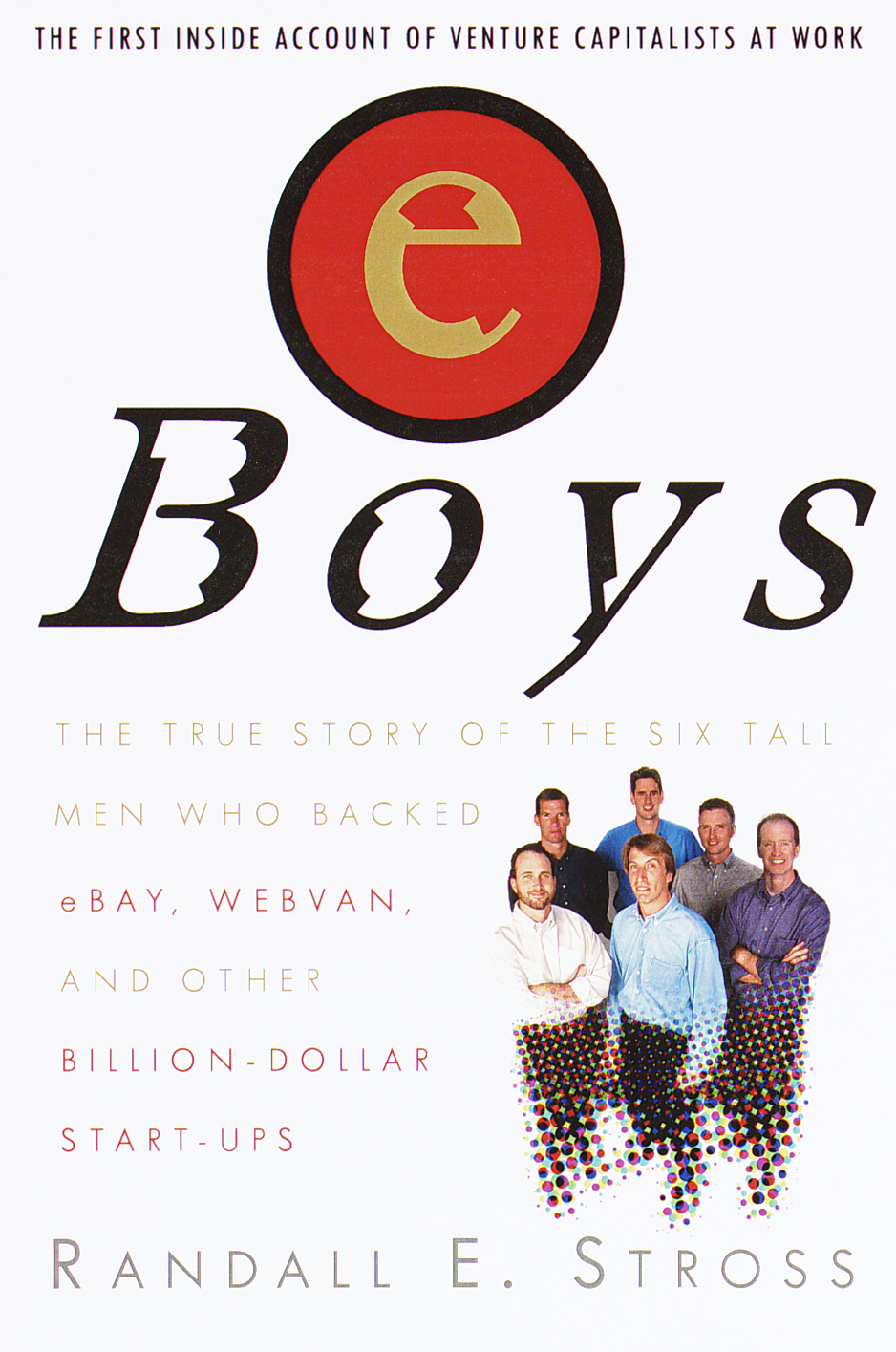

The Cast

The Benchmark Partners

Dave Beirne previously, founder of Ramsey Beirne Associates, an executive search firm in Ossining, New York

Bruce Dunlevie previously, general partner at Merrill Pickard, a venture capital firm in Menlo Park, California

Bill Gurley previously, general partner at Hummer Winblad, a venture capital firm in San Francisco, California; joined Benchmark in 1999

Kevin Harvey previously, founder of Approach Software, in Redwood City, California

Bob Kagle previously, general partner at Technology Venture Investors (TVI), a venture capital firm in Menlo Park, California

Andy Rachleff previously, general partner at Merrill Pickard, a venture capital firm in Menlo Park, California

Selected Individuals Mentioned

Bill Atalla son of TriStrata founder John Atalla

John Atalla founder, TriStrata

Louis Borders founder and CEO, Webvan

Eric Greenberg founder, Scient

Bob Howe CEO, Scient

Jerry Kaplan CEO, Onsale

Bill Lederer CEO, artuframe/Art.com

Burt McMurtry general partner, Technology Venture Investors

Pete Mountanos CEO, Charitableway

Pierre Omidyar founder and chairman, eBay

Tom Perkins retired general partner, Kleiner Perkins Caufield & Byers

Danny Shader Benchmark entrepreneur in residence; founder and CEO, Accept.com

Rob Shaw founder, Newwatch/Ashford.com

Jeff Skoll cofounder and vice president, eBay

Paul Wahl CEO, TriStrata

Jay Walker chairman, Priceline

Steve Westly vice president, marketing, eBay

James Whitcomb president, Newwatch/Ashford.com

Meg Whitman president and CEO, eBay

Selected Companies Mentioned

(Partner representing Benchmark)

Accept.com (Bruce Dunlevie) payment systems for electronic commerce

Ariba (Bob Kagle) online ordering of materials and supplies for businesses

Art.com [originally named artuframe] (Bob Kagle) posters and frames sold via the Web

Ashford.com [originally named Newwatch] (Kevin Harvey) watches, pens, leather bags, and other luxury goods sold via the Web

Charitableway (Andy Rachleff) online for-profit solicitor for nonprofit organizations

Critical Path (Kevin Harvey) hosts e-mail services for large organizations

eBay (Bob Kagle) online person-to-person auctions via the Web

ePhysician (Dave Beirne) prescription ordering for doctors via a PalmPilot

Juniper Networks (Andy Rachleff) manufacturer of high-speed routers for the Internet

Newwatch [renamed Ashford.com; see above]

Priceline (Dave Beirne) online bidding for airline tickets and hotel rooms

Red Hat (Kevin Harvey) distributor of Linux, an alternative operating system to Windows

Scient (Dave Beirne) technical consulting services to e-tailers

Toysrus.com (Bruce Dunlevie) aborted joint venture to sell toys via the Web; to have been cofunded by, but organizationally separate from, Toys R Us

TriStrata (Dave Beirne) security software for data networks within large corporations

Webvan (Dave Beirne) groceries sold via the Web and delivered to the home

Introduction

When eBay, a small Internet auction company based in San Jose, California, sought venture capital, it had to pass an informal test administered by the venture guys before they would consider making an investment: Was there a reasonably good likelihood that the investors could make ten times their money within three years? In eBays favor, the company displayed some momomentum measured in revenues and profitability. It did not have much visibility in the public at large, however, and the growth potential of its businesswhat seemed to be nothing more than a flea market onlinewas unproven. There was risk that the best that could ever be said about it would be that it was a good little business, with the emphasis on little.

The venture capital firm that in the end backed eBay was Benchmark Capital, itself a start-up, then only two years old. When Benchmark invested $6.7 million in eBay in 1997, the auction companys valuation was put at $20 million. EBay grew, prospered, went public. In September 1998, after the first day of public trading, eBays market capitalization was $2 billion, and Benchmarks original $6.7 million stake was now worth $400 million. Little more than three months later, the stock had gained more than 1,300 percent. By the next spring, the company was valued at more than $21 billion; the value of Benchmarks stake had grown 100,000 percent in less than two years time, making it the Valleys best-performing venture investment ever.

The eBay story happened to unfold right in front of my eyesand my tape recorder; I must confess I was as surprised as anyone.

A year before eBay knocked on Benchmark Capitals door, I had knocked there, interested in writing a book about a corner of the financial world whose inner workings remained shrouded, even to those in other precincts of professional money management. Yet venture capitalists, who were concentrated in Silicon Valley, were entrusted with ever by institutions, such as university endowments and charitable foundations, to invest in newly formed companies. In 1996 venture funds attracted $10 billion in capital; in 1997 the total jumped to $20 billion; and in 1998 it passed $26 billion.

It was a form of investing that brought higher risk than investing in shares of publicly traded companies found in the stock market, but it offered the prospect of higher returns, too. As for the venture capitalists, they received a significant cutat least 20 percentof any resulting gains in the portfolios investments, so in flush times their personal wealth, on paper at least, grew as fast as the valuations of the new companies they funded.

Anyone who had followed the rise of Netscape, Amazon, and Yahooall were venture-backedhad already figured out that the venture guys were seated at the center of the New Economy. Endowment-fund managers who had not previously developed connections to the top venture capital firms pounded their fists on closed doors, begging for entry, but even with recent increases in size, the funds were already oversubscribed.

, the best means of fighting poverty, according to advocates in nonprofit initiatives that sprang up to teach entrepreneurship in neighborhood classes, schoolseven in kindergartens.

And all of these entrepreneurs and would-be entrepreneurs and institutional investors and individual investorsthe entire money culturetrained their attention on the venture capitalists, who were the gatekeepers to the world of high-tech start-ups, the place where new firms grew the fastest and investors reaped the greatest returns. The venture guys made decisions that appeared to have oracular power. By the approach of the year 2000, the venture guys comprised the symbolically preeminent profession that served to define the zeitgeist in the nineties in the same way that investment bankers had in the eighties, investigative journalists had in the seventies, and hippiesas the antiprofessionhad in the sixties.