The Complete Guide to

Investing During

Retirement

Turn Your Savings into Earnings

THOMAS MASKELL, M.B.A.

Copyright 2009 by Thomas Maskell

All rights reserved.

This book, or parts thereof, may not be reproduced in any

form without permission from the publisher; exceptions are

made for brief excerpts used in published reviews.

Published by

Adams Media, an F+W Media

57 Littlefield Street, Avon, MA 02322. U.S.A.

www.adamsmedia.com

ISBN 10: 1-59869-455-3

ISBN 13: 978-1-59869-455-0

eISBN: 978-1-44051-474-6

Printed in the United States of America.

J I H G F E D C B A

Library of Congress Cataloging-in-Publication Data

is available from the publisher.

This publication is designed to provide accurate and authoritative information with regard to the subject matter covered. It is sold with the understanding that the publisher is not engaged in rendering legal, accounting, or other professional advice. If legal advice or other expert assistance is required, the services of a competent professional person should be sought.

From a Declaration of Principles jointly adopted by a Committee of the American Bar Association and a Committee of Publishers and Associations

Many of the designations used by manufacturers and sellers to distinguish their product are claimed as trademarks. Where those designations appear in this book and Adams Media was aware of a trademark claim, the designations have been printed with initial capital letters.

This book is available at quantity discounts for bulk purchases.

For information, please call 1-800-289-0963.

DEDICATION

This book is dedicated to Peggy Chapman, a dear friend, who has left

this world, but will never leave my heart or thoughts. Thank you for your

friendship; it was one of the many gifts God has given me.

Contents

Preface

Why an investment book for retirees? There are hundreds of books on the stock market, investing, and financial planning. They are wonderful excursions into the world of stocks and stock markets. These guided tours are conducted by some of the most accomplished investors Wall Street has ever known, who have forged their credentials in the trenches. They have written on the theory, practice, and manipulations of Wall Street. Their promise, or at least your hope, is that their success can be your success, but it is a hollow promise.

Professor Kenneth Froewiss, a financial professor at New York University Stern School of Business, states, A good book about personal finance always elaborates on three simple themes: save early, know your risk tolerance and diversify. Any book that suggests it has a new way to riches should probably be a little suspect. Thats great advice; but like all good advice, it must be placed in context.

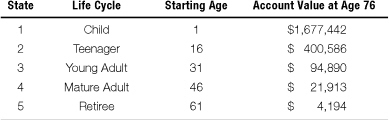

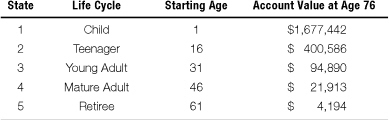

All organic systems follow a life cycle: birthdevelopment growthmaturitytransitiondecline. For humans, each of these stages has unique mental, physical, and financial characteristics. Comparing Professor Froewisss simple themes in most personal finance books to these life stages yields some interesting results. For instance, look at the possible value of an investment account. You can imagine starting this account at a number of different ages, ranging from one to sixty-one. For purposes of this example, well assume that youre risking just $10 per month, or $120 per year. Well also assume youre getting the average long-term stock market return of 1012 percent a year, which represents a diversified stock portfolio. Table I illustrates what following the conventional investing wisdom embodied in the professors themes will get you.

Its clear that if you follow conventional investment advice, the best advice is start early. Unfortunately, not many one-year-olds read the tomes of stock market gurus. The teenagers of stage two and the young adults of stage three are also not high on the mailing lists of the stock market experts. Serious investment decisions are not made until retirement comes into view, a stage four occurrence. By then, its too late to start early. By age forty-six, following conventional advice wont add much to your retirement fund.

TABLE I

Conventional Investment Advice

Example: $120 a year invested at a 10% annual return.

Diversification doesnt help. After age forty-six, the moderate returns of diversification are insufficient to build a meaningful nest egg. The only hope is to increase your contributions. Increasing your yearly investment from $120 to $1,200 or even $12,000 will multiply the account value by ten- or a hundredfold. Can the average forty-six-year-old afford a tenfold increase in contributions? If he can, is he willing to risk it? If he has not made a massive investment plunge by age forty-six, it is unlikely that he will make it after forty-six.

What are aging investors to do when the experts good advice is not good for them? They have two choices. The first is to find a new expert. There are plenty to choose from. Some are well known, but others are just masters of the fad. They provide sure-fire systems and tales of investment derring-do. They promote their anecdotal expertise in books, newsletters, and mutual funds. Remember Professor Froewisss warning: A new way to riches should probably be a little suspect. Many of these fad masters rise and fall like the business cycle.

Even the well-known experts advice can be contradictory. In Burton Malkiels book, A Random Walk Down Walk Street, he wrote that since small stocks carry greater risk, investors demand greater rewards. Sounds good, but he proved his point by showing that small stocks routinely outperformed the major market indexes. He concluded that since the major market indexes are deemed less risky, the higher returns of the small stocks proved his point. Wait a minute! If they are riskier, shouldnt small stocks underperform the major market indexes? If they dont, wheres the risk? To use a gambling comparison, if you bet only long shots, over the long term you should win less money, not more. At the very best, you should break even.

The contradiction arises because Mr. Malkiel mixed apples and oranges. When he was explaining risk, he defined it as short-term volatility. When he was comparing returns, he was writing about the tendency of a stock to rise in price over the long term. If the reward is measured in the long term, the risk should also be measured in the long term. I will not make that mistake. My goal is to educate, not confuse.

In this book, I will not be advocating the simple themes, because this book was written especially for retirees. Why especially for retirees? Because retirees are special-needs investors, so the old rules do not always apply to them. Start early, diversify, and know your risk tolerance seem like good rules, but they dont work for all ages. They especially dont work well for the average retiree.

Most books on investing seem to misunderstand who their audience is and what resources they have. They leave out retirees because they focus on the rewards of the stock market rather than the fears of the investors. While retirees are drawn to the market by its rewards, in the end, their fear of it leaves them on the outside looking in. This book seeks to overcome their fears by giving them the knowledge and understanding they need to get into the game.

Next page