AUTOMATIC INCOME

How to Use the Power of Dividend Investing to Beat the Market and Generate Passive Income for Life

MATTHEW PAULSON

Automatic Income: How to Use the Power of Dividend Investing to Beat the Market and Generate Passive Income for Life

Copyright 2017 by Matthew Paulson. All rights reserved.

No part of this book may be used or reproduced in any manner whatsoever without written permission except in the case of brief quotations embodied in critical articles or reviews. Please do not participate in or encourage piracy of copyrighted materials in violation of the authors rights.

Published by American Consumer News, LLC.

First edition: January 2017

ISBN: 978-1539737667 (print)

Cover design: Rebecca McKeever

Editing: Jennifer Harshman (HarshmanServices.com)

Book Design: James Woosley (FreeAgentPress.com)

Printing: Amazon CreateSpace

TABLE OF CONTENTS

INTRODUCTION

P reparing for a secure retirement just isnt as easy it was 30 years ago. Investment returns were much more consistent on a year-to-year basis than they are today. There was no deluge of complicated investment options to choose from. You could either invest in major public companies like AT&T and General Electric, or you could buy one of a handful of mutual funds that were available at the time. Social Security was in the black and you didnt have to worry about whether or not you would actually receive the benefits promised to you. You could work for a big employer and know that if you put in the work, you would have a secure job until the day you retired.

In the 80s and 90s, you could simply invest in an S&P 500 index fund and receive consistently good rates of return on your money. Between 1980 and 1999, there were only two years where the S&P 500 had a negative annual total return and they were both pullbacks of less than 5%. You could build up a nest egg inside of an IRA or a 401K plan and know that it would consistently grow by about 10% each year. You could withdraw 4% to 5% of your portfolio each year in retirement without eroding your portfolio value and even give yourself a raise every year in retirement to account for inflation.

Unfortunately, those days are gone. Between the crash of technology stocks in 2000, the 9/11 attacks in 2001 and the ongoing war on terrorism, the S&P 500 had three consecutive years of negative returns between 2000 and 2002. We had a couple of good years in the 2000s, but those returns evaporated when the S&P 500 lost 37% of its value in 2008 during the Great Recession. Major American corporations, like General Motors and Merrill Lynch, went bankrupt. Tax revenue fell sharply and the national debt doubled in just a few years. Interest rates fell to near zero and the government had to step in and provide an unprecedented economic stimulus to get the economy back on its feet.

We have had some good years since the Great Recession ended, but the promise of working for an employer for life and setting aside money in a 401K plan, then having a secure retirement has all but disappeared. Corporations are no longer loyal to their employees. Social Security is effectively insolvent. Financial experts are now telling us that we are going to have to work longer and live on just 3% of our investment portfolio during retirement.

We can no longer rely on the government or big corporations to take care of us during our retirement years. We cant simply throw money at the S&P and expect to receive consistently good returns over the long term. These strategies may have worked for people retiring 25 years ago, but people who are in their 20s, 30s, 40s and 50s need a new investing game plan that will offer them superior returns, consistent growth, and the opportunity for a secure retirement.

Enter Dividend Investing

What if I told you that there was an investment strategy that could provide you with a secure stream of lifetime cash flow? If there was an investment strategy that would allow you to live off of 4% to 6% of your portfolio each year without having to ever sell shares of stock or touch your principal, would you be interested? What if this strategy was less volatile than the S&P 500 and has historically offered higher returns than the S&P 500? What if the income stream generated by this portfolio actually grew by 510% each year? Would you be interested?

This investment strategy actually exists and its not a super-secret hedge fund thats only available to the ultra-wealthy, a little-known strategy that will stop working as soon as everyone knows about it, or the next Ponzi scheme waiting to unravel. This strategy is quite simple and frankly, incredibly boring but it actually works. This miracle investment strategy is investing in dividend stocks. While it might not seem like theres anything all that special about companies that pay dividends, the performance numbers will change your mind.

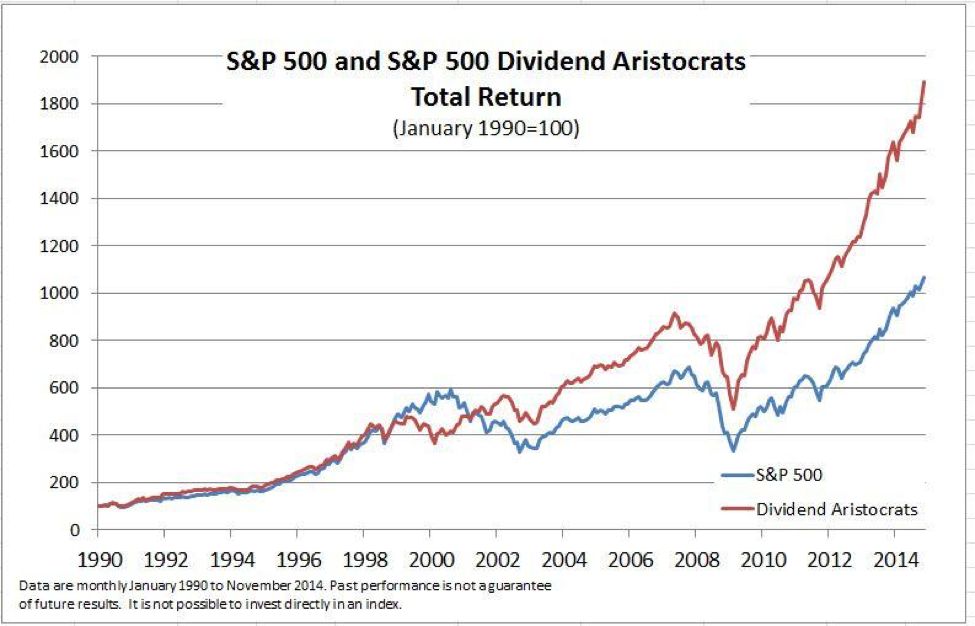

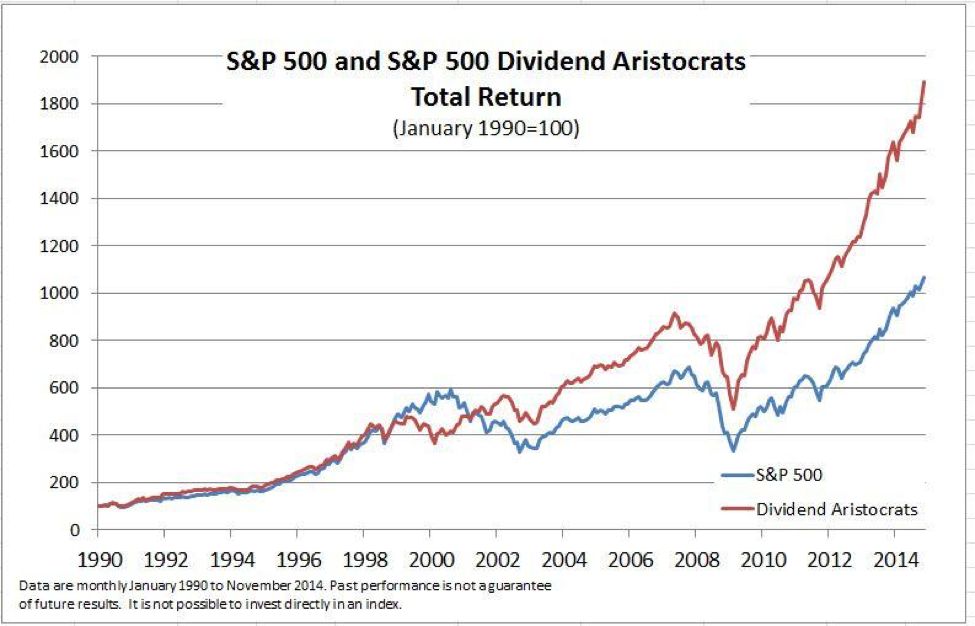

Standard and Poors keeps track of a list of S&P 500 companies that have grown their dividend every year for at least 25 consecutive years, known as the S&P Dividend Aristocrats Index. This group of 52 companies includes household names like 3M, AT&T, Chevron, Coca-Cola, Exxon Mobil, McDonalds, Procter & Gamble and Wal-Mart. It would be natural to think that these long-established companies wouldnt grow as fast as the broader market, but actual investment returns tell a different story.

The Indexology blog recently published a chart comparing the performance of the S&P Dividend Aristocrats Index to the performance of the S&P 500 between 1990 and 2015. While investing in the S&P 500 resulted in cumulative returns of about 1,100% during this time frame, the S&P 500 Dividend Aristocrats Index had cumulative returns of more than 1,900%.

During the 10-year period ending in September 2016, the S&P Dividend Aristocrats has indexed an average annual rate of return of 10.14% while the S&P 500 Index has returned an average annualized rate of return of just 7.22%. No one will deny that dividend stocks have had a good run during the last few decades, but what about over the long term? It turns out that dividend payments are responsible for 40% of the annualized returns of the S&P 500 over the last 80 years.

Do I Have Your Attention Now?

Dividend investing really works and you can make it work for you, too. You can use the power of dividend investing in your personal 401K plan, your IRA, and your individual brokerage account to create an investment portfolio of dividend-growth stocks that will generate a steady income stream, be less volatile than the broader market, and offer returns that are superior to the S&P 500. You can build a dividend-stock portfolio that has an annualized yield of 4%6% and that yield will grow by 5%10% each year as companies raise their dividend over time. Dividend investing offers a perfect combination of income investing and growth investing. You get income from the dividend payments you receive as well as long-term capital gains from price appreciation in the stocks you invest in. If dividend stocks continue to perform as they have over the last 10 years, its not unreasonable to expect an annualized rate of return of 10% in the years to come.