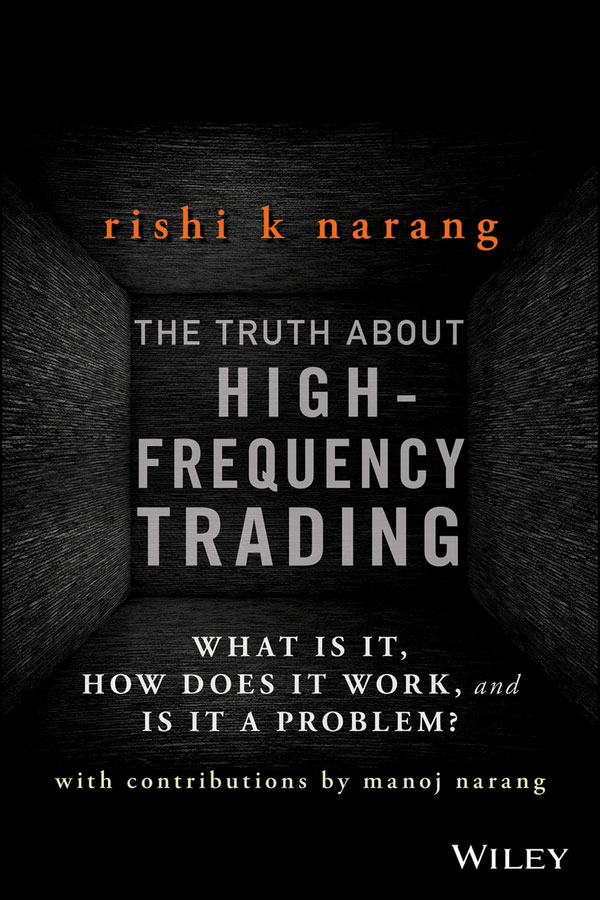

The Truth about High-Frequency Trading

What Is It, How Does It Work, and Is It a Problem?

RISHI K NARANG

Cover Design: Wiley

Cover Image: iStock.com / madrat

Copyright 2014 by Rishi K Narang. All rights reserved.

Published by John Wiley & Sons, Inc., Hoboken, New Jersey.

Published simultaneously in Canada.

No part of this publication may be reproduced, stored in a retrieval system, or transmitted in any form or by any means, electronic, mechanical, photocopying, recording, scanning, or otherwise, except as permitted under Section 107 or 108 of the 1976 United States Copyright Act, without either the prior written permission of the Publisher, or authorization through payment of the appropriate per-copy fee to the Copyright Clearance Center, Inc., 222 Rosewood Drive, Danvers, MA 01923, (978) 750-8400, fax (978) 646-8600, or on the Web at www.copyright.com. Requests to the Publisher for permission should be addressed to the Permissions Department, John Wiley & Sons, Inc., 111 River Street, Hoboken, NJ 07030, (201) 748-6011, fax (201) 748-6008, or online at http://www.wiley.com/go/permissions.

Limit of Liability/Disclaimer of Warranty: While the publisher and author have used their best efforts in preparing this book, they make no representations or warranties with respect to the accuracy or completeness of the contents of this book and specifically disclaim any implied warranties of merchantability or fitness for a particular purpose. No warranty may be created or extended by sales representatives or written sales materials. The advice and strategies contained herein may not be suitable for your situation. You should consult with a professional where appropriate. Neither the publisher nor author shall be liable for any loss of profit or any other commercial damages, including but not limited to special, incidental, consequential, or other damages.

For general information on our other products and services or for technical support, please contact our Customer Care Department within the United States at (800) 762-2974, outside the United States at (317) 572-3993 or fax (317) 572-4002.

Wiley also publishes its books in a variety of electronic formats. Some content that appears in print may not be available in electronic books. For more information about Wiley products, visit our web site at www.wiley.com.

Library of Congress Cataloging-in-Publication Data:

ISBN 978-1-118-96092-9 (ePub)

Preface

The debate about high frequency trading (HFT) has been raging since around the beginning of 2010, after a couple of years of record profits in 2008 and 2009 were reported upon by the press with a generally negative tone. In particular, reports of HFTs' profits in 2008 stung, having just lived through the worst economic downturn this country had seen since the Great Depression, a downturn which in some ways remains with us today. Reports of a programmer on Goldman Sachs' market making desk stealing code that could manipulate markets, coupled with the Flash Crash of May 2010, added fuel to the proverbial fire.

Aside from the press, who have the job of selling papers, (or clicks, or eyeballs), two main groups joined the fray. On the one hand were the ubiquitous conspiracy theorists, who prefer any explanation but the simplest and most likely one. The other constituency of this triumvirate of illumination was people with an incentive, an axe to grind. They were and are mainly high-touch Wall Street traders whose livelihoods had been adversely impacted by the explosion of complexity of the U.S. equity market and the increase in the role of technology in navigating this new reality. Their inability or unwillingness to evolve to compete has led them to cry out for a setting-back of the clock to the good old days when they could make money off their clients more easily.

All of this was fine and manageable. Regulators were making careful, but mostly correct moves to fix what needed fixing. There was an increasing convergence between the anti-HFT crowd and HFTs themselves, in terms of what the actual, solvable problems are in the markets. After all, it is hard to dispute credibly that the U.S. equity market is exceedingly well-functioning and exceedingly cheap to trade. Thus, the changes to market structure that would eliminate most of what the anti-HFT crowd was complaining about were actually roughly in line with what the HFTs believed was wrong with market structure as well. These include potential reforms like speeding up the data feed that basically all market participants have access to by default and ending a ban on a zero-spread market (if tight spreads are good, a zero-spread market is as good as it gets). These two simple changes would have the effect of eliminating a large portion of the strange and new order types that have led to so much of the conspiracy theorizing in the first place.

All that potential progress was dramatically set back with the release of Michael Lewis's latest best-seller, Flash Boys. It has all the typical Lewisian story-telling and page-turning that has led him to be such a successful author. But where I found his previous work, like Moneyball and Liar's Poker both well-written and well-researched, Flash Boys was a disaster when it came to facts and objectivity. Lewis threw around claims that cannot be supported by evidence, and his arrogance in asserting these points on television programs over and over, coupled with his hard-won credibility, appear to have set off an explosion of misinformed bad will. What had been simmering somewhat quietly and productively is now boiling over with a lot of heat and virtually no light (sorry for the mixed, chained metaphor).

Therefore, I decided to release an expanded and updated carve-out of the HFT portion of my 2013 book, Inside the Black Box. I've tried hard to make it a standalone mini-book without references to the longer, more comprehensive work. The goal was not to provide an exhaustive (and therefore exhausting!) look at market structure and trading, but rather a close look at the topic of high frequency trading in its various aspects: what it is, how it's done, why it matters, and whether we should have concerns. I hope you find it helpful.

Acknowledgments

I am indebted to Manoj Narang, my brother, for his help with this book, and to Mani Mahjouri and Lewis Hyatt for all of their suggestions and help. Mike Beller's and Dmitry Sarkisov's help with the micro-bursting information was both enlightening and very much appreciated. My colleagues at T2AM, Myong Han, Huang Pan, and especially Julie Wilson, read through various portions of this text and offered many valuable suggestions.

I must acknowledge the help of the rest of my partners at T2AM: Eric Cressman, John Cutsinger, Lisa Borland, and Elizabeth Castro. I would like to thank Steve Drobny for his encouragement and support through almost 10 years of friendship. Thanks go to Vlad Khandros at UBS and the folks at Bank of America Merrill Lynch (especially Lisa Conde, Tim Cox, and Ashok Krishnan) for various bits of market information I found useful in this book. And of course, I am grateful to my wife for putting up with me spending family time producing this work.

Underlying data, where necessary, were downloaded from Yahoo! Finance or Bloomberg, unless otherwise noted.

CHAPTER 1

Next page