Founded in 1807, John Wiley & Sons is the oldest independent publishing company in the United States. With offices in North America, Europe, Australia, and Asia, Wiley is globally committed to developing and marketing print and electronic products and services for our customers' professional and personal knowledge and understanding.

The Wiley Trading series features books by traders who have survived the market's ever changing temperament and have prosperedsome by reinventing systems, others by getting back to basics. Whether a novice trader, professional, or somewhere in-between, these books will provide the advice and strategies needed to prosper today and well into the future.

For a list of available titles, visit our web site at www.WileyFinance.com .

Cover image: Crusitu Robert/iStockphoto

Cover design: John Wiley & Sons, Inc.

Copyright 2013 by Irene Aldridge. All rights reserved.

Published by John Wiley & Sons, Inc., Hoboken, New Jersey.

The First Edition of High-Frequency Trading: A Practical Guide to Algorithmic Strategies and Trading Systems was published by John Wiley and Sons, Inc. in 2010.

Published simultaneously in Canada.

No part of this publication may be reproduced, stored in a retrieval system, or transmitted in any form or by any means, electronic, mechanical, photocopying, recording, scanning, or otherwise, except as permitted under Section 107 or 108 of the 1976 United States Copyright Act, without either the prior written permission of the Publisher, or authorization through payment of the appropriate per-copy fee to the Copyright Clearance Center, Inc., 222 Rosewood Drive, Danvers, MA 01923, (978) 750-8400, fax (978) 646-8600, or on the Web at www.copyright.com . Requests to the Publisher for permission should be addressed to the Permissions Department, John Wiley & Sons, Inc., 111 River Street, Hoboken, NJ 07030, (201) 748-6011, fax (201) 748-6008, or online at www.wiley.com/go/permissions .

Limit of Liability/Disclaimer of Warranty: While the publisher and author have used their best efforts in preparing this book, they make no representations or warranties with respect to the accuracy or completeness of the contents of this book and specifically disclaim any implied warranties of merchantability or fitness for a particular purpose. No warranty may be created or extended by sales representatives or written sales materials. The advice and strategies contained herein may not be suitable for your situation. You should consult with a professional where appropriate. Neither the publisher nor author shall be liable for any loss of profit or any other commercial damages, including but not limited to special, incidental, consequential, or other damages.

For general information on our other products and services or for technical support, please contact our Customer Care Department within the United States at (800) 762-2974, outside the United States at (317) 572-3993 or fax (317) 572-4002.

Wiley publishes in a variety of print and electronic formats and by print-on-demand. Some material included with standard print versions of this book may not be included in e-books or in print-on-demand. If this book refers to media such as a CD or DVD that is not included in the version you purchased, you may download this material at http://booksupport.wiley.com . For more information about Wiley products, visit www.wiley.com .

Library of Congress Cataloging-in-Publication Data:

Aldridge, Irene, 1975

High-frequency trading: a practical guide to algorithmic strategies and trading systems/Irene Aldridge.2nd Edition.

pages cm.(Wiley trading series)

Includes index.

ISBN 978-1-118-34350-0 (Cloth)ISBN 978-1-118-42011-9 (ebk)ISBN 978-1-118-43401-7 (ebk) ISBN 978-1-118-41682-2 (ebk) 1. Investment analysis. 2. Portfolio management. 3. Securities. 4. Electronic trading of securities. I. Title.

HG4529.A43 2013

332.64dc23

2012048967

To my family

PREFACE

If hiring activity is highest in profitable and rapidly expanding industries, then high-frequency trading (HFT) is by far the most successful activity in the financial sector today. Take, for example, the Jobs classifieds in the Money and Investing section of the Wall Street Journal on November 27, 2012. All five advertisements placed there were for high-frequency trading and related roles. Morgan Stanley alone was hiring four candidates in its high-frequency trading operation. HFT candidates were sought at all levels: associate vice presidents were required in HFT technology development, executive directors were needed in HFT strategy development, and vice presidents were sought for in HFT operations. To warrant the investment into new employees at all levels, prospective employees with HFT skills were clearly expected to generate high returns for their employers for the foreseeable future.

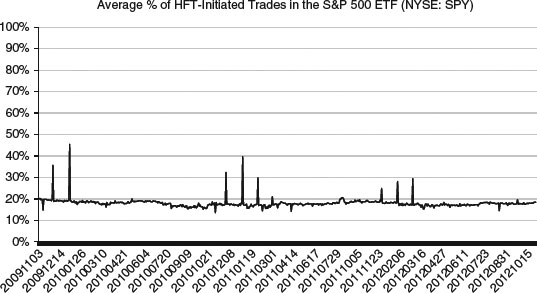

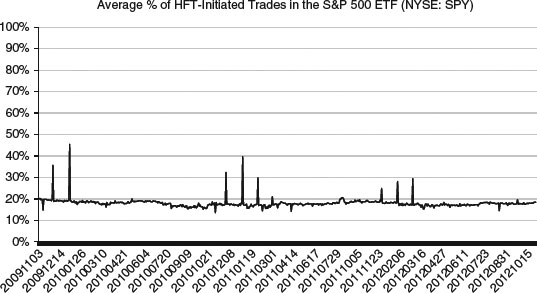

Despite considerable hiring in the field, the high-frequency trading industry is still in its infancy. While some claim that high-frequency traders comprise 60 to 70 percent of all market participants, such numbers are seldom reached in reality. Scientific examinations find that HFTs still account for as little as 25 percent of all market activity in such frequently traded instruments as the S&P 500 E-mini futures (see Kirilenko et al., 2011). As shows, even in the very liquid S&P 500 ETF (NYSE: SPY), high-frequency traders on average account for just 20 percent of daily trades.

Source: Aldridge (2012a)

As shown in , the average levels of HFT participation in SPY remain remarkably stable: on most days in 2009 through 2012, 15 to 17 percent of all trades in SPY can be attributed to HFTs. At the same time, evidence of resource allocation to HFT suggests that the industry is growing at a rapid pace. A natural explanation reconciling the two observations exists: HFT has low barriers to entry, yet it can be extremely complex, requiring years of toiling with data to proficiently develop and deploy trading models.

Indeed, as any successful HFT operator will tell you, development of consistently profitable ultra-short-term trading strategies takes at least three years. While the number may seem extreme, it is not really different from the time required to develop proficiency or block in any other industry or specialization.

HFT is particularly complex as the discipline rests at the confluence of two already complicated areas of study: high-frequency finance and computer science. Very few academic institutions offer programs that prepare students to be simultaneously competent in both areas. Most finance-trained people do not understand computer programming, and most computer scientists do not have a grasp on the required highly academic finance.

This book is written to fill that academic void: to supply true, accurate, and up-to-date graduate-level information on the subject of high-frequency trading, as well as to address the questions and opinions that many have about the subject. The book has a companion web site, www.hftradingbook.com , where you can find practical examples, updates, and teaching materials. I hope you find the book informative and helpful in your future endeavors.

ACKNOWLEDGMENTS

I am extremely grateful to my husband for tireless encouragement and insightful suggestions, to my son Henry for helping me keep a balanced perspective, to Gaia Rikhye for terrific front-line edits, and to my wise editor Bill Falloon, ber-patient development editor Judy Howarth, diligent senior production editor Vincent Nordhaus, and terrific publisher Pamela Van Giessen for making it all happen.