CONTENTS

INTRODUCTION

This work is my second book on the strategy of selling stock options as an investment tool for long term capital growth. The precursor to this book delved on the subject of trading options utilizing the technique of selling uncovered or naked puts and calls. While extremely profitable for the experienced options trader naked option selling can be quite risky for the novice investor. While that book teaches the many ways that one can cancel the perceived risk many readers do not possess enough knowledge and experience to apply and use the system effectively. Consequently I received an overwhelming positive response to the Chapter in that book where I briefly discussed another trading system that is simpler to follow and just nearly as profitable, if not even better, than naked option selling. That is the strategy of selling cash secured put options and covered call options. Answering the demands of my readership I thought it would be prudent to produce an entire book dealing solely with this remarkable option trading strategy.

Covered calls and puts is a trading system that is fairly easy to learn for the novice trader who desires to get into the options trading game without getting too much involved with all the intricacies of options. It is especially of much benefit to individuals as well as financial institutions that have much cash parked in low interest cash accounts such as CDs and money funds. With todays money market rates of less than 2% it makes little sense to park money in low yielding cash investments. The income received from these investments does not even cover moneys loss of value caused by inflation.

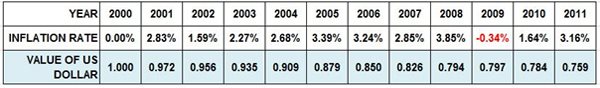

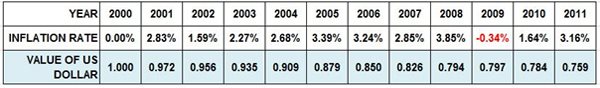

In the past twelve years inflation has caused the value of the US dollar to dwindle from $1.00 at the end of 2000 to a much decreased $.76 at the end of 2011. The table below shows inflation rates for each of the past twelve years and how it has steadily eaten away at the dollar. This does not bode well for those invested in money funds who are earning less than 2% annual returns.

If you are one of those who are grumbling and complaining about how little interest you are earning on your cash deposits you will certainly want to start looking at the strategy of selling puts against your cash. This book will guide you on how to do this.

The other group of investors that could stand to benefit immensely from selling put and call options are those who are invested in stocks but are getting little benefit from their stockholdings. Surprisingly there is a vast multitude of investors who buy stocks and maintain an attitude of wait-and-see hoping the value of their portfolio will steadily rise in the course of time. Some depend on the dividend income provided by their holdings with yields that seldom exceed 2-3% annual return. These types of investors would do well to make their stockholdings work for them by selling covered calls and deriving a steady flow of cash income.

This entire book is aimed at explaining and teaching these two very lucrative investment tools to those with idle cash deposits and those holding stock portfolios.

Cash Secured Put Option Selling, or covered put selling or covered put writing, is a little known investing strategy that is fast gaining popularity as a possible alternative to earning high returns on cash reserves. This cash investment approach is being used by many rich individuals and institutions to enhance annual returns on their cash resources of as much as 15% or even more. As will be explained in the book the technique involves using cash funds as security or collateral to engage in selling or writing put options. In similar fashion writing covered calls is an ideal method for holders of stocks to enhance their investment returns by 15% percent or better.

While many still believe that trading in stock options is extremely risky it is not the case when using the system of covered put and call selling. Selling cash secured put options in stocks or ETFs (Exchange Traded Funds) is among the safest investment strategies of all options trading systems.

Options, whether they are derivatives of stocks, commodities, futures, or other financial instruments, are complex in nature and must be understood fully in order for one to make the most out of them. Having said this, dont be frightened by the word complex. It is by reading books like this that you will learn to demystify the complexity of options. In your learning process do not feel overwhelmed by all the mumbo jumbo about this lucrative investment instrument even if you believe that you are just an ordinary person in the street. I am just an ordinary man in the street like yourself who learned to trade options by teaching myself. In the early days when options were some kind of novelty, only financial professionals used them in the marketplace. There were very few books and teaching materials on the subject. You can then appreciate what Ive gone through in my learning process. Most of what I know today has been learned in the school of hard knocks, by actually diving in the market and learning from my own mistakes and successes. Today, with options becoming phenomenally popular with the investing public there are now quite a number of books, web sites, blogs, investment forums, and schools that are dedicated to teaching options. Still, the complexities of various option trading strategies continue to overwhelm investors and it is my hope that this book will present a simple teaching method of what may be to some a complex trading system.

This book, while giving the novice trader a basic education in options and what this phenomenon is all about, will mainly talk about a very special area of options trading. I will be discussing how the strategy of selling options can be an excellent tool for the long term investor who is in search of an investment vehicle that will provide him with steady, above average returns year in, year out.

It is my intention to make selling options available to every Tom, Dick and Harry without the need for the individual to be knowledgeable in the fundamentals and technicalities of the stock market. I, even to this day, continue my option selling activities without devoting much time and attention getting into the fundamentals and technicalities of market behavior. Every book on option trading strategies has the author recommending trading strategies based on the assumptions about the traders perception of market direction. What they are saying is that you should use the trading strategy that would work best with the way you anticipate the markets movement. But its impossible to predict the market!

It has been said, and I fully subscribe to this thinking, that the stock market is a random walk down Wall Street. Even the highly paid experts in the financial world cant predict the market with consistent accuracy, so how can you and I, non-professionals, even attempt to do so? My trading system is based not on how we foresee market direction but on the assumption that we dont know where the market will go and we trade only in reaction to its movement not in anticipation of it. I invested in mutual funds for many years and I can tell you there are very few, if any, funds that outperform the market consistently year in, year out. What does this tell you? That despite the millions of dollars at their disposal for research and studies even the most highly paid investment experts cannot predict the markets direction with infallible accuracy.

By purchasing this book Im assuming you have some familiarity with options, what they are, what they can do and how you can use them to enhance your trading and investment results. It is important that you have a good basic understanding of how options behave to fully grasp and understand the methods outlined in this book. The first chapters of this book deal with basic information about options which I hope would be sufficient to enable you to follow the book intelligently. Once you become proficient in the option selling strategy that is outlined here, you can go forward and explore other option selling techniques that will further boost your trading and investment returns.

Next page